In line with CoinGecko’s quarterly report, the general crypto market cap fell 18.6% in Q1 2025. Buying and selling quantity on centralized exchanges additionally fell 16% in comparison with the earlier quarter.

This report recognized just a few constructive traits, however most of them contained at the least one important draw back. Regardless of the market euphoria in January, recession fears are taking a really severe toll.

Crypto Suffered Heavy Losses in Q1

The most recent CoinGecko report exhibits simply how bearish the primary quarter of the yr has been. Though the crypto market began January with a serious bullish cycle, macroeconomic elements have closely impacted market sentiment for the previous two months.

In line with this report, crypto’s whole market cap fell 18.6% in Q1 2025, a staggering $633.5 billion. Investor exercise fell alongside token costs, as day by day buying and selling volumes fell 27.3% quarter-on-quarter from the tip of 2024. Spot buying and selling quantity on centralized exchanges fell 16.3%, which CoinGecko at the least partially attributes to the Bybit hack.

The report largely targeted on concrete numbers, but it surely pointed to a couple particular occasions that impacted crypto. Markets hit a neighborhood excessive round Trump’s inauguration, due to market euphoria over potential pleasant insurance policies.

His TRUMP meme coin fueled a short frenzy in Solana meme coin exercise, however this shortly slumped. The LIBRA scandal had an extra dampening affect.

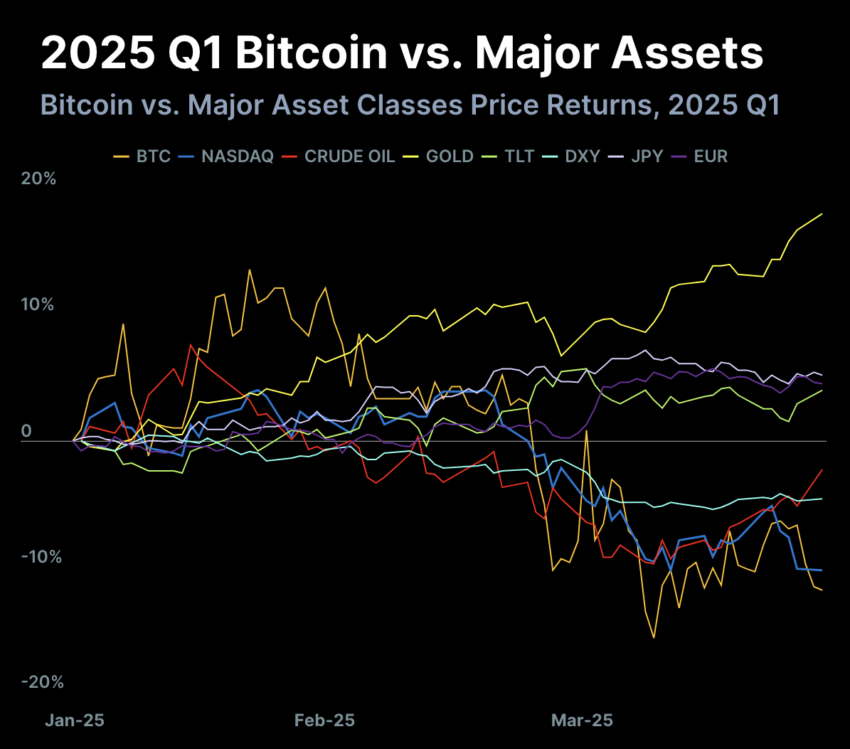

Bitcoin elevated its dominance in Q1 2025, accounting for 59.1% of crypto’s whole market cap. It hasn’t maintained that share of the market since 2021, symbolizing how way more steady it’s been than altcoins.

However, BTC additionally fell 11.8% and was outperformed by gold and US Treasury bonds.

This information level is very worrying as a result of Trump’s tariffs have wrought havoc on Treasury yields. Even so, the report clearly exhibits that the remainder of crypto suffered much more. Ethereum’s total 2024 beneficial properties vanished in Q1 2025, and multichain DeFi TVL fell 27.5%. C

ountless different areas noticed comparable outcomes, however they’re too quite a few to simply summarize.

That’s to say, nearly each quantifiable constructive growth got here with at the least one main caveat. Solana dominated the DEX commerce, however its TVL declined by over one-fifth.

Bitcoin ETFs noticed $1 billion in recent inflows, however whole AUM fell by almost $9 billion on account of worth drops. The experiences replicate that recession fears are gripping the crypto market.

Disclaimer

In adherence to the Belief Undertaking pointers, BeInCrypto is dedicated to unbiased, clear reporting. This information article goals to supply correct, well timed data. Nonetheless, readers are suggested to confirm details independently and seek the advice of with an expert earlier than making any choices primarily based on this content material. Please notice that our Phrases and Circumstances, Privateness Coverage, and Disclaimers have been up to date.