- SHIB’s caught in a downtrend, buying and selling close to $0.0000119 with low quantity and heavy resistance round $0.0000128—signaling extra draw back if bulls can’t break by quickly.

- Bearish momentum dominates, with 62% of prime merchants shorting SHIB and a robust likelihood of a 30% drop if the worth fails to carry above key help ranges.

- Regardless of a current try to interrupt out, SHIB stays beneath each its 50 and 200-day EMAs, exhibiting no actual bullish power until sentiment shifts quick.

Shiba Inu (SHIB) appears to be shedding steam once more, with value motion tilting bearish—and yeah, issues may get a bit tough if present developments maintain.

In the meanwhile, the broader crypto market is wobbling. Volatility’s excessive, sentiment’s shaky, and merchants are hesitant to leap into riskier property like memecoins. That’s not precisely serving to SHIB’s case.

During the last 24 hours, SHIB slipped by round 3.5%, touchdown just below the $0.000012 mark. It was buying and selling near $0.0000119 when final checked. Not dramatic, however not nice both.

To make issues worse, buying and selling quantity fell by over 17%, which isn’t only a random dip—it reveals fewer people are even bothering with SHIB proper now. That’s each retail and possibly even some whales stepping again.

Value Construction: Nonetheless Caught in That Downward Channel

From a technical standpoint, SHIB’s been in a downward-sloping channel since method again in December 2024. Decrease highs, decrease lows—it’s textbook bearish.

There was a short try to interrupt out lately, using on a short-lived market bounce, however… nope. SHIB didn’t make it previous that key resistance.

Proper now, it’s hovering dangerously near the highest fringe of the channel. Traditionally, that’s the place value has flipped and headed again down. If that sample repeats (and it usually does), we could possibly be watching a 30% drop—probably all the way in which to $0.0000084.

Oh, and don’t ignore the quantity: it’s low. And low quantity throughout a downtrend? That’s a recipe for a pointy fall if sellers get aggressive once more.

Nonetheless Beneath Each EMAs

Zooming out a bit—yeah, SHIB’s nonetheless buying and selling beneath each the 50 and 200-day Exponential Shifting Averages. Not very best. That setup normally means there’s little to no bullish momentum within the short-term. Not until one thing main shifts within the broader market.

For SHIB to flip bullish once more, a pair issues would wish to occur quick:

- An enormous wave of optimism out there.

- And a each day shut above $0.0000128. In any other case, sellers keep in management.

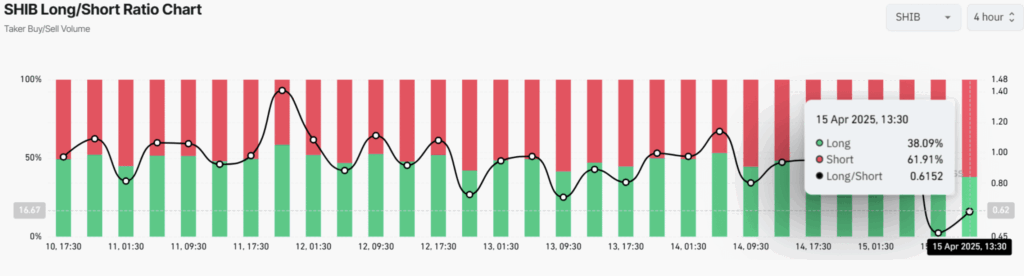

Most Merchants Are Betting Towards SHIB

In response to Coinglass, the sentiment amongst merchants isn’t wanting too sizzling both. The Lengthy/Quick Ratio sits at simply 0.615, which means bearish merchants have the higher hand proper now.

The truth is, about 62% of prime merchants are shorting SHIB. Solely 38% are holding lengthy positions, which tells you the place the bulk thinks that is headed.

Leverage information reveals some severe exercise at two key ranges: $0.0000117 (help) and $0.00001245 (resistance). And with quick positions nearing $952K in comparison with $375K in longs… yeah, the bears are clearly in cost for now.

Remaining Ideas

Until one thing adjustments dramatically—both on the chart or in general market sentiment—Shiba Inu could possibly be heading decrease. The descending channel continues to be intact, quantity’s drying up, and the massive gamers are shorting exhausting.

So, for anybody holding SHIB, this could be a wait-and-watch second. And for merchants… properly, watch out attempting to catch a falling knife.