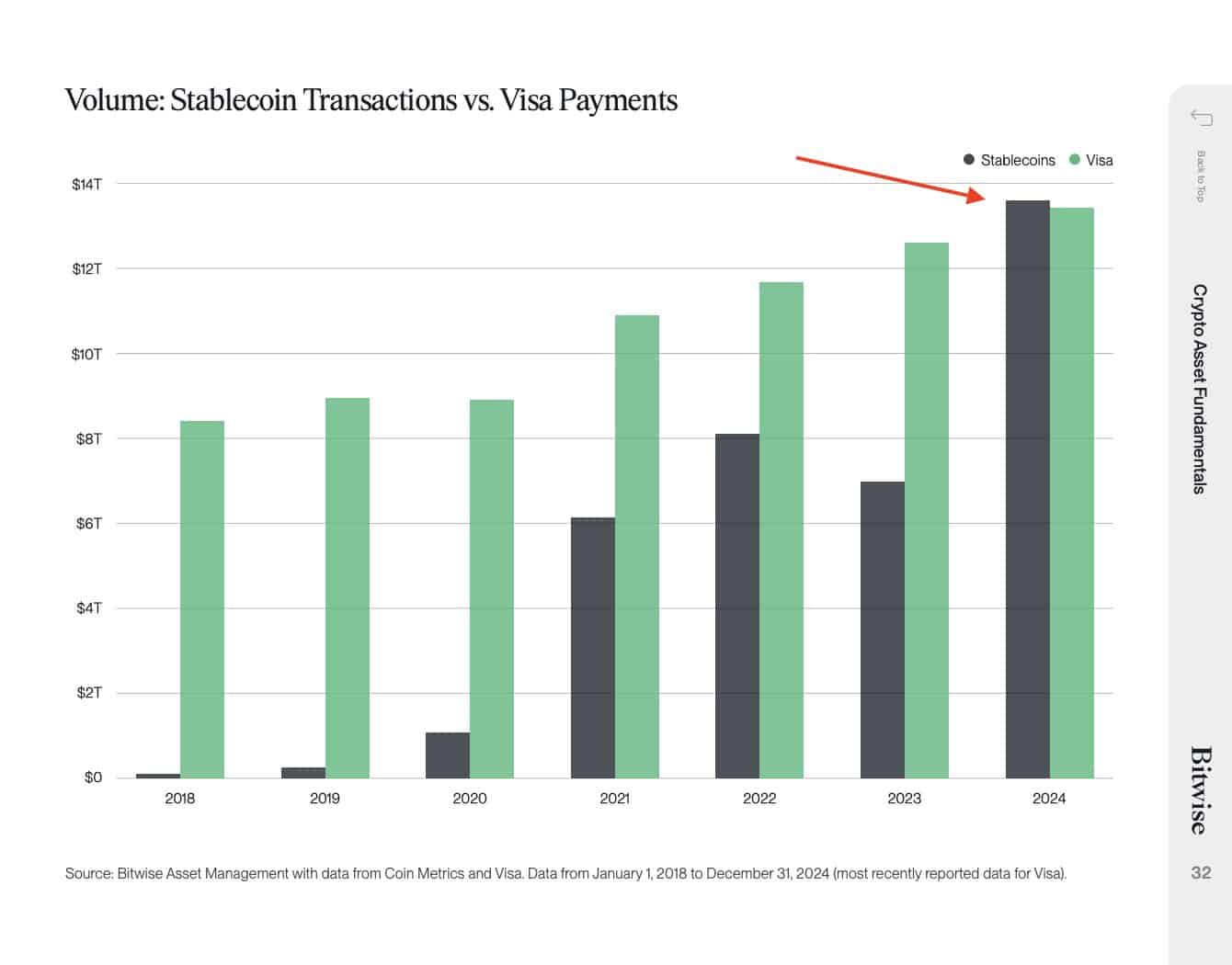

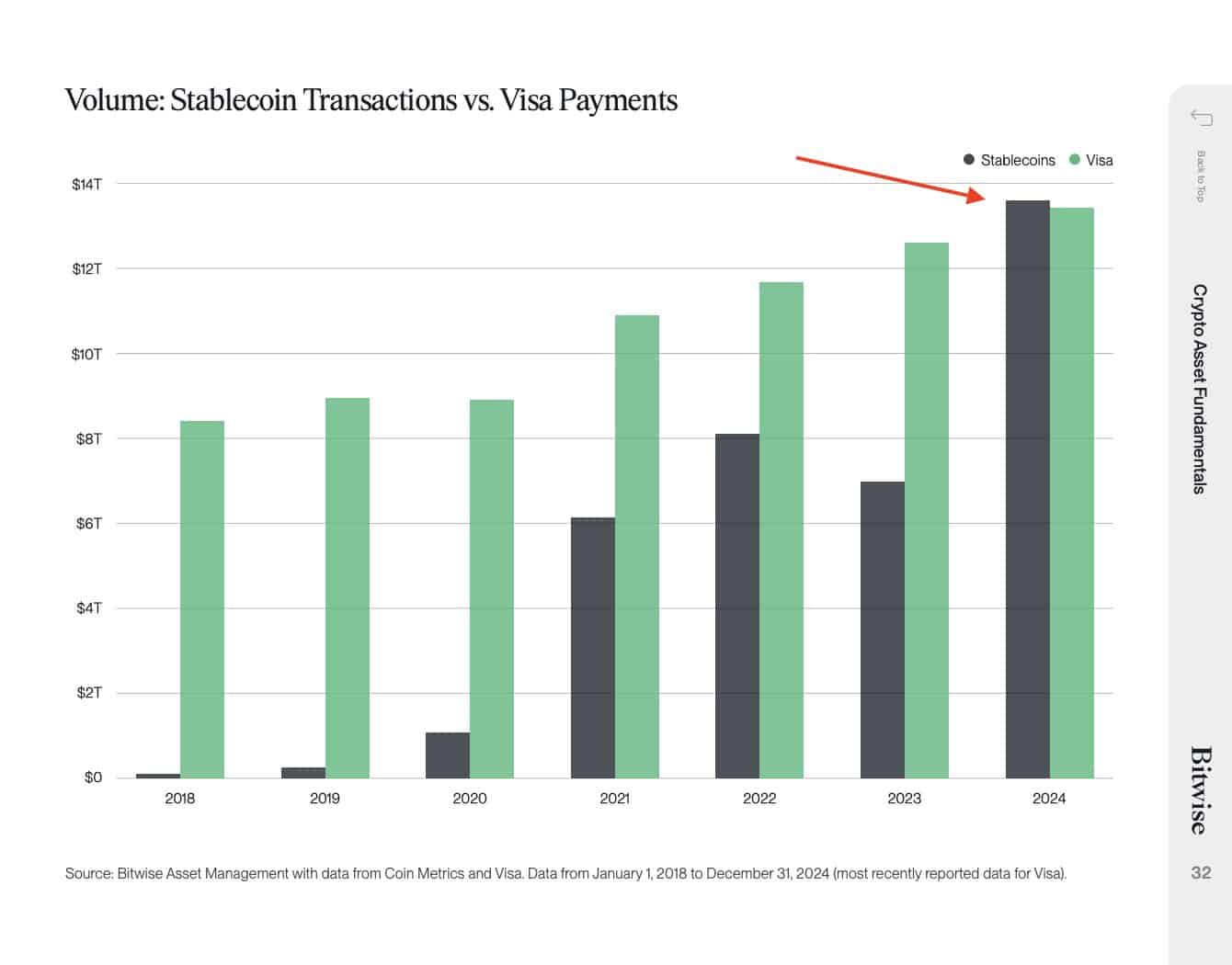

- Stablecoins whole market capitalization crossed $233 billion as processed quantity hit $27.6 trillion transactions in 2024—larger than Visa.

- Altcoin market troubles recommend capital is coming into steady property in durations of volatility.

The stablecoin market has hit a milestone as its whole market capitalization crossed $233 billion.

This surge in stablecoin market cap comes because the broader altcoin market remains to be below stress, dipping steadily on the weekly charts.

The contrasting actions elevate a key query — if the market is seeing rising adoption of stablecoins or a widespread exit from unstable crypto property?

From fringe utility to monetary spine

A couple of years in the past, stablecoins have been primarily used for quick trades and arbitrage. Quick-forward to at the moment, they’re backstop infrastructure for crypto finance.

Stablecoins alone enabled a staggering $27.6 trillion in quantity in 2024, greater than Visa processed throughout the identical interval. Virtually all of that quantity was settled on Ethereum, solidifying the chain’s lock on stablecoin buying and selling.

The numbers communicate loudly, stablecoins are not a distinct segment as they’re turning into the inspiration of digital worth switch.

Supply: Bitwise

Are stablecoins a security web?

The rising market capitalization of stablecoins doesn’t merely indicative of wider utilization – additionally it is a sign of investor perspective.

In instances of excessive volatility or downturns within the crypto market, traders usually rotate capital from altcoins into steady property like USDT, USDC and DAI.

Steady tokens function a haven whereas nonetheless permitting participation on this planet of cryptocurrencies with out having to dip into different areas.

This behavioral pattern is extra pronounced in bear cycles, the place danger urge for food is secondary to the necessity to protect capital. The result’s an elevated influx into stablecoins and away from high-beta property like altcoins.

Altcoins are squeezed as liquidity flows

As stablecoins rise, altcoins are doing the other. The overall altcoin market cap has been shedding floor for just a few weeks since early December.

It is a signal that the availability improve is probably not reflecting web new capital coming into crypto—however reasonably capital biking inside the market.

As extra altcoins are transformed into stablecoins, there may be much less liquidity obtainable to help in fueling altcoin rallies. That may stifle worth motion and prolong restoration instances.

It’s a dynamic that may amplify a bearish momentum within the altcoin universe.

Supply: TradingView

If stablecoins proceed their present trajectory, their position within the crypto economic system will develop additional. And with quantity already surpassing Visa in 2024, it’s clear that that is just the start.

The subsequent few years might make at the moment’s $27.6 trillion determine look modest.