- SUI’s stablecoin provide simply hit a file $746.81M, signaling main liquidity progress—up 99.82% this yr.

- Chart patterns like a wedge + constructive RSI trace at a possible bullish breakout, particularly if SUI clears the $2.90 degree.

- A brand new partnership with Greece’s Inventory Change provides real-world utility, boosting adoption and long-term worth potential.

SUI hasn’t precisely been cruising recently—market volatility’s stored the token from gaining sturdy momentum. However below the floor, issues are trying… fascinating. Between a spike in stablecoin provide and a few big-name partnerships, SUI may simply be warming up for its subsequent transfer.

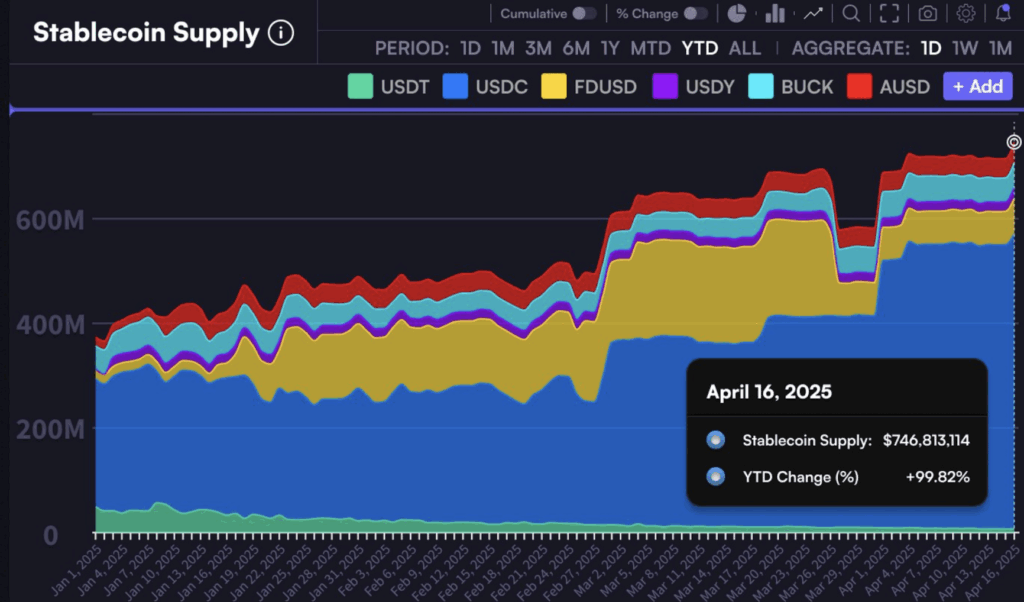

Stablecoin Provide Hits All-Time Excessive—Liquidity On the Rise

So right here’s a giant one: the SUI blockchain simply logged a record-breaking stablecoin provide, hitting $746.81 million. That’s an enormous deal. 12 months-to-date, that’s a 99.82% improve, in response to knowledge shared by Torero Romero on X.

Now, why does that matter? Extra stablecoins on the community = extra liquidity. And extra liquidity normally results in smoother transactions, extra person exercise, and—if issues go effectively—stronger worth efficiency. Mainly, it helps the entire ecosystem breathe a bit simpler.

Some market watchers say this sort of progress in stablecoin provide could possibly be a key issue behind SUI’s long-term worth. It’s like giving the community additional gasoline to scale up dApps, good contracts, and entice larger gamers.

Wedge Sample Hints at Breakout—Up or Down?

On the charts, SUI’s exhibiting indicators of stress increase. A wedge sample is forming—and if you happen to’ve been across the crypto block, you recognize these normally finish with a bang.

Even after a steep 60% pullback, SUI’s holding the $2 line fairly effectively. That wedge is getting tighter, and ultimately, one thing’s gotta give.

The Relative Power Index (RSI) is rising too—pulling away from oversold territory. Bearish momentum’s cooling off, and that is likely to be the cue bulls have been ready for. A leap above $3? Could possibly be on the desk.

Regardless of a Dip, SUI Stays Sturdy Above $2

Sure, SUI’s seen higher days—it’s down 7.38% for the month—however it’s nonetheless clinging to that key $2 degree. That’s a strong psychological help, and to this point, it’s holding.

After 4 crimson candles in a row, a small bullish one simply popped up. Nothing wild, however it’s the sort of early sign that will get technical analysts speaking. If SUI manages to clear the $2.90 resistance degree, that might open the door to $5 territory, in response to CryptoWZRD.

Greece Partnership Provides a Actual-World Increase

And right here’s the kicker—SUI simply teamed up with Greece’s Nationwide Inventory Change. Yeah, that’s not your common DeFi collab. The 2 plan to construct out a blockchain-powered fundraising system utilizing SUI’s infrastructure.

That sort of real-world utility? Big. It doesn’t simply show SUI’s tech works—it builds belief with conventional monetary gamers. And extra belief means extra adoption, which may drive up demand (and worth).

Remaining Ideas

On the time of writing, SUI’s buying and selling at $2.14, up just below 1% on the day. The token briefly examined $2.12 earlier than bouncing round a bit—fairly commonplace consolidation stuff.

However once you put all of it collectively—rising liquidity, technical setups, and high-profile partnerships—SUI may simply be loading the slingshot. Whether or not it fires straight to $5 or takes its time, momentum is beginning to stir.