The Aptos neighborhood is at the moment evaluating a brand new governance proposal, AIP-119, that would halve staking rewards over the subsequent three months. It seeks to scale back the present annual staking yield from round 7% to three.79%.

Aptos Labs senior engineer Sherry Xiao and community core developer Moon Shiesty launched the proposal on April 18.

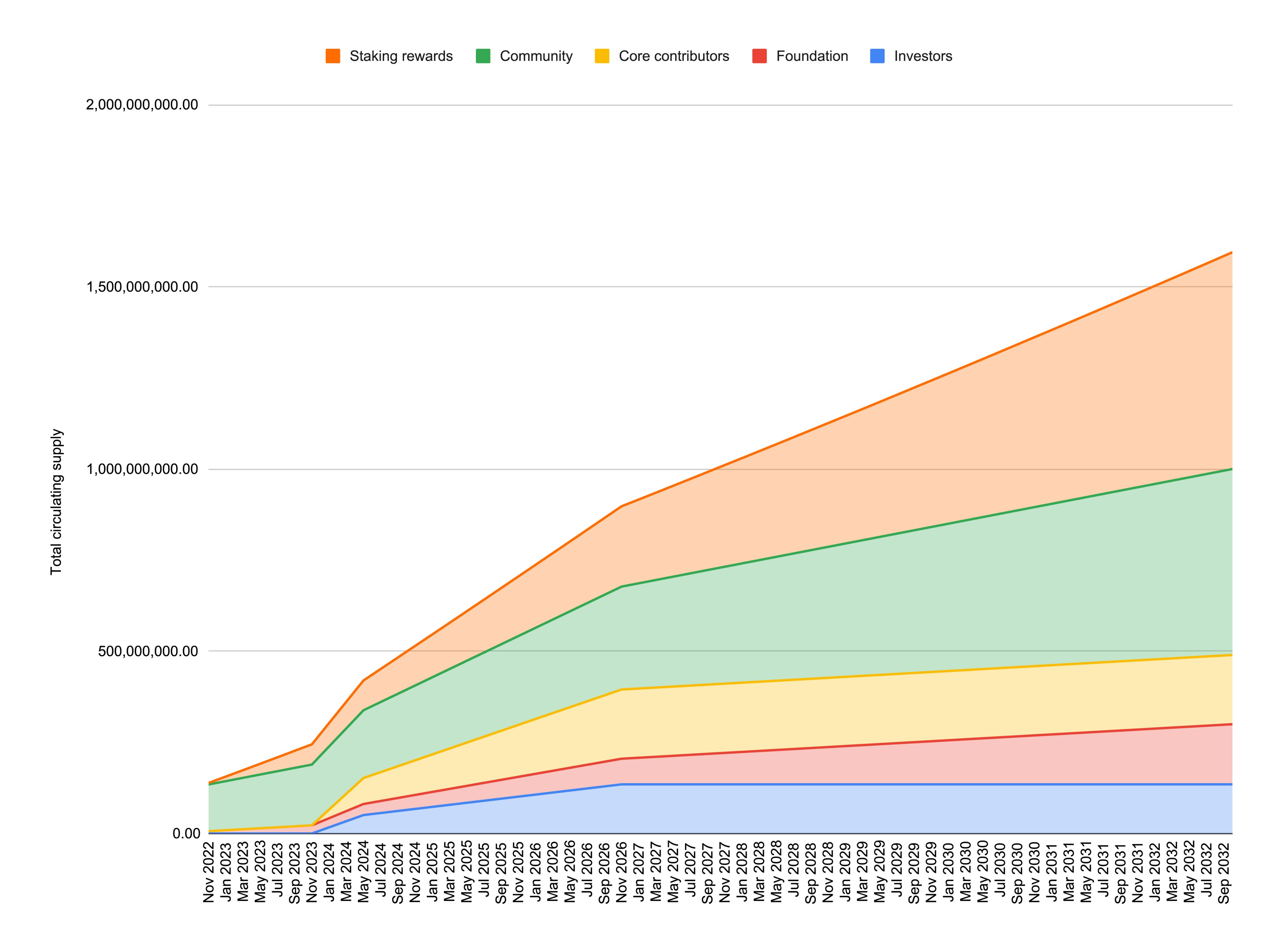

Aptos Eyes Trimming Staking Rewards to Fund New Initiatives

The proposal AIP-119 describes staking rewards as a “risk-free” benchmark, just like the position of rates of interest in conventional finance. In response to the proposal, the present yield price of seven% is just too excessive and discourages productive use of capital inside the ecosystem.

As an alternative, the authors purpose to decrease the yield to round 3.79%. They hope this variation will encourage community customers to pursue extra dynamic financial actions past passive staking.

In response to them, this might stimulate demand for extra energetic methods, similar to restaking, MEV extraction, and participation in DeFi.

“I count on any lowered staking demand [to] be offset by the discount in inflation from this AIP and new reward-generating alternatives launching within the subsequent 6 months, and different sources of defi rewards,” Shiesty added on X.

Furthermore, Shiesty identified {that a} portion of the saved emissions might as a substitute assist initiatives like liquidity incentives and gasoline payment subsidies. He additionally talked about that stablecoin-related packages might profit, particularly in early-stage Layer 1 experiments.

Regardless of the proposal’s broader ambitions, AIP-119 raises considerations about validator sustainability. Beneath the proposed modifications, smaller operators with decrease stake volumes might face monetary pressure.

Shiesty identified that working a validator node in a cloud setting can value wherever from $15,000 to $35,000 per yr. Presently, over 50 validators handle underneath 3 million APT every, accounting for round 9% of the whole community stake.

On account of this, the proposal introduces a validator delegation program to assist these smaller gamers. The initiative would allocate funds and delegate tokens to assist preserve decentralization, geographic variety, and neighborhood involvement.

In the meantime, the neighborhood’s response to the proposal has been divided.

Yui, COO of Aptos-based Telegram recreation Slime Revolution, warned that smaller validators is likely to be pushed out. The chief emphasised the significance of discovering a stability that encourages innovation with out sacrificing decentralization.

“Whereas it might drive innovation, I’m involved concerning the potential influence on smaller validators and decentralization. We want to verify the transfer doesn’t push out smaller members! Aptos ought to deal with stability and long-term resilience,” Yui wrote on X.

Nevertheless, Kevin, a researcher at BlockBooster, argued that the shift may benefit Aptos in the long term. He famous that top inflation typically masks weak product-market match. Decrease inflation, then again, forces builders to construct actual demand.

Kevin additionally prompt that decreased token emissions would possibly enhance APT’s shortage and enhance its value, probably balancing out the decrease staking yield.

“We count on APT’s value to develop because of the decreased inflation price, and validators’ precise returns might offset the APY decline by way of value appreciation, forming a optimistic cycle,” Kevin concluded.

Disclaimer

In adherence to the Belief Mission tips, BeInCrypto is dedicated to unbiased, clear reporting. This information article goals to supply correct, well timed info. Nevertheless, readers are suggested to confirm information independently and seek the advice of with an expert earlier than making any selections primarily based on this content material. Please notice that our Phrases and Circumstances, Privateness Coverage, and Disclaimers have been up to date.