- Filecoin (FIL) is struggling, down 14% over the previous month and 33% over six months, with bears nonetheless in management and key assist ranges being examined.

- Chainlink (LINK) exhibits extra resilience, up almost 12% previously six months regardless of current dips, with merchants eyeing the $8.57 assist and $20.13 resistance.

- FIL affords storage-focused utility, whereas LINK powers sensible contracts, making each attention-grabbing — however danger tolerance and timing matter earlier than leaping in.

Each Filecoin (FIL) and Chainlink (LINK) are sitting at fairly important factors proper now. Market sentiment’s been shaky, momentum retains shifting — and truthfully, it’s bought merchants asking the massive query: Is that this the fitting second to leap in? Let’s break it down and see which of those two would possibly really be price keeping track of.

Filecoin Struggles However Holds Potential — Type Of

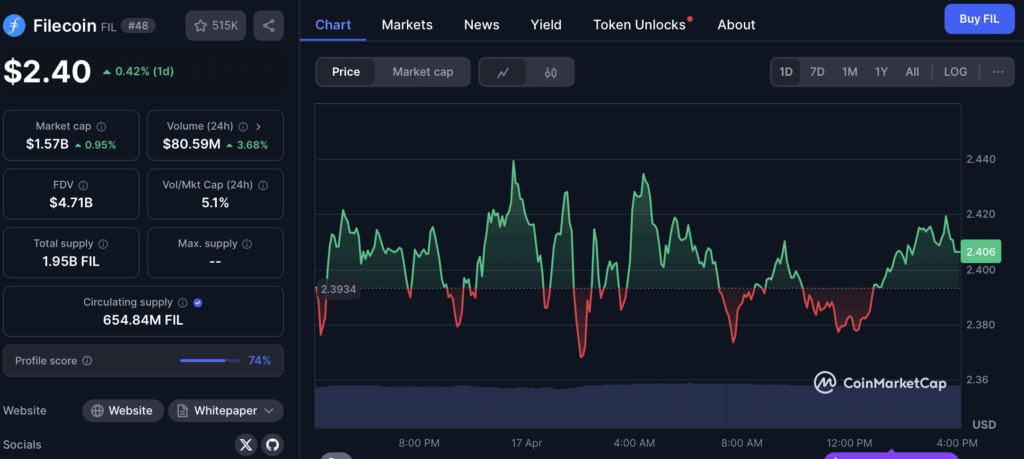

Let’s be actual — Filecoin hasn’t precisely been on fireplace recently. It’s down 14% previously month, and if you happen to zoom out additional? You’ll see a 33% drop over the past six months. Ouch. Certain, there was a bit of 8% bounce final week, however when the general pattern is down… it’s onerous to have fun an excessive amount of.

Proper now, FIL is bouncing round between $2.29 and $3.44. Resistance is up at $4.10, and there’s a good greater wall at $5.25. On the flip facet, assist sits down at $1.79, with a a lot deeper ground close to $0.64 if issues actually go south.

The vibe? Bears nonetheless appear to have management. Indicators aren’t doing FIL any favors, and except we see a clear breakout above resistance, this one would possibly keep uneven. When you’re enjoying it, you’re in all probability watching these assist zones carefully and hoping to catch a bounce — or possibly simply staying affected person for now.

Chainlink: Not Excellent, However Extra Resilient

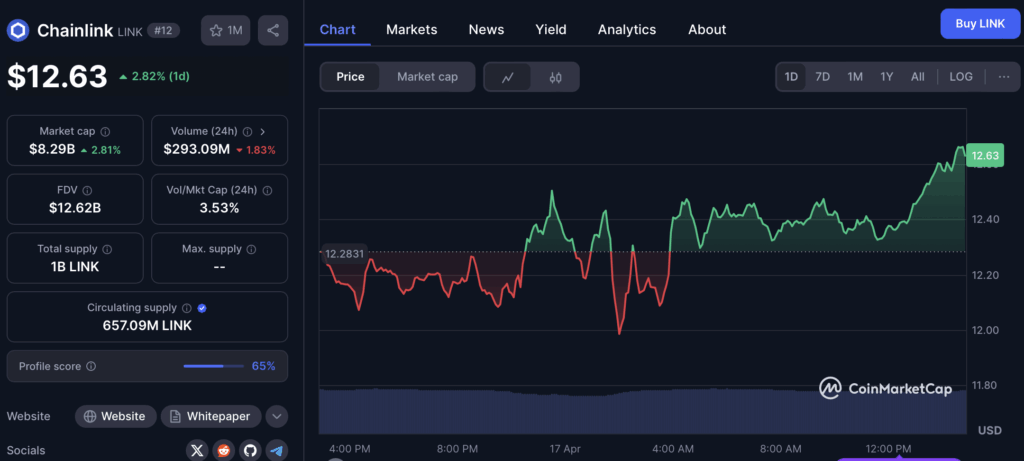

Now, Chainlink’s story is a bit more balanced. It’s down about 7.6% over the previous month, however if you happen to pull again to the six-month view, it’s really up almost 12% — so there’s that.

LINK’s been buying and selling between $11.04 and $16.82, displaying extra volatility than some would possibly like — however that additionally means alternative. Help is sitting round $8.57, and resistance is looming close to $20.13. It’s a wide array.

Final week’s 13% acquire positively introduced a bit of bullish power again into the room. That mentioned, the RSI continues to be round 44, and shifting averages aren’t leaning too constructive simply but — so, yeah, the momentum continues to be type of… meh.

It’s a type of setups the place merchants are in all probability considering: “Purchase near assist, promote close to resistance, and don’t get caught within the center.” Not the worst technique in this type of atmosphere.

So… Is It Time to Purchase?

Onerous to say. FIL is attention-grabbing due to its decentralized storage mission — it’s actual infrastructure for Web3. However the value hasn’t been form, and the bears nonetheless look cozy. LINK, however, is holding its floor a bit higher and continues to be a giant participant in oracle providers for sensible contracts. It’s bought extra momentum, even when it’s not precisely flying.

For traders, it’s much less about selecting a winner and extra about understanding your personal danger urge for food. Need to take a shot at a bounce? FIL is perhaps interesting. Want one thing with a stronger long-term use case and extra secure value motion? LINK could possibly be your transfer.

Simply keep in mind — none of that is monetary recommendation. DYOR, keep level-headed, and possibly don’t FOMO into something with out a plan. Crypto’s bizarre like that.