Cause to belief

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Created by business consultants and meticulously reviewed

The best requirements in reporting and publishing

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Este artículo también está disponible en español.

Dogecoin has been buying and selling in a decent vary currently, with its value motion more and more narrowing over the previous few days between $0.15 and $0.16. This more and more narrowing vary comes off a wider draw back consolidation transfer because the starting of April, which has led to the creation of a triangle sample on the 4-hour candlestick timeframe chart.

Associated Studying

Because it stands, Dogecoin is making an attempt to get well from earlier losses in April, and a current increased low factors to rising bullish exercise that might ship it pushing above the higher trendline of the triangle sample within the coming week.

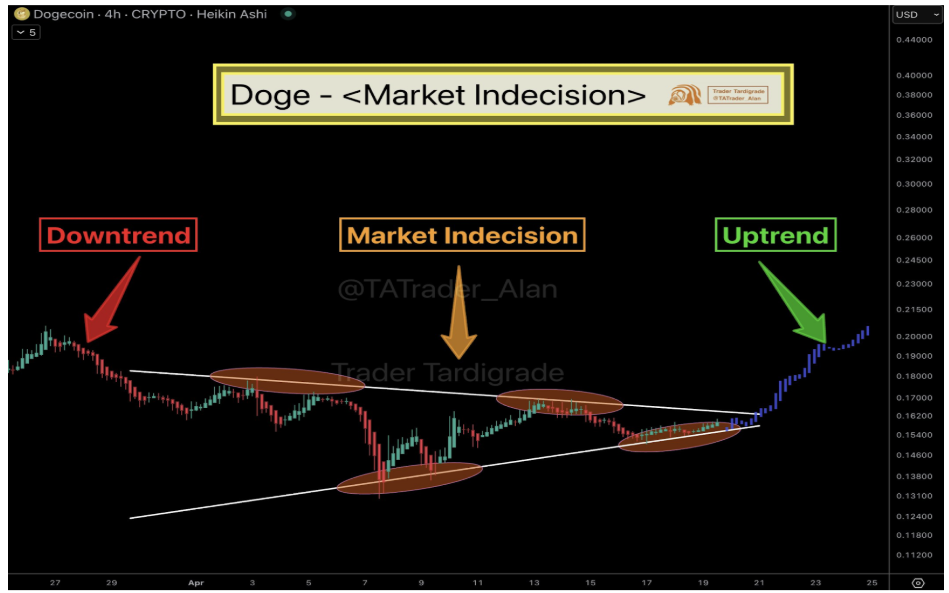

Analyst Notes Traditional Market Indecision In Dogecoin Construction

Crypto analyst Dealer Tardigrade just lately introduced consideration to Dogecoin’s present value construction in a submit shared on the social media platform X, noting a converging triangle formation that displays rising indecision available in the market.

In accordance with his evaluation, Dogecoin’s value motion has transitioned from a transparent downtrend (seen all through late March and increasing into the primary week of April) right into a state of consolidation that has persevered over the previous two weeks.

Wanting on the ensuing triangle formation on the 4-hour candlestick timeframe chart, it’s straightforward to deduce that each patrons and sellers are exercising warning. Patrons are reluctant to enter at increased ranges, whereas sellers appear unwilling to push costs decrease, making a narrowing band of value motion since April 15. The result’s a compression of volatility, which might escape in both route.

What Comes After The Indecision Section?

As proven within the Dogecoin value chart above, the memecoin is now approaching the tip of the triangle. On this specific case, the construction leans towards a bullish breakout, with market conduct exhibiting indicators of upward strain constructing beneath the floor by a 2.77% enhance in buying and selling quantity prior to now 24 hours.

Dealer Tardigrade projected an uptrend that cancels out the downtrend in late March, following the traditional sample of a downtrend, indecision, and a ensuing uptrend.

A powerful bullish candle that closes above the higher trendline of the triangle is essential to validate the expected uptrend. Dealer Tardigrade’s projection exhibits that if such a transfer happens, Dogecoin might reclaim the $0.20 stage inside a comparatively brief timeframe earlier than the tip of the month.

Dogecoin opened the month of April at $0.166. As such, a clear upside breakout adopted by a sustained shut above $0.20 would mark a constructive end for Dogecoin in April.

Associated Studying

Such a constructive month-to-month shut would doubtless affect market sentiment heading into Might and probably invite elevated shopping for exercise. It might additionally assist affirm that the current interval of bearishness is over and assist reestablish a bullish construction.

On the time of writing, Dogecoin was buying and selling at $0.1573

Featured picture from 21Shares, chart from TradingView