Yearly on April 20, the Dogecoin (DOGE) neighborhood gears up for what has change into generally known as “Dogeday.” It isn’t official, in fact. There isn’t any company sponsor, no banner on buying and selling platforms, no real-world occasion. However on the planet of meme cash and crypto tradition, Dogeday is a factor — an internet-born celebration rooted within the 4/20 meme calendar date and Dogecoin’s joke-fueled origins.

And this yr, Dogeday introduced extra than simply jokes. It introduced numbers.

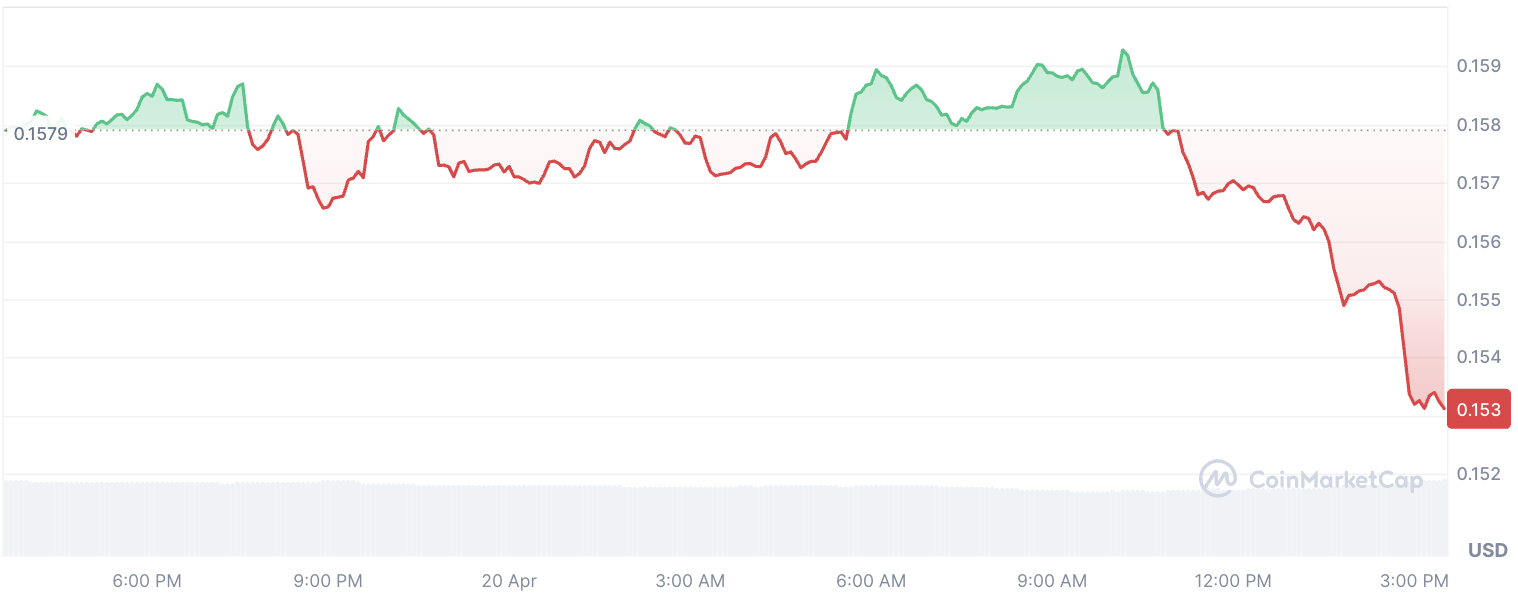

Regardless of DOGE spending a lot of the day sliding down the charts — from round $0.159 early within the session to beneath $0.153 by the afternoon — derivatives merchants determined to gentle issues up anyway.

In response to CoinGlass, choices open curiosity jumped by 58.51%, whereas quantity greater than doubled, rising 116.11%. What will be concluded briefly — current positions had been being shuffled aggressively, however the urge for food for short-term hypothesis was very actual.

Throughout main exchanges, the lengthy/brief ratio leaned closely bullish. Merchants anticipated a Dogeday bounce, however what they received as a substitute was a reasonably brutal intraday downtrend, and practically $2.75 million in liquidations. Longs took the hit, with over $2 million worn out in 24 hours.

So what precisely occurred? Sentiment ran forward of worth, once more. Dogeday might have sparked enthusiasm, however there was no follow-through. No catalyst. Simply momentum fading into the afternoon and a market filled with merchants positioned the mistaken manner.

Nonetheless, that type of speculative spike — particularly when it comes with heavy choices circulate — normally means one factor: Volatility is coming. Both we see a short-term bounce as these positions get reloaded, or the market continues to unwind and DOGE drifts decrease whereas the hype resets.

So, will Dogecoin recuperate from a tough Dogeday? That’s the query now.