- BONK stays caught in a descending channel, with current rejections at resistance and weak shopping for quantity suggesting the bearish pattern continues to be in management.

- The RSI has climbed above 50, hinting at short-term bullish momentum, however the lack of rising OBV reveals demand hasn’t returned in any significant approach.

- Key ranges to observe are $0.0000113 and $0.000014, with a bounce from mid-channel assist potential — although merchants are suggested to comply with the pattern, not chase the pump.

The memecoin insanity that when fueled BONK’s wild rise looks like a distant reminiscence. Currently, the chart’s been telling a reasonably grim story — particularly on the 1-day timeframe. BONK’s been sliding, clinging to the $0.0000099 stage, which has already been examined twice up to now month.

That very same stage? It was key assist approach again in January 2024. And if the present pattern doesn’t break quickly, BONK may simply blow previous its 2024 lows… and never in a great way.

Making an attempt to Discover a Backside — However It’s Slippery Down There

Zooming out a bit — since March, BONK’s been trapped inside a descending channel, and it’s sticking to the script. The mid-line of that channel (that dotted white line on the chart) has acted as each assist and resistance relying on BONK’s temper.

Simply this previous Sunday, BONK obtained rejected on the high of the channel, and now the following logical step is — yep, a transfer again towards that mid-line. To date, it’s taking part in by the textbook.

Now, right here’s the twist: the RSI climbed above 50 final week. That normally hints at bullish momentum, or a minimum of a flicker of it. However let’s not get too excited — it’s not clear whether or not that transfer’s obtained endurance or if it’s only a blip in an in any other case bearish pattern.

Quantity’s Not Backing It Up (But)

The true downside? No demand.

The On-Steadiness Quantity (OBV) — a key instrument for sniffing out whether or not patrons are literally displaying up — continues to be caught close to February and March lows. So despite the fact that worth bounced off assist final week, it doesn’t appear like anybody’s actually aping in.

Translation? The bounce won’t be the true deal. For those who’re buying and selling this factor, these little upward strikes might truly be strong quick entries.

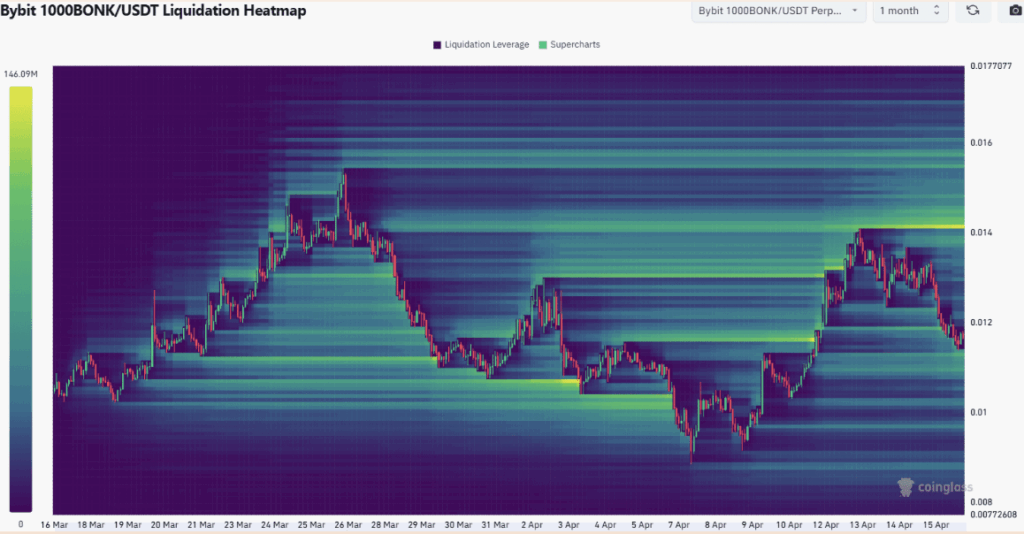

Heatmap Says Watch $0.0000113 — and Possibly $0.000014

Peeking on the liquidation heatmap (thanks, Coinglass), there are two zones merchants ought to regulate.

The primary one’s $0.0000113 — not removed from present worth ranges. It’s not a super-dense cluster, but it surely’s shut sufficient to draw short-term motion. The second stage is $0.000014, and that one? It’s obtained extra warmth — and it traces up with the high of the descending channel.

So, if BONK can bounce off the mid-channel assist (proper round $0.000011), there’s a shot it would push towards $0.000014. However keep in mind — that may simply be a take a look at of resistance. Not a breakout. At the very least not but.

Closing Ideas — Play the Pattern, Not the Hype

Backside line: market construction continues to be bearish, and there’s not sufficient purchaser power to shift issues — a minimum of not proper now.

Merchants? Finest to attend for a bounce, then look to journey the pattern decrease till there’s an actual construction break. BONK may attempt to rally from the $0.000011 zone, however until shopping for quantity critically picks up, it’s most likely simply one other decrease excessive in a long-term downtrend.

Don’t get faked out by the frog — not simply but.