Pi Community (PI) has climbed over 4% prior to now 24 hours after the launch of its Migration Roadmap. The token is exhibiting early indicators of restoration throughout a number of indicators, however affirmation of a sustained uptrend stays unsure.

Whereas technical setups just like the Ichimoku Cloud and RSI recommend a potential shift in sentiment, resistance ranges proceed to carry sturdy. On the similar time, frustration among the many neighborhood persists because of the lack of readability within the Migration Roadmap, including one other layer of stress to PI’s subsequent transfer.

PI Assessments Cloud Resistance With Weak Pattern Construction Forward

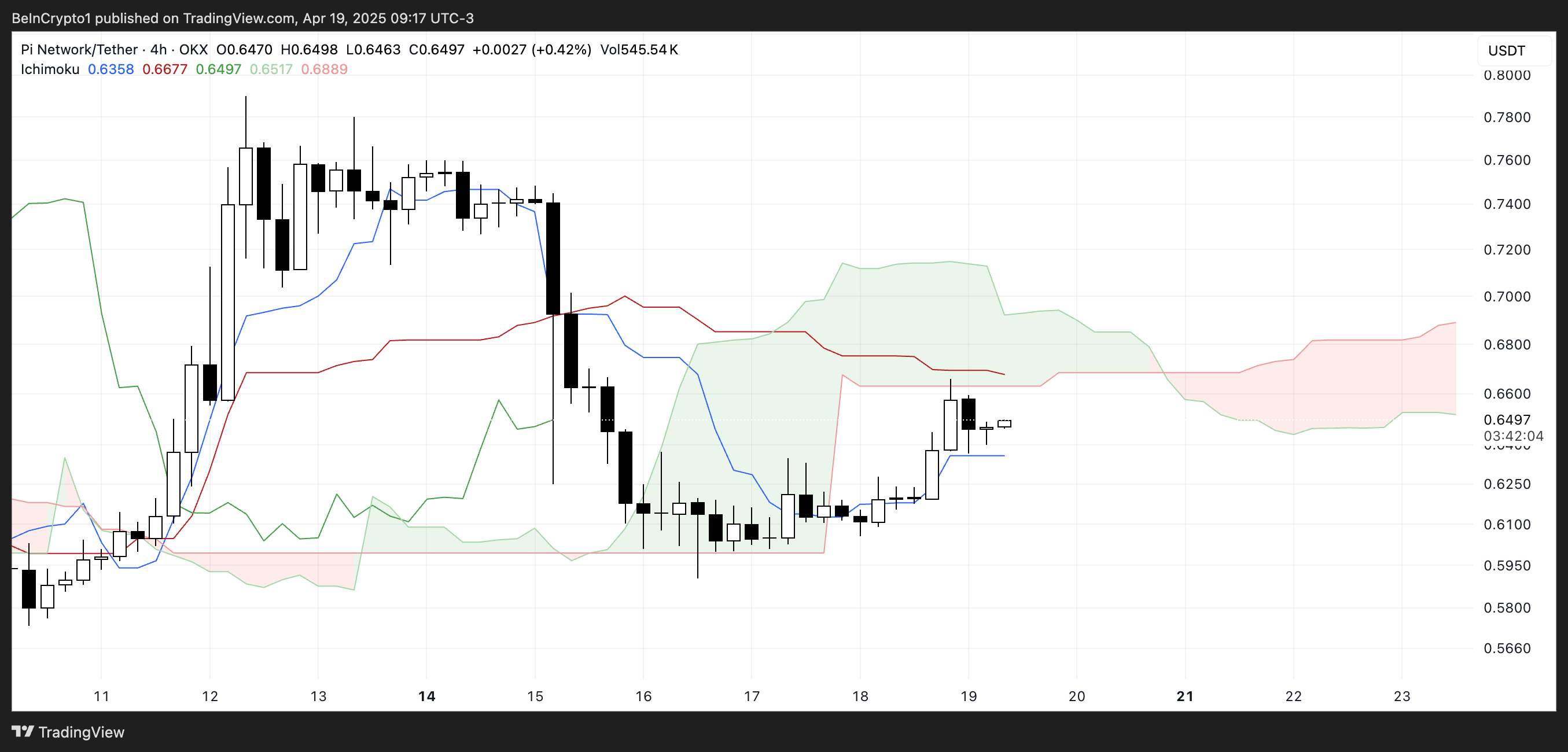

Pi Community is at present buying and selling just under the Ichimoku Cloud, signaling hesitation as patrons try to regain management. Whereas latest candles present larger lows and a few bullish intent, the worth stays underneath the cloud’s resistance zone.

The Tenkan-sen (blue line) continues to be beneath the Kijun-sen (crimson line), which means short-term momentum hasn’t overtaken the medium-term pattern but.

Till a bullish crossover types and the worth breaks via the cloud, the construction favors warning over affirmation.

Trying ahead, the cloud turns into thicker and more and more sloped, suggesting that volatility might return and a stronger pattern—bullish or bearish—might quickly develop.

This widening Kumo signifies that the market could also be making ready for a extra decisive transfer, and a profitable breakout above the cloud could be a big sign.

Nonetheless, so long as PI stays beneath this zone, it stays in a susceptible place, with rejection and continued sideways motion nonetheless on the desk.

Pi Community RSI Rises, However Fails to Maintain Above 57

The Pi Community’s RSI is at present at 53.77, reflecting a big restoration from its deeply oversold studying of 32.34 two days in the past.

Nonetheless, after peaking at 57.25 yesterday, the RSI has barely cooled, suggesting that bullish momentum has weakened considerably.

This shift signifies that whereas shopping for stress lately returned, it has not but been sturdy or constant sufficient to maintain a full breakout. The market seems to be stabilizing, however not aggressively trending in both route.

The Relative Energy Index (RSI) is a momentum oscillator that measures the pace and magnitude of latest worth adjustments on a scale from 0 to 100.

Values above 70 usually recommend an asset is overbought and may be due for a correction, whereas readings beneath 30 point out oversold circumstances and potential upward reversals. With PI’s RSI sitting at 53.77, the token is in neutral-bullish territory, exhibiting average energy however nonetheless removed from overbought ranges.

This leaves room for additional upside if momentum picks again up, but in addition indicators that warning is warranted because the pattern hasn’t but solidified.

PI Eyes Breakout Regardless of Roadmap Frustrations

PI worth is at present hovering just under a key resistance stage, suggesting {that a} decisive transfer may very well be approaching. If this resistance is examined and damaged, PI might resume its upward trajectory, with potential targets round $0.789 and $0.858.

A sustained breakout might even reignite the sturdy momentum seen just a few months in the past, paving the way in which for a push towards $1.23 and even $1.79.

Regardless of the latest 4% worth improve prior to now 24 hours, sentiment stays combined as a result of rising frustration over the Migration Roadmap, which nonetheless lacks a transparent timeline.

On the draw back, if PI fails to interrupt via the $0.66 resistance, the token might face a pullback towards $0.54. A lack of that help stage would open the door for a deeper correction, doubtlessly dragging the worth right down to $0.40.

This makes the present zone an important battleground between patrons and sellers, as the following few periods might decide whether or not PI enters a brand new bullish part or slips again into decline.

Till there’s a transparent breakout or breakdown, the worth stays in a delicate place, closely influenced by each technical ranges and neighborhood sentiment.

Disclaimer

In keeping with the Belief Undertaking tips, this worth evaluation article is for informational functions solely and shouldn’t be thought-about monetary or funding recommendation. BeInCrypto is dedicated to correct, unbiased reporting, however market circumstances are topic to vary with out discover. All the time conduct your individual analysis and seek the advice of with an expert earlier than making any monetary selections. Please word that our Phrases and Situations, Privateness Coverage, and Disclaimers have been up to date.