XRP is down 5% over the previous week, struggling to regain momentum as technical indicators flash blended indicators. Its Relative Power Index (RSI) has dropped under 50, and the worth stays caught inside a good vary between key assist and resistance ranges.

On the similar time, the Ichimoku Cloud has shifted from inexperienced to pink, with a thickening cloud forward suggesting rising bearish strain. With volatility compressing and momentum fading, XRP is nearing a essential level the place a breakout—or breakdown—appears more and more probably.

XRP Struggles to Regain Momentum as RSI Drops Beneath 50

XRP’s Relative Power Index (RSI) is at the moment sitting at 44.54, after recovering from an intraday low of 40.67. Simply yesterday, it was at 51.30, highlighting elevated short-term volatility.

RSI is a momentum indicator that measures the velocity and magnitude of latest value modifications to guage overbought or oversold circumstances.

Readings above 70 usually counsel an asset is overbought, whereas readings under 30 point out it might be oversold.

With XRP’s RSI at 44.54, it’s at the moment in impartial territory, displaying neither robust shopping for nor promoting strain.

Nevertheless, the truth that it hasn’t crossed the overbought threshold of 70 since March 19—over a month in the past—indicators an absence of sustained bullish momentum. This might imply XRP remains to be in a consolidation part, with the market ready for a clearer path.

If RSI continues to climb towards 50 and past, it might trace at constructing momentum, however with out a breakout above 70, upside may stay restricted.

XRP Faces Uncertainty as Bearish Development Begins to Broaden

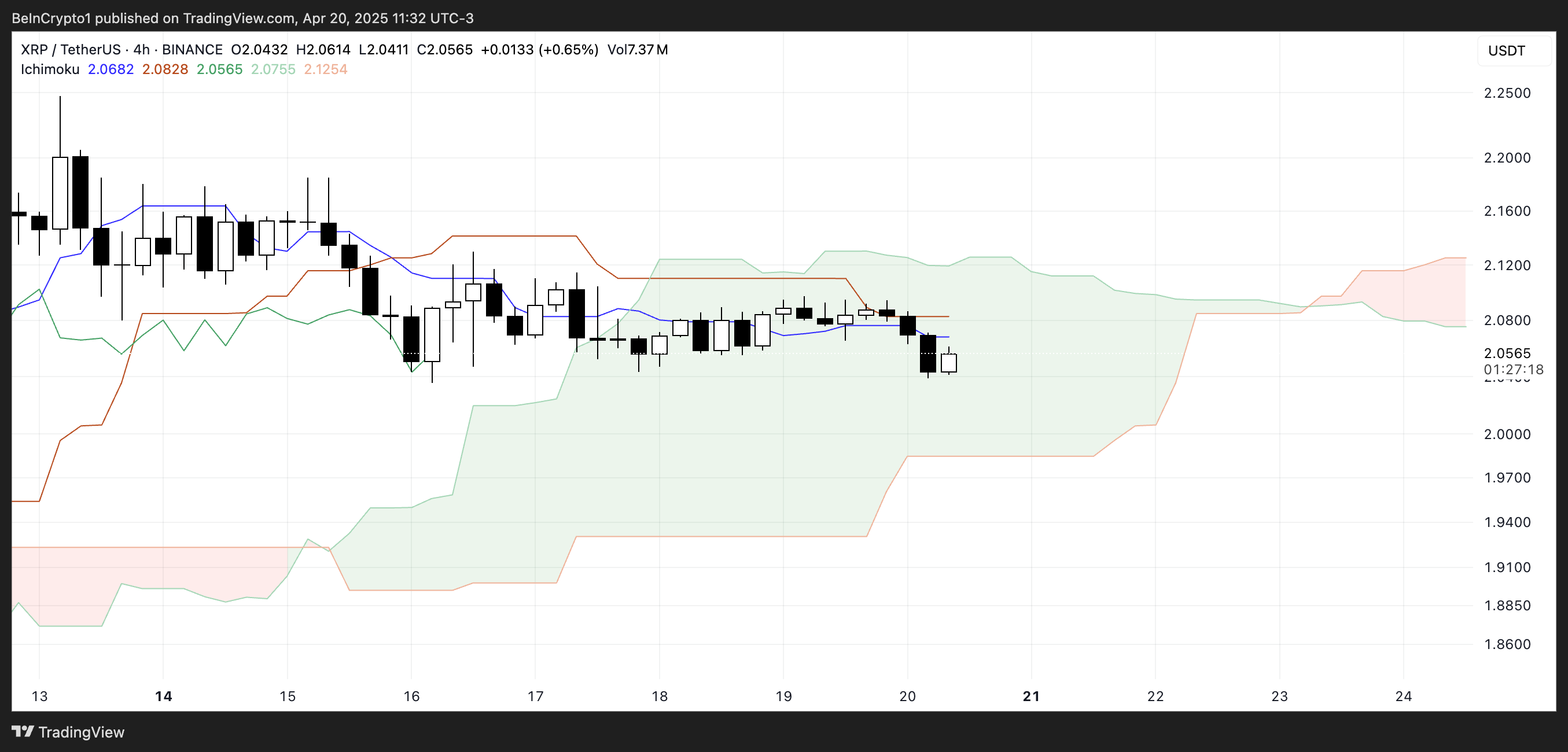

XRP is at the moment buying and selling contained in the Ichimoku Cloud, signaling market indecision and a impartial development.

The Tenkan-sen (blue line) has crossed under the Kijun-sen (pink line), which is a bearish sign, however with the worth nonetheless throughout the cloud, it lacks full affirmation.

The cloud itself acts as a zone of assist and resistance, and XRP is now shifting sideways inside that zone.

Trying forward, the cloud has shifted from inexperienced to pink—an indication that bearish momentum could also be constructing. Much more regarding is that the pink cloud is widening, which suggests growing downward strain within the close to future.

A thickening pink Kumo usually indicators stronger resistance overhead and a possible continuation of a bearish development if the worth breaks under the cloud.

Till XRP breaks out decisively in both path, the market stays in a wait-and-see part, however the rising pink cloud tilts the bias towards warning.

XRP Compression Zone: A Breakout Might Ship Worth to $2.50 — Or A lot Decrease

XRP value is at the moment buying and selling inside a good vary, caught between a key assist degree at $2.05 and resistance at $2.09. This slim channel displays short-term uncertainty, however a decisive transfer in both path may set the tone for what’s subsequent.

If the $2.05 assist fails, the following degree to look at is $1.96. A break under that would set off a steep drop towards $1.61, which might mark the primary shut under $1.70 since November 2024—a bearish sign that would speed up promoting strain.

Just lately, veteran analyst Peter Brandt warned {that a} main correction may hit XRP quickly.

On the flip facet, if bulls regain management and push XRP above the $2.09 resistance, the following goal lies at $2.17. A breakout past that would open the door to a transfer towards $2.50, a value degree not seen since March 19.

For that to occur, XRP would wish a transparent resurgence in momentum and shopping for quantity.

Till then, the worth stays trapped in a slim zone, with each upside and draw back potential on the desk.

Disclaimer

Consistent with the Belief Venture tips, this value evaluation article is for informational functions solely and shouldn’t be thought-about monetary or funding recommendation. BeInCrypto is dedicated to correct, unbiased reporting, however market circumstances are topic to alter with out discover. At all times conduct your personal analysis and seek the advice of with knowledgeable earlier than making any monetary selections. Please observe that our Phrases and Situations, Privateness Coverage, and Disclaimers have been up to date.