- HBAR is up 5% within the final 24 hours, however key pattern indicators nonetheless present weak momentum and indecisive value motion.

- Technical alerts just like the DMI and Ichimoku Cloud trace at a doable bullish shift, however the market stays sideways till a stronger breakout happens.

- Help at $0.156–$0.153 is holding for now, but when bulls can’t push previous $0.168, the worth dangers dropping towards $0.124 in a deeper pullback.

Hedera’s native token, HBAR, is displaying a little bit of a pulse—up greater than 5% up to now 24 hours. That’s a strong bounce after what’s been a reasonably tough begin to April. However right here’s the factor… the broader pattern nonetheless seems to be kinda weak. The bulls are hanging in there, certain, however technical alerts are blended, and momentum? Nonetheless shaky.

Momentum Caught in Impartial

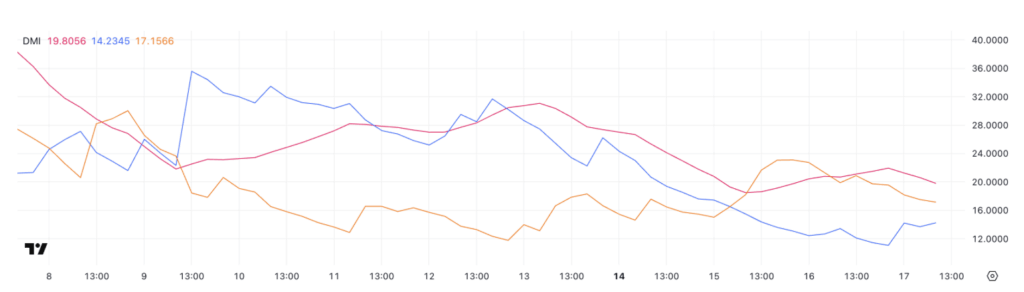

Let’s begin with the DMI (Directional Motion Index), which supplies us a good sense of how robust the present pattern is. Proper now, HBAR’s ADX is sitting at 19.8. That’s a slight bump from 18.49 a pair days in the past, however nonetheless down from a latest peak of 21.94 earlier at this time. Something under 20 often simply screams “meh.”

Which means, technically, HBAR’s pattern power is kinda… effectively, delicate. Not bullish, not bearish. Simply drifting sideways.

In the meantime, the +DI (that’s the bullish strain) crept up from 13.42 to 14.2. Not precisely fireworks, nevertheless it’s one thing. The -DI (bearish strain) dropped from 19.89 to 17.15, so there’s a bit much less weight from the bears now. That narrowing hole could possibly be early indicators of a pattern flip—nevertheless it’s too early to name.

If +DI crosses above -DI with some actual quantity? That’d be one thing. Till then, it’s simply cautious chop.

Ichimoku Cloud: Combined Indicators Galore

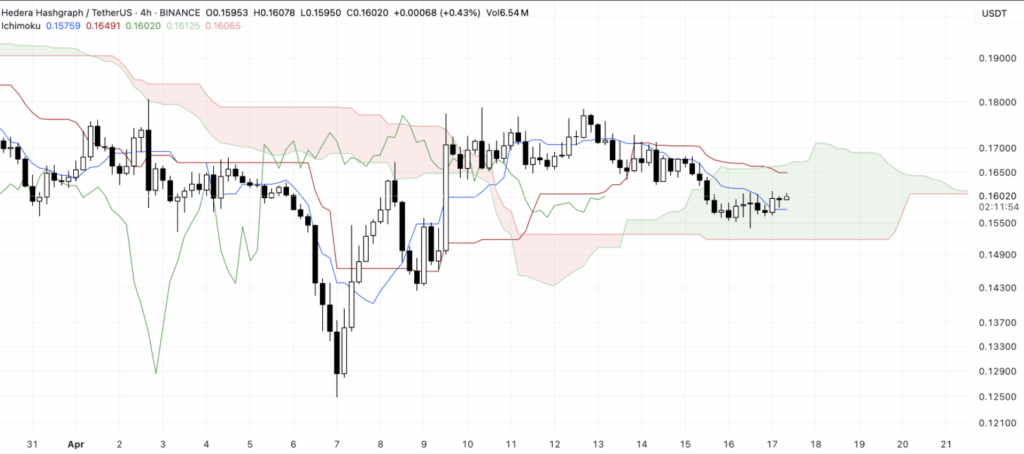

Over on the Ichimoku Cloud chart—yeah, the image’s nonetheless foggy.

HBAR’s value is kinda caught close to the Tenkan-sen and Kijun-sen traces (these are your short- and medium-term pattern indicators). They usually’re each flat. Which, in buying and selling phrases, often means… nothing’s occurring.

The cloud forward is fairly thick and bearish. The Senkou Span A is beneath Span B—not nice. However value has snuck intothe cloud, which may imply the downtrend is cooling off.

Additionally, the Chikou Span (that trailing inexperienced line) is tangled with previous costs. That’s one other traditional signal of sideways motion and uncertainty. TL;DR—no robust push both approach but.

Bulls Defend Help, However Can They Flip It Round?

So right here’s the brilliant spot—HBAR’s managing to carry some key assist ranges. The $0.156 and $0.153 zones have been examined and, thus far, consumers are stepping as much as defend them. That’s promising.

If momentum retains constructing, the primary actual check will probably be breaking via resistance at $0.168. Crack that, and also you’re taking a look at $0.178 subsequent. And if bulls get actual critical, $0.201 could possibly be again on the radar.

However… if this bounce fizzles and sellers come again? Then yeah, HBAR may slide proper again right down to these assist ranges—and if these fail? We’re staring down the $0.124 vary, which might undoubtedly sting.

Last Ideas

HBAR’s 5% bounce is cool and all, nevertheless it hasn’t confirmed a lot but. Till we see stronger quantity, cleaner breakouts, and possibly an ADX above 25, the pattern’s nonetheless kinda misplaced. The bulls try, little doubt—however the market’s nonetheless ready for a transparent transfer.

Keep sharp. This one may go both approach.