- Lengthy-term holders added 297K BTC in 9 days, displaying elevated confidence.

- Continued Bitcoin accumulation may push BTC previous $88K, presumably testing $90K quickly.

Since recovering from the current market crash, Bitcoin [BTC] has witnessed a major surge in demand, with traders returning to the market. Naturally, this resurgence has sparked elevated accumulation exercise throughout the board.

Based on Glassnode, Bitcoin’s Accumulation Development Rating has surged to a year-to-date excessive. At press time, the rating sat at 0.43, signaling rising demand for the crypto.

Supply: Glassnode

A rising accumulation rating means that wallets are re-entering accumulation on a broader scale.

Regardless of current value hesitation, massive investor teams have cautiously resumed stacking, with long-term holders (LTHs) main the cost. Over the previous 9 days, LTH provide has elevated by 297,000 BTC, signaling rising confidence amongst seasoned traders.

Additional reinforcing this pattern, LTH Binary Spent has dropped to 0.3 up to now week, indicating that fewer long-term holders are promoting Bitcoin – a robust bullish sign.

Supply: Checkonchain

With LTH lowering promoting actions, different market contributors have adopted swimsuit. Inasmuch, unspent outputs have sustainably grown via 2025, hitting 3.03 million.

Though it’s a drop from 5.2 million in 2024, present ranges stay comparatively excessive, implying that BTC holders stay bullish and anticipate higher returns and market circumstances within the close to time period.

Supply: BitBo

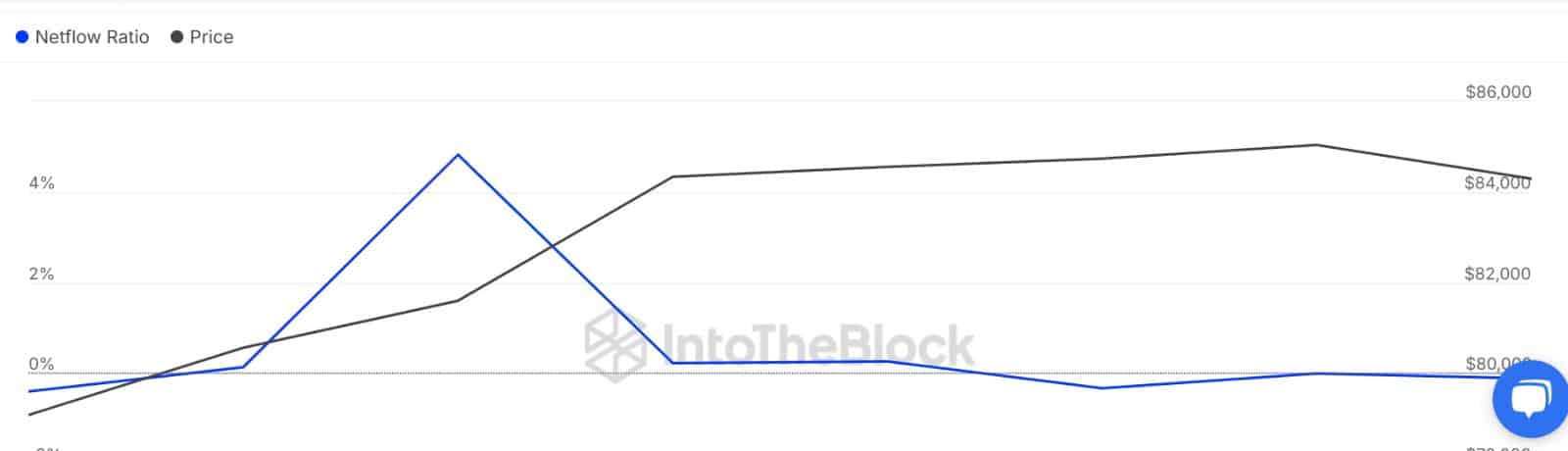

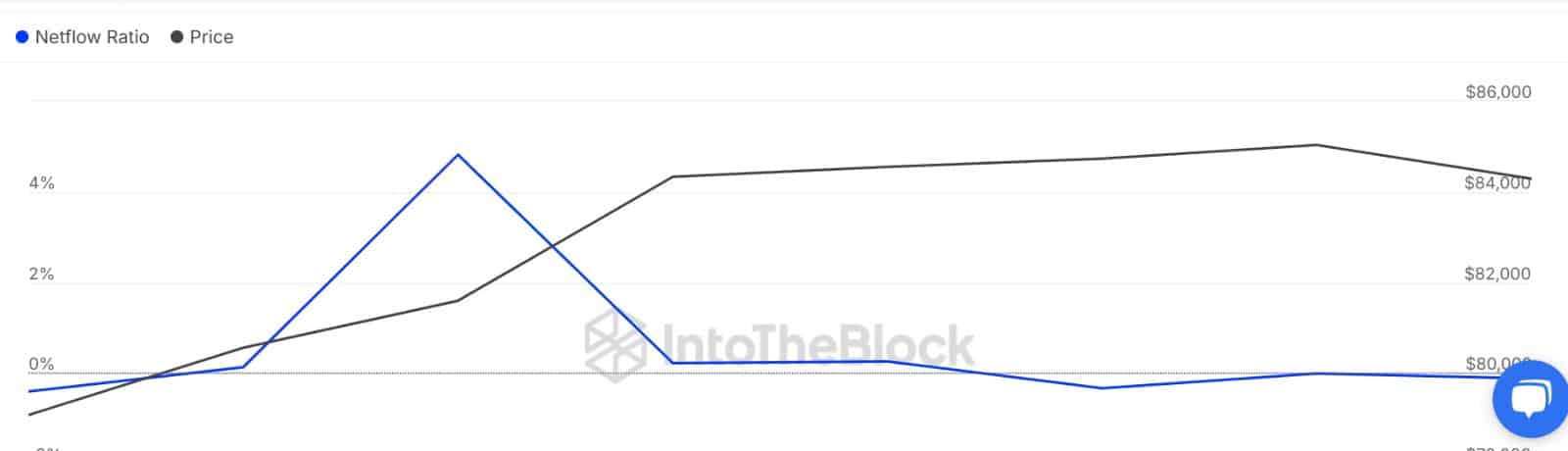

On high of that, whale exercise has additional bolstered the continuing accumulation narrative.

For the previous three consecutive days, Trade Circulation from massive holders remained destructive, indicating that extra BTC was being withdrawn than deposited.

Merely put, whales are stockpiling—a traditional sign of a possible bullish shift.

Supply: IntoTheBlock

What does it imply for BTC?

With long-term holders (LTHs) and enormous traders accumulating, Bitcoin’s market stability seems robust as large gamers guess on improved efficiency.

This optimistic sentiment amongst market contributors typically drives increased costs.

If the present accumulation pattern continues, Bitcoin may see a reversal in fortunes, fueled primarily by natural demand.

An upward transfer from right here may result in a breakout from consolidation, with BTC surpassing $86,700. If momentum holds, Bitcoin may reclaim $88K and push towards the psychological $90K degree.

Conversely, if short-term holders (STHs) take income from current features, Bitcoin would possibly appropriate downward, probably dropping to $82,696.

Monitoring accumulation tendencies and investor exercise shall be essential in figuring out BTC’s subsequent course.