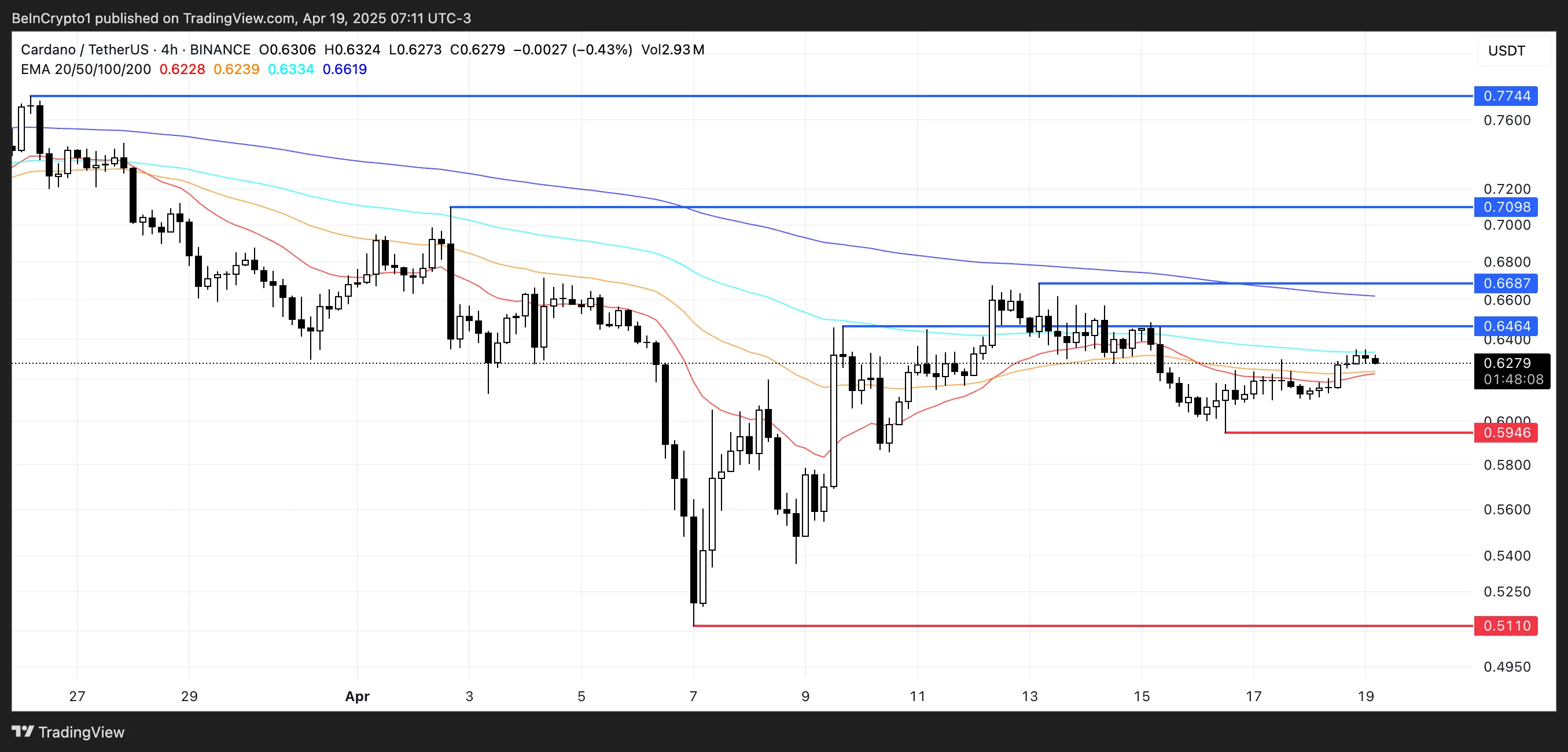

Cardano (ADA) has traded in a decent band between $0.64 and $0.60 for the final 4 days, reflecting a market looking for path. Key indicators present a mixture of weak pattern power and early indicators of potential bullish momentum.

Whale exercise has ticked up barely, and short-term EMA strains are beginning to slope upward, hinting at a potential breakout. Nonetheless, with the ADX remaining low and general sentiment cautious, ADA’s subsequent transfer hinges on whether or not it may possibly break above resistance or maintain its important help.

Cardano’s Development Stays Fragile With ADX Under Key Threshold

Cardano’s ADX (Common Directional Index) is at present at 16.66, rebounding barely after falling from 28.35 4 days in the past to a low of 12 only a day in the past.

This motion reveals that whereas pattern power weakened considerably, there are early indicators of a potential restoration. ADA seems to be making an attempt to kind an uptrend, and the slight bounce in ADX could point out that momentum is beginning to rebuild.

Nevertheless, the general studying stays low, suggesting that any rising pattern remains to be weak and lacks robust conviction for now.

The ADX measures the power of a pattern, no matter its path, on a scale from 0 to 100. Readings beneath 20 counsel a weak or nonexistent pattern, whereas values above 25 usually point out {that a} robust pattern is taking form.

With ADA’s ADX now at 16.66, the present pattern stays weak, however the current uptick may trace at a shift.

If momentum continues to rise and ADX pushes above 25, it could verify {that a} significant pattern—possible bullish—is gaining power. Till then, warning is warranted as the worth stays in a fragile section.

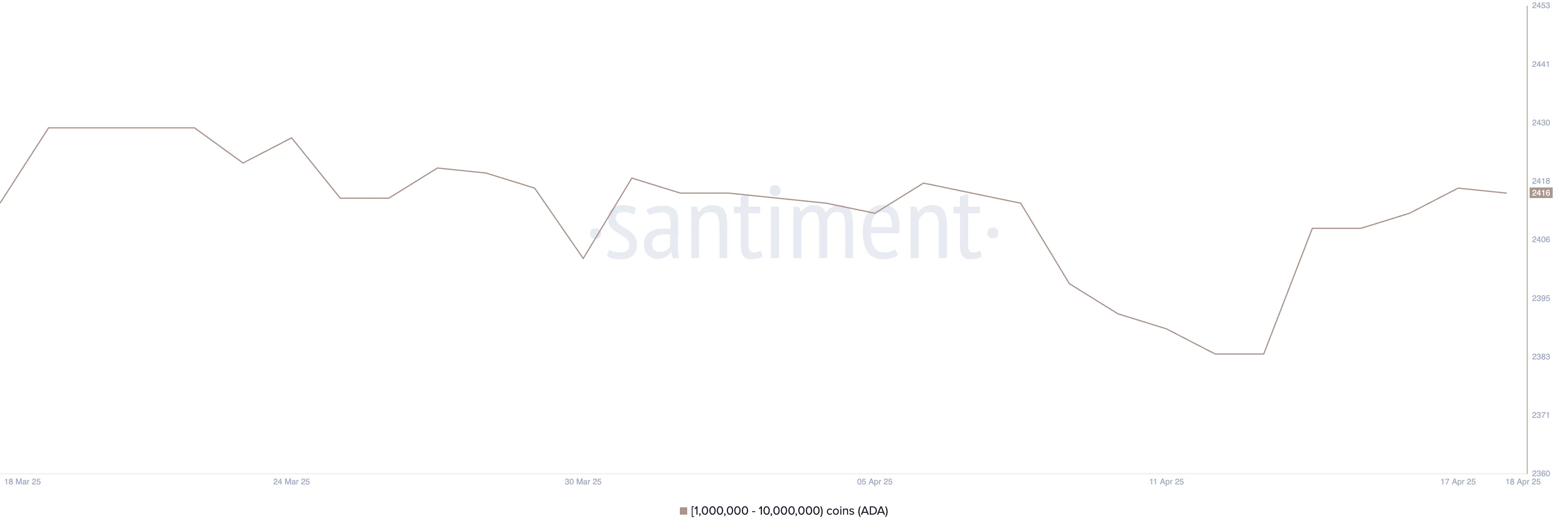

ADA Whales Return – However Nonetheless Under Latest Highs

The variety of Cardano whale addresses—wallets holding between 1 million and 10 million ADA—noticed a pointy improve between April 13 and April 17, leaping from 2,384 to 2,417, marking the best stage since early April.

Nevertheless, the momentum rapidly cooled, with the quantity ticking down barely to 2,416. This fast slowdown means that whereas accumulation picked up briefly, it might not have been robust or sustained sufficient to shift broader market sentiment.

The present whale depend, regardless of the current rise, stays nicely beneath the degrees seen in earlier months.

Monitoring whale exercise is necessary as a result of massive holders can considerably affect value motion by means of concentrated shopping for or promoting.

A rising variety of whales could point out rising confidence amongst main gamers, typically previous value rallies. Nevertheless, the current knowledge reveals solely a modest improve with fading momentum, hinting at hesitation or restricted conviction.

If whale accumulation doesn’t decide up once more, ADA’s value could battle to construct robust upside momentum within the quick time period.

A Breakout Might Push Cardano to a 3-Week Excessive

Cardano value is at present buying and selling inside a decent vary, sitting between resistance at $0.64 and help at $0.59.

Its EMA strains level to consolidation, however the short-term averages are step by step turning upward, hinting at the opportunity of a golden cross forming quickly.

If that bullish crossover occurs and the $0.64 resistance is damaged, ADA may push towards $0.66 and $0.70, with a robust rally doubtlessly sending it to $0.77, reclaiming territory not seen in over three weeks.

Nevertheless, the outlook isn’t with out threat. If the $0.59 help is examined and fails to carry, ADA may lose momentum and slide right into a deeper downtrend, doubtlessly falling all the way in which to $0.51.

With indicators displaying a mixture of consolidation and early bullish indicators, the following transfer possible will depend on whether or not patrons or sellers take management at these key ranges.

Till a breakout or breakdown happens, Cardano stays in a wait-and-see zone.

Disclaimer

According to the Belief Challenge pointers, this value evaluation article is for informational functions solely and shouldn’t be thought of monetary or funding recommendation. BeInCrypto is dedicated to correct, unbiased reporting, however market circumstances are topic to alter with out discover. At all times conduct your individual analysis and seek the advice of with an expert earlier than making any monetary selections. Please notice that our Phrases and Circumstances, Privateness Coverage, and Disclaimers have been up to date.