- BNB is buying and selling round $592, reclaiming key EMAs and breaking out of a short-term downtrend.

- A day by day shut above $600 may set off a transfer towards $626 and even $660, with the golden pocket at $606 appearing as the subsequent main take a look at.

- Momentum’s constructing—MACD is bullish, RSI’s holding regular, however quantity affirmation continues to be wanted. Hold your eyes on that $600 stage—it’s the game-changer.

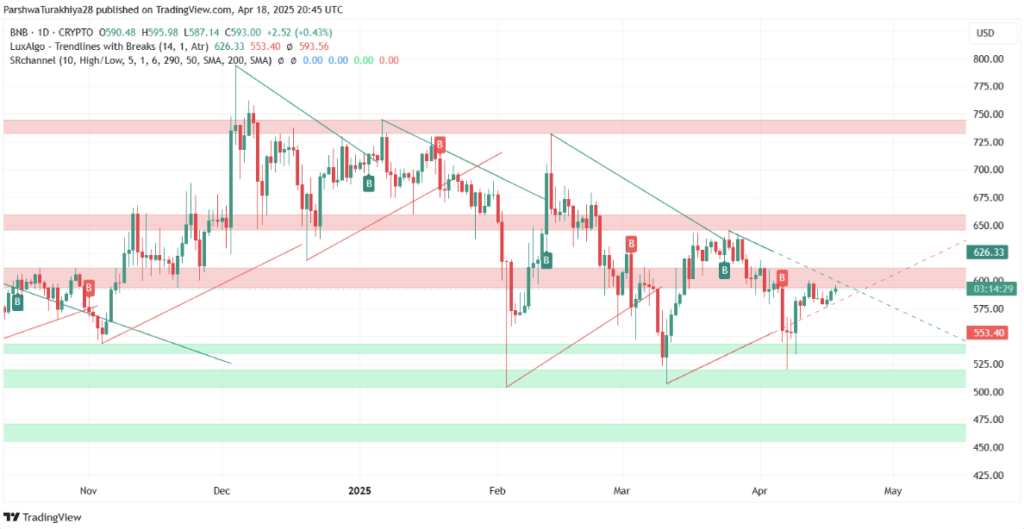

Binance Coin (BNB) is beginning to stir once more—after a tough patch earlier this month, it’s now creeping up the charts and teasing a technical breakout. As of Thursday, BNB’s sitting round $592, reclaiming a bunch of transferring averages and poking above a cussed descending trendline. Yep, issues are beginning to look a bit extra bullish.

On each the 4-hour and day by day charts, the token’s damaged out of its short-term bearish funk and flipped key EMAs—the 20, 50, and 100 are actually sitting comfortably beneath worth between $586 and $589. That’s nice and all, however the large one—the 200 EMA at $594.48—continues to be looming. That’s the final domino earlier than a full development shift kicks in.

Retest, Reclaim, Repeat

Zooming in, the $585–$589 area has now turn into a key help zone, because of a number of profitable retests. Thus far, BNB is holding up nicely. If bulls can lock in a day by day candle above the $594–$600 vary, the subsequent targets on deck are $626 and $660. These line up with key horizontal ranges from again in March, plus that ever-important golden pocket on the Fibonacci retracement—at all times a spicy space for merchants.

MACD, RSI, and Different Good Stuff

The symptoms are flashing inexperienced—nicely, largely. On the 4H chart, MACD simply crossed above the sign line and people inexperienced histogram bars are getting chunkier, which often hints at continued bullish momentum. RSI is sitting round 59.15, so there’s some upside left earlier than issues get overheated.

Bollinger Bands are widening too, displaying that volatility’s choosing up. Worth is at the moment browsing the higher band—bullish signal. That stated, a bit yellow flag: the CE indicator flashed a promote sign close to $594, so merchants would possibly wish to maintain off on the confetti till we get a clear shut above that stage.

Weekly Outlook: The Golden Pocket Problem

Let’s discuss Fibonacci. The 0.618 retracement stage round $606 is the place issues may actually get attention-grabbing. That’s drawn from the 2023 excessive ($794) all the way down to the 2024 low ($400). This “golden pocket” zone has a rep for being severe resistance—so if BNB can muscle its manner by and shut above $606 on the weekly chart? That’s your development reversal proper there.

In fact, if bulls fumble and worth drops beneath $577, the setup weakens. Beneath that, help sits at $553, then $530. Not a catastrophe, however positively a dent within the rally narrative.

Last Take

BNB’s slowly piecing collectively a stable restoration after that brutal March–April slide. Breaking above $577 final week was the 1st step. Now it’s all about that $600 breakout stage. Quantity’s been regular, momentum seems to be first rate, and construction is bettering—however affirmation is vital. A powerful transfer above $600 may open the floodgates for extra upside… however for now, the market’s holding its breath.