Cause to belief

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Created by trade consultants and meticulously reviewed

The best requirements in reporting and publishing

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Este artículo también está disponible en español.

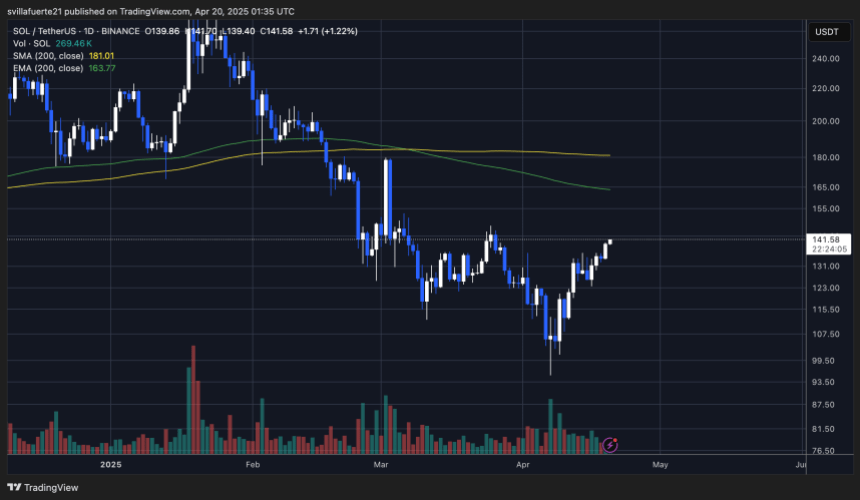

Solana is displaying indicators of power after weeks of heightened volatility and aggressive promoting stress. Because the broader crypto market stabilizes amid ongoing macroeconomic uncertainty and international commerce tensions, Solana has managed to inch nearer to a crucial resistance stage. Regardless of the dangers nonetheless looming, particularly with commerce warfare rhetoric between the US and China escalating, some market members consider the situations are aligning for a possible restoration rally.

Associated Studying

Including weight to that view, latest on-chain information from Glassnode reveals a refined but notable shift in whale exercise. The variety of wallets holding greater than 10,000 SOL has elevated by 1.53% over the previous week, rising from 4,943 to five,019.

This uptick means that bigger holders could also be accumulating forward of a doable breakout, deciphering present value ranges as favorable entry factors. Traditionally, such accumulation phases have preceded sturdy upward strikes, significantly when mixed with technical restoration alerts and enhancing market sentiment.

Whether or not Solana can break by way of resistance and maintain a restoration stays unsure, however the rising whale curiosity paints a cautiously optimistic image for the times forward.

Whale Accumulation Grows As Bulls Regain Momentum

Solana has been one of many hardest-hit belongings through the latest market downturn. Since peaking in January, SOL has misplaced over 65% of its worth, reflecting deep investor uncertainty and heightened promoting stress. As macroeconomic tensions between the US and China proceed to develop, international markets have shifted towards a risk-off sentiment, with high-volatility belongings like Solana taking the brunt of the injury. Nevertheless, there could now be indicators of aid.

A doable decision within the ongoing commerce dispute and enhancing liquidity situations are respiration recent life into the broader altcoin market. In Solana’s case, the restoration narrative is gaining help from on-chain metrics. In line with information shared by prime analyst Ali Martinez on X, the variety of wallets holding over 10,000 SOL has elevated by 1.53% over the previous week, rising from 4,943 to five,019. This refined however notable uptick in large-holder exercise suggests rising institutional or whale confidence in Solana’s long-term potential.

This accumulation pattern, paired with rising momentum amongst bulls, might mark the start of a shift in sentiment after weeks of relentless stress. If international danger urge for food improves and Solana can maintain key help zones, this whale habits might result in a sustained rebound in value.

Associated Studying

Solana Exams Key Resistance As Traders Purpose For A Restoration

Solana (SOL) is presently buying and selling at $140, just under a crucial resistance zone that has capped value advances for weeks. After displaying indicators of power in latest classes, bulls are actually trying to push SOL above the $150 stage—a key threshold that, if damaged, might shortly propel the value towards the $180 mark. The present momentum is being carefully watched, as reclaiming this resistance would sign a pattern reversal and supply the inspiration for a stronger bullish restoration.

To substantiate an uptrend, SOL should break and maintain above the $150 mark after which goal the 200-day transferring common, presently appearing as a dynamic resistance. A decisive transfer above the 200-day MA would point out a shift in sentiment and reinforce Solana’s breakout potential within the close to time period.

Associated Studying

Nevertheless, if bulls fail to reclaim and defend these ranges, bearish stress might return. A rejection at present costs would possible open the door for a retest of decrease demand zones. Shedding help across the $125 stage might take SOL again to $100—a stage that beforehand served as a powerful help throughout earlier selloffs. The following few days might be pivotal for figuring out Solana’s short-term trajectory.

Featured picture from Dall-E, chart from TradingView