Huge Bitcoin withdrawals value a whole bunch of thousands and thousands of USD from main exchanges have sparked important curiosity within the crypto group.

Nevertheless, if Bitcoin fails to interrupt the $86,000 barrier, a worth correction stays an actual chance, particularly amid wavering investor confidence.

Bitcoin Whales Withdraw Tons of of Hundreds of thousands in BTC

Knowledge from the X account OnchainDataNerd on April 17, reveals that a number of massive Bitcoin whales executed substantial withdrawals from high exchanges. Galaxy Digital withdrew 554 BTC, valued at roughly $76.74 million, from OKX and Binance.

Abraxas Capital pulled out 1,854 BTC, value round $157.26 million, from Binance and Kraken.

Two different whales, recognized by addresses 1MNqX and 1BERu, withdrew 545.5 BTC ($45.5 million) and 535.2 BTC ($45.44 million) from Coinbase, respectively. In a single day, over $280 million in Bitcoin was faraway from exchanges.

Such withdrawals from Bitcoin whales, like these by Galaxy Digital and Abraxas Capital, usually sign a technique to maneuver BTC into chilly storage. That is sometimes considered as a bullish signal, lowering promoting strain and reflecting expectations of future worth will increase.

Surge in First-Time Bitcoin Patrons

A report from Glassnode on X highlights a pointy rise in first-time Bitcoin patrons. This inflow of latest buyers may drive short-term worth good points. Nevertheless, long-term holders (LTHs) have paused their accumulation, signaling warning amid heightened market volatility.

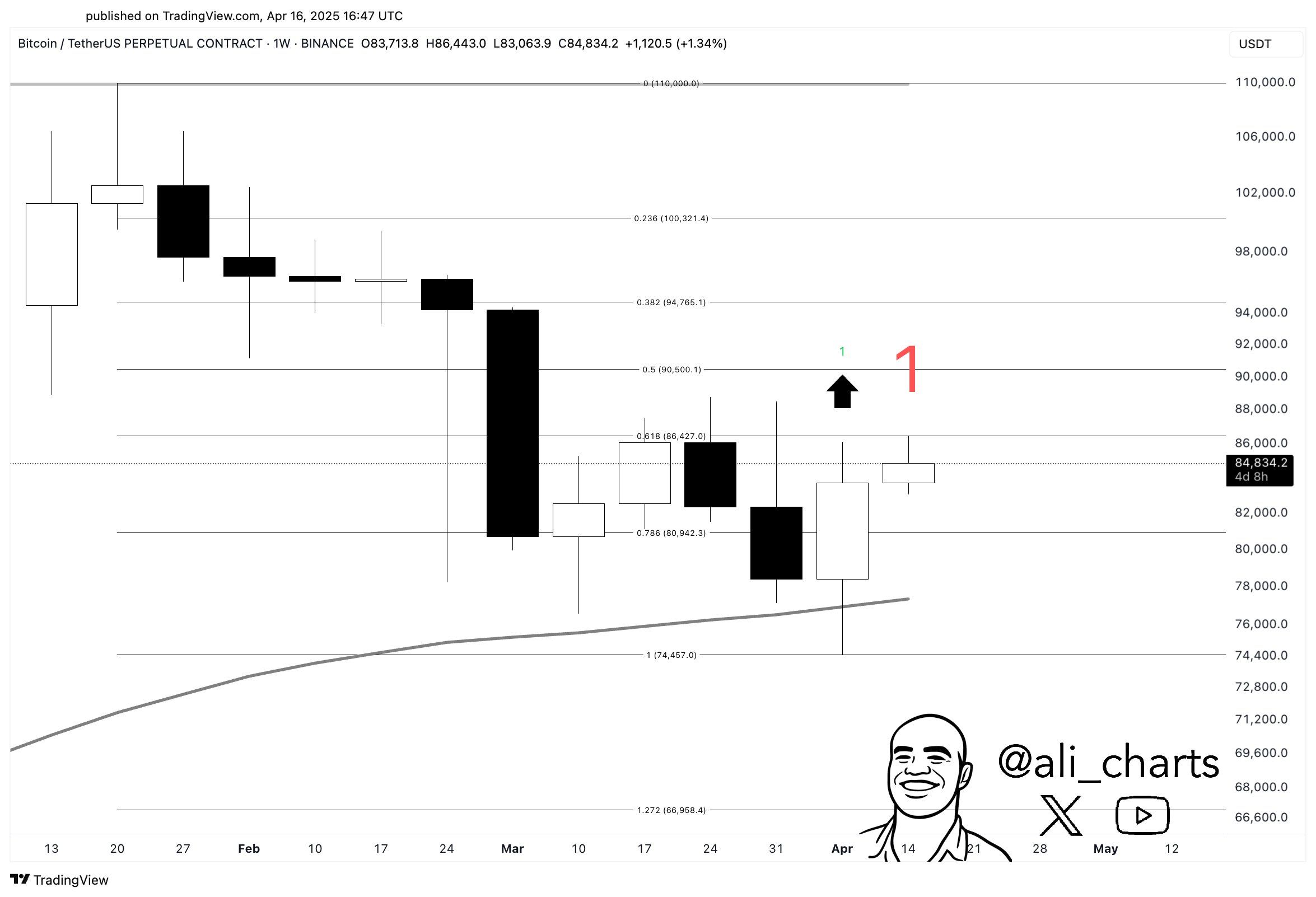

In a submit on X, the analyst Ali used the TD Sequential technical indicator to forecast Bitcoin’s worth pattern. The TD Sequential flashed a purchase sign on the Bitcoin weekly chart.

If Bitcoin persistently closes above $86,000, additional worth will increase are possible. Presently, Bitcoin is hovering above $80,000, indicating progress potential. Nevertheless, surpassing the essential $86,000 resistance stage is important to verify the bullish pattern.

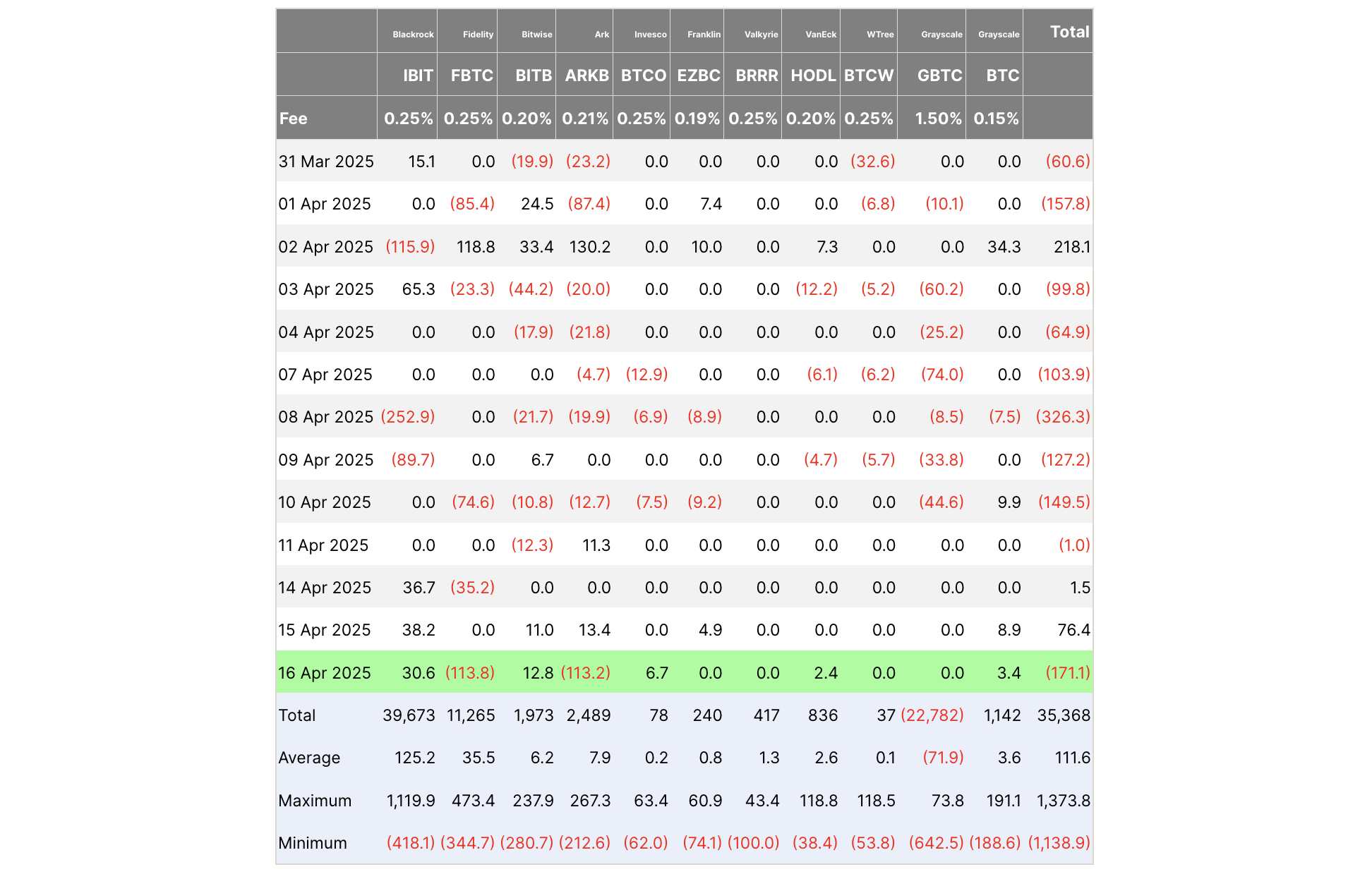

Regardless of latest whale accumulation, not all alerts are optimistic. Inflows into Bitcoin ETFs have dropped considerably. This decline suggests weakening investor confidence, which may exert downward strain on costs with out recent catalysts.

Moreover, information from Lookonchain signifies that over $1.26 billion in Bitcoin was unstaked from Babylon. If this capital flows again to exchanges, promoting strain may intensify, making it tougher for Bitcoin to breach key resistance ranges.

Disclaimer

In adherence to the Belief Challenge pointers, BeInCrypto is dedicated to unbiased, clear reporting. This information article goals to offer correct, well timed data. Nevertheless, readers are suggested to confirm details independently and seek the advice of with knowledgeable earlier than making any choices based mostly on this content material. Please notice that our Phrases and Circumstances, Privateness Coverage, and Disclaimers have been up to date.