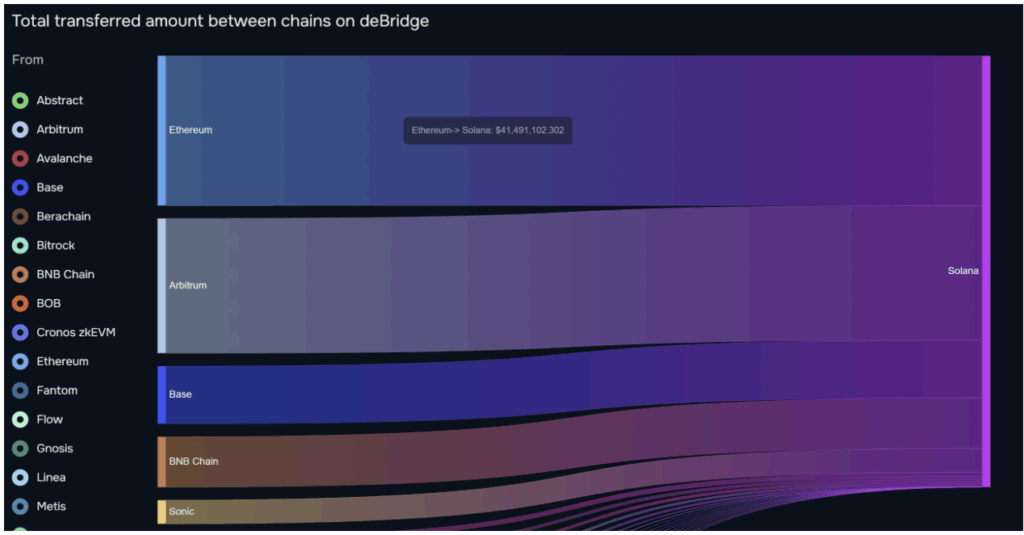

- Over $120M in liquidity has returned to Solana, largely from Ethereum and Arbitrum, fueled by renewed curiosity and surging memecoin costs like POPCAT and BONK.

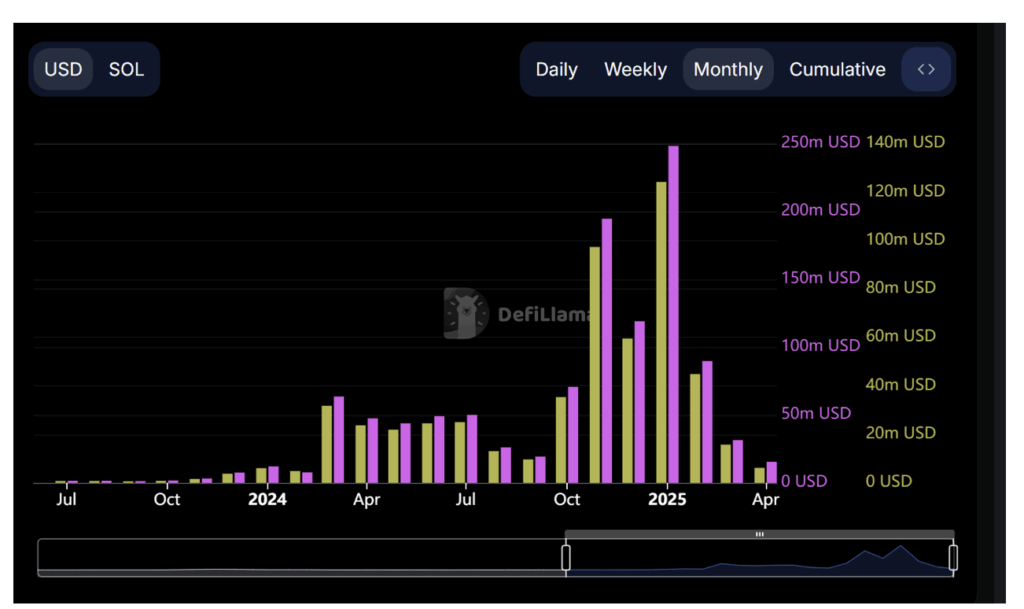

- Regardless of the hype, Solana’s charge era has dropped sharply, with April charges sitting round $22M — far beneath January’s $400M peak.

- SOL stays technically bearish, needing a day by day shut above $147 to flip bullish, whereas key help zones sit at $130 and $115 amid ongoing bearish divergences.

During the last month, greater than $120 million in liquidity has been bridged to Solana — a notable signal of renewed curiosity within the community. Most of that money got here from Ethereum — round $41.5M — adopted by $37.3M from Arbitrum, in line with information from Debridge. Even Base, BNB Chain, and Sonic chipped in with $16M, $14M, and $6.6M respectively. Cash’s shifting, little doubt.

From Exodus to Comeback?

Not way back, it was a really completely different story. After the entire LIBRA memecoin fiasco in Argentina, which someway roped in President Javier Milei (yeah, that occurred), traders pulled $485 million out of Solana and moved it to chains like Ethereum and BNB.

Now? Issues are flipping. Solana’s seeing memecoins fly once more — names like POPCAT, FARTCOIN, BONK, and WIF have jumped 79%, 51%, 25%, and 21% simply this previous week. That sort of momentum tends to draw consideration — and liquidity.

Charges Are Lagging Behind the Hype

Regardless of the inflow and meme coin mania, Solana’s precise charge era isn’t maintaining. March noticed just below $46 million in complete charges. For comparability, January 2025? That quantity was over $400 million. April’s not trying a lot better to this point — sitting round $22 million and counting.

So yeah, whereas the vibes are again, the precise income numbers… not fairly.

Technically Talking: SOL Nonetheless Has Work to Do

Value-wise, Solana remains to be attempting to interrupt by some robust ranges. Proper now, it’s buying and selling underneath $140, and the 50-day EMA is appearing like a wall. To essentially shift the pattern, SOL must shut above $147 on the day by day chart. With out that, the bearish construction stays intact.

Zoom into the decrease time-frame (LTF), and it’s not tremendous fairly both. A bearish divergence has popped up once more between value and RSI. If historical past repeats — and it has just a few occasions this 12 months — this might sign one other dip incoming. Since January, we’ve seen 4 bearish divergences, all adopted by corrections.

The setup seems to be eerily comparable once more: value briefly popped above the 50-day and 100-day EMAs on the 4-hour chart, however couldn’t maintain. That transfer often doesn’t finish effectively.

Help and Resistance: The Key Ranges to Watch

Wanting forward, Solana’s quick demand zone sits between $115–$108 — that’s the place patrons might step in once more. However curiously, there’s a little bit of power constructing round $130, too.

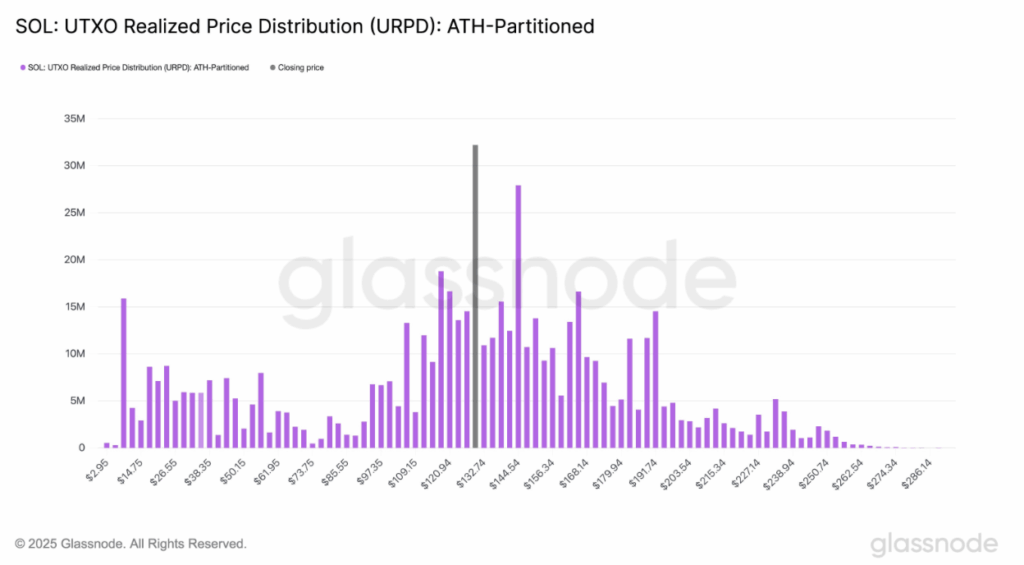

In a latest publish on X, Glassnode famous that over 32 million SOL (that’s round 5% of complete provide) was purchased on the $130 degree. That sort of focus often creates a sturdy help zone.

They added:

- $129 is the pivot.

- $117 might kind the decrease help.

- $144.50 is likely to be the highest of the present vary.

So, in brief: Solana’s in a squeeze — momentum’s constructing, however except it could possibly punch by $144–$147, there’s nonetheless danger to the draw back. At the least for now.