SUI blockchain has been gaining traction in latest weeks, and its market cap is now approaching $7 billion. Fueled by meme coin exercise and rising DeFi engagement, the community has seen a notable soar in DEX quantity and technical momentum.

Whereas indicators like RSI and EMA strains present early indicators of a possible development shift, general power stays blended. SUI sits at a key crossroads—supported by short-term pleasure however nonetheless needing stronger affirmation to problem top-tier chains.

SUI Surges to fifth in DEX Quantity, However Nonetheless Trails Prime Chains

SUI’s latest surge in DEX exercise has grabbed consideration, largely fueled by rising curiosity in meme cash and speculative buying and selling on its ecosystem. Over the previous seven days, SUI’s DEX quantity hit $2.1 billion, marking a 4.49% improve and persevering with its regular upward development.

This momentum has helped SUI outperform different ecosystems, most notably surpassing Arbitrum prior to now 24 hours to turn into the fifth-largest chain by DEX quantity.

Nevertheless, regardless of the short-term features, SUI nonetheless trails effectively behind top-tier networks like Base, BNB Chain, Ethereum, and Solana in complete DEX exercise.

These established ecosystems proceed to dominate when it comes to liquidity, person base, and general transaction quantity.

Whereas SUI’s rise is notable, particularly given its comparatively new place within the DeFi ecosystem, it might want to maintain this development and diversify past meme coin hype to really problem the main gamers.

For now, it stays an thrilling underdog with momentum—however not but a serious contender.

SUI Momentum Rebuilds, However Pattern Stays Weak

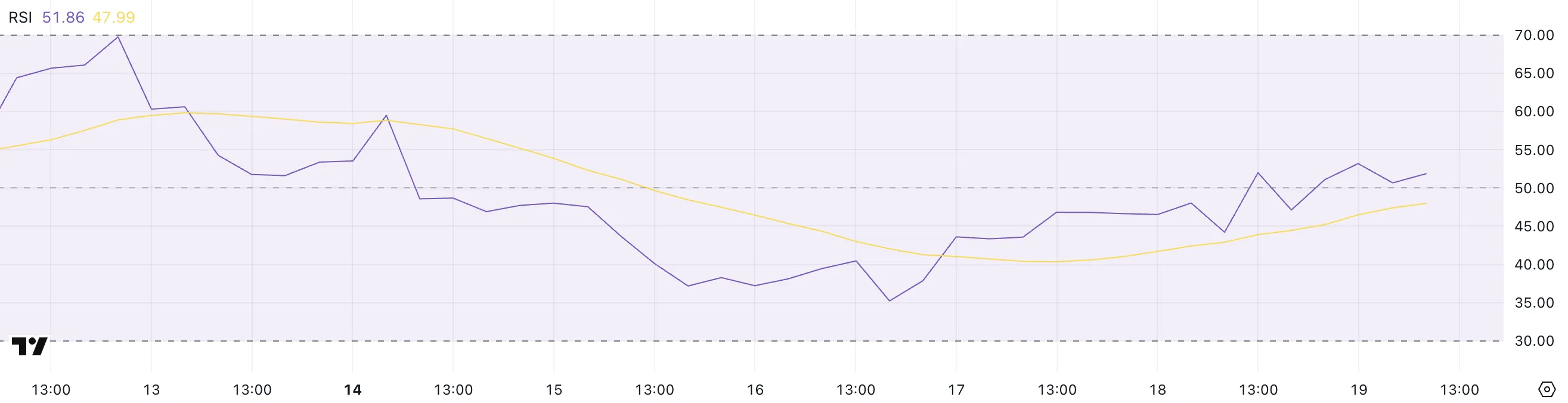

SUI’s RSI is now at 51.86, up from 35.22 simply three days in the past. This means shopping for strain has returned after a short-term dip, serving to stabilize worth motion.

The Relative Energy Index (RSI) measures momentum on a scale from 0 to 100. Readings above 70 are thought-about overbought, whereas these beneath 30 point out oversold circumstances.

Sitting close to the midpoint, SUI’s RSI factors to impartial momentum. It hasn’t crossed above 70 in nearly a month, exhibiting that bullish power has remained restricted.

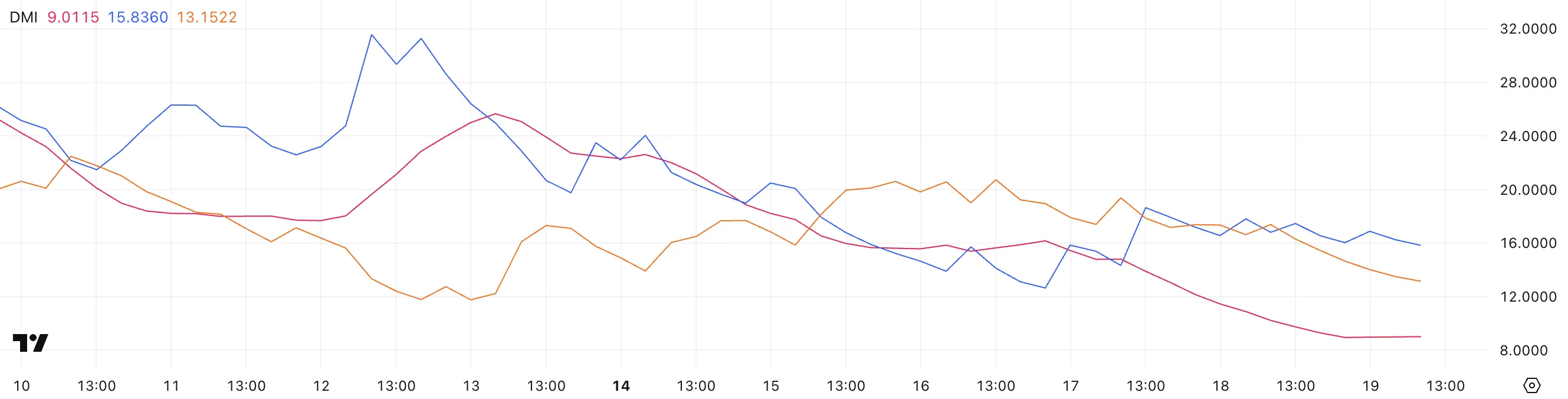

In the meantime, SUI’s DMI (Directional Motion Index) exhibits that its ADX is right down to 9 from 14.79 simply two days in the past. The ADX measures development power, and something beneath 20 alerts a weak or nonexistent development.

The +DI is at 15.83 whereas the -DI is at 13.15, which means consumers have a slight edge—however the low ADX means that edge isn’t robust. There’s no clear development dominating the market proper now.

Collectively, the RSI and DMI recommend that SUI is in a consolidation section. Patrons are exhibiting some exercise, however not sufficient to construct a powerful, sustained development—not less than for now.

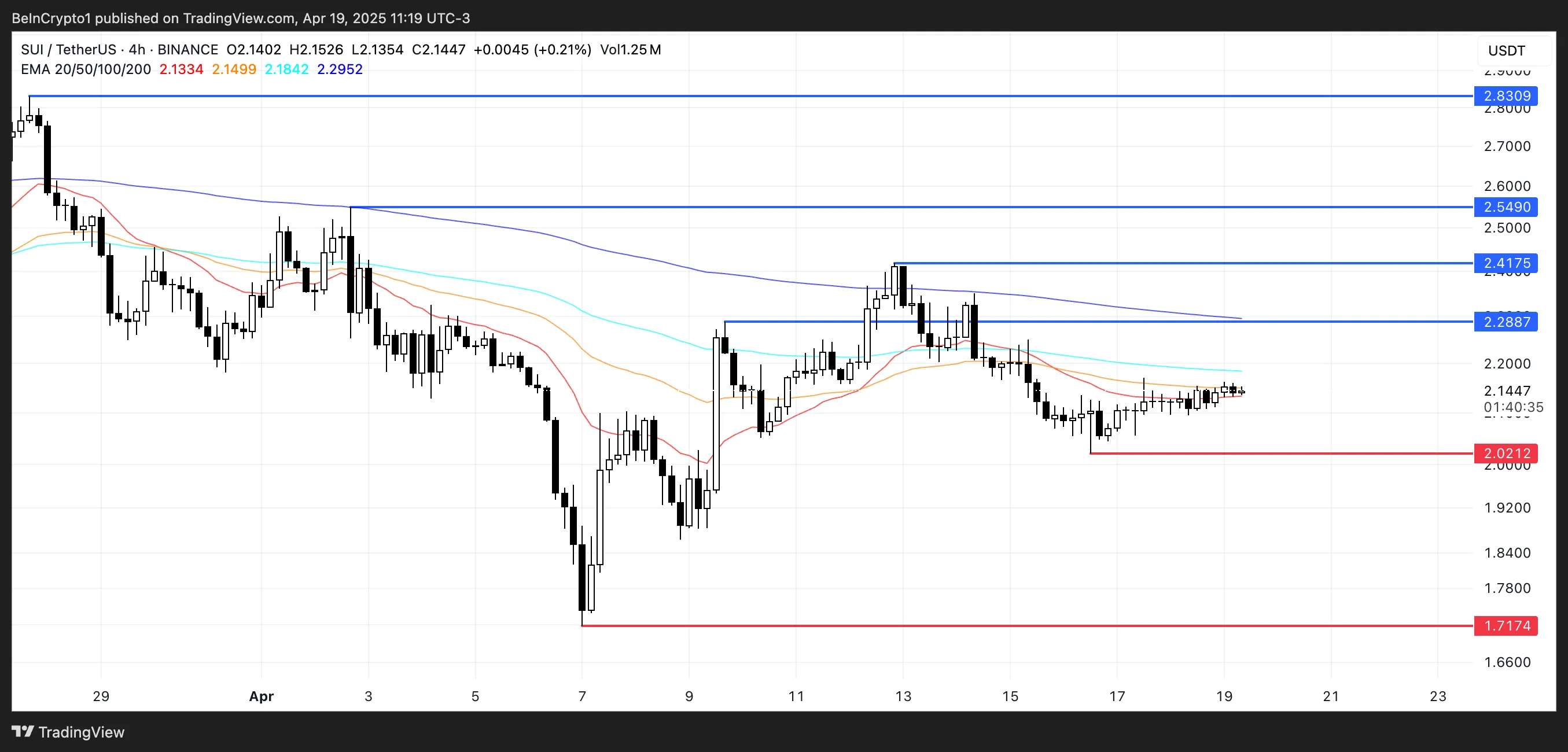

EMA Setup Nonetheless Bearish, However SUI Bulls Present Indicators of Life

SUI’s EMA strains are nonetheless exhibiting a bearish setup, with short-term averages sitting beneath the long-term ones. Nevertheless, the hole between them has narrowed, and a possible golden cross could also be forming.

A golden cross happens when a short-term EMA crosses above a long-term one, typically seen as a bullish sign. If this performs out, SUI may achieve momentum and push towards the $2.28 resistance stage.

Breaking above that would open the trail towards $2.41 and $2.54. If bullish momentum builds additional, SUI blockchain may even take a look at the $2.83 stage—its highest since early March.

But when the market fails to carry present ranges and promoting strain returns, a correction may start. In that case, it’d fall again to check the $2.02 assist.

Shedding that assist may carry deeper draw back, probably pushing SUI towards $1.71. For now, worth motion is at a essential level, with each breakout and breakdown situations on the desk.

Disclaimer

In keeping with the Belief Challenge pointers, this worth evaluation article is for informational functions solely and shouldn’t be thought-about monetary or funding recommendation. BeInCrypto is dedicated to correct, unbiased reporting, however market circumstances are topic to alter with out discover. All the time conduct your personal analysis and seek the advice of with an expert earlier than making any monetary choices. Please observe that our Phrases and Situations, Privateness Coverage, and Disclaimers have been up to date.