- AAVE is displaying indicators of restoration, leaping 3.34% in 24 hours after a tough month, pushed by improved liquidity and a promising improve proposal.

- Aave V3 might quickly broaden to Aptos, a high-speed chain (150,000 TPS), doubtlessly boosting person progress and adoption.

- Rising TVL and pockets exercise point out stronger investor confidence, with giant AAVE purchases and a shift towards long-term holding. Derivatives information additionally reveals bullish momentum constructing.

Seems like consumers are slowly getting again into Aave [AAVE], with the token leaping 3.34% in simply the previous 24 hours. That’s a welcome change after AAVE slipped almost 19% over the past month. The temper’s shifting, and it’s not simply value motion—liquidity is selecting up, and a giant protocol improve is likely to be pulling in some recent consideration.

Aave V3 Growth: Aptos Might Be a Sport Changer

Aave V3 is making strikes. The protocol’s newest proposal, which remains to be beneath governance vote, may see Aave launching on Aptos [APT]—its first non-Ethereum-compatible chain. If it passes, this might open some severe doorways.

Why Aptos? Nicely, it boasts speeds of as much as 150,000 transactions per second. Examine that to Ethereum’s 12 to fifteen TPS… yeah, that’s an enormous soar. This might imply quicker trades, extra customers, and deeper liquidity swimming pools. No shock then that sentiment has turned bullish. Everybody’s watching to see the place this goes.

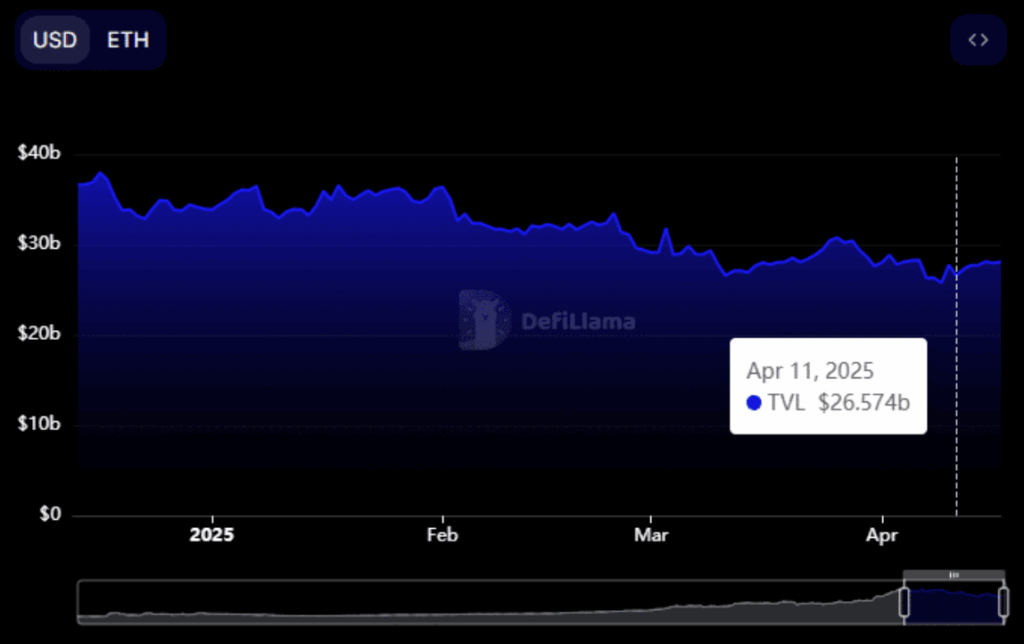

TVL Ticks Up: Liquidity Flows into AAVE

You possibly can’t pretend confidence, and Whole Worth Locked (TVL) numbers inform the story. Since April eleventh, Aave V3’s TVL has risen from $26.57 billion to simply over $28 billion—a stable $1.5 billion acquire. TVL isn’t only a self-importance stat—it reveals how a lot cash individuals are locking into Aave’s sensible contracts. The upper it goes, the extra belief there appears to be.

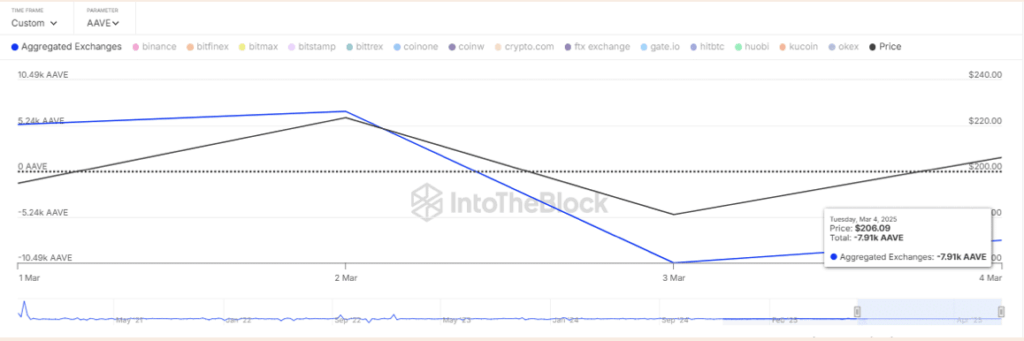

New Wallets, New Cash: Retail’s Again

On-chain exercise reveals individuals are paying consideration. IntoTheBlock information reveals over 174,000 lively AAVE addresses lately. That’s a spike in retail curiosity. Plus, round 7,910 AAVE (value a bit over $1 million) had been snapped up within the final 24 hours. Not solely that—Trade Netflows turned adverse, that means these tokens obtained pulled off exchanges and into wallets. That often indicators holders are pondering long-term, not simply chasing fast flips.

Derivatives Market Siding with the Bulls

Futures merchants appear to agree with the broader optimism. The OI-Weighted Funding Fee stays in constructive territory, a metric that mixes open curiosity with funding charges to get a way of the place merchants lean. Constructive readings sometimes imply extra lengthy positions than shorts—merchants are betting the worth retains climbing.