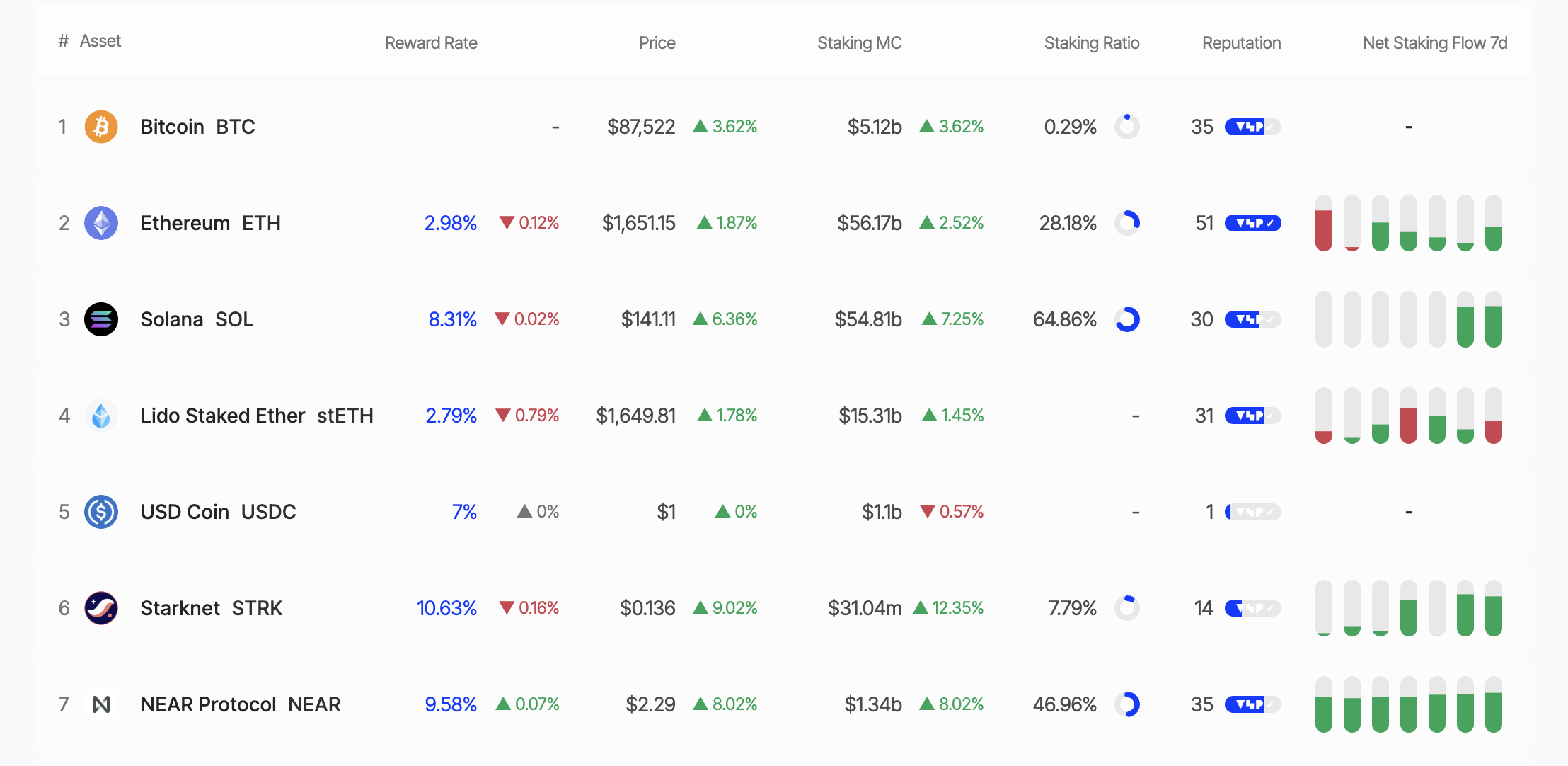

In accordance with information from StakingRewards, Solana (SOL) has overtaken Ethereum (ETH) in staking market capitalization, reaching $53.15 billion in comparison with Ethereum’s $53.72 billion.

This milestone has sparked heated discussions throughout the social media platform X, elevating the query: Is that this a turning level for Solana, or merely a short-lived surge?

Solana Outpaces Ethereum As Excessive Staking Yields Show Interesting

Latest information reveals that 64.86% of Solana‘s complete provide is at the moment staked, delivering a powerful annual share yield (APY) of 8.31%. In distinction, Ethereum has solely 28.18% of its provide staked, with an APY of two.98%.

This disparity highlights Solana’s rising attraction for traders in search of passive revenue by way of staking. Staking market capitalization is calculated by multiplying the whole variety of staked tokens by their present value. With SOL priced at $138.91 as of this writing, Solana has formally surpassed Ethereum on this metric.

Nonetheless, Solana’s excessive staking ratio has sparked some controversy. Critics, akin to Dankrad Feist on X, argue that Solana’s lack of a slashing mechanism (or penalties for validator violations) undermines the financial safety of its staking mannequin. With its slashing mechanism, Ethereum affords larger safety, regardless of its decrease staking ratio.

“It’s very ironic to name it ‘staking’ when there isn’t any slashing. What’s at stake? Solana has near zero financial safety in the intervening time,” Dankrad Feist shared.

Elevated Whale Exercise Indicators Warning

In the meantime, latest strikes by “whales” (massive traders) have additional fueled curiosity in Solana. On April 20, 2025, a whale unstaked 37,803 SOL (value $5.26 million). Equally, Galaxy Digital withdrew 606,000 SOL from exchanges over 4 days (April 15–19, 2025), concluding with 462,000 SOL.

Moreover, on April 17, 2025, a newly created pockets withdrew roughly $5.15 million value of SOL from the Binance alternate. In the identical tone, Binance whales withdrew over 370,000 SOL tokens valued at $52.78 million.

Whereas some whales withdrew their SOL holdings, different massive holders amassed. Janover, a US-listed firm, elevated its Solana holdings to 163,651.7 SOL (value $21.2 million) and partnered with Kraken alternate for staking on April 16, 2025.

These actions sign diverging performs from institutional traders and whales, because the Solana value fluctuates round key ranges.

SOL Value Evaluation: Alternatives and Challenges

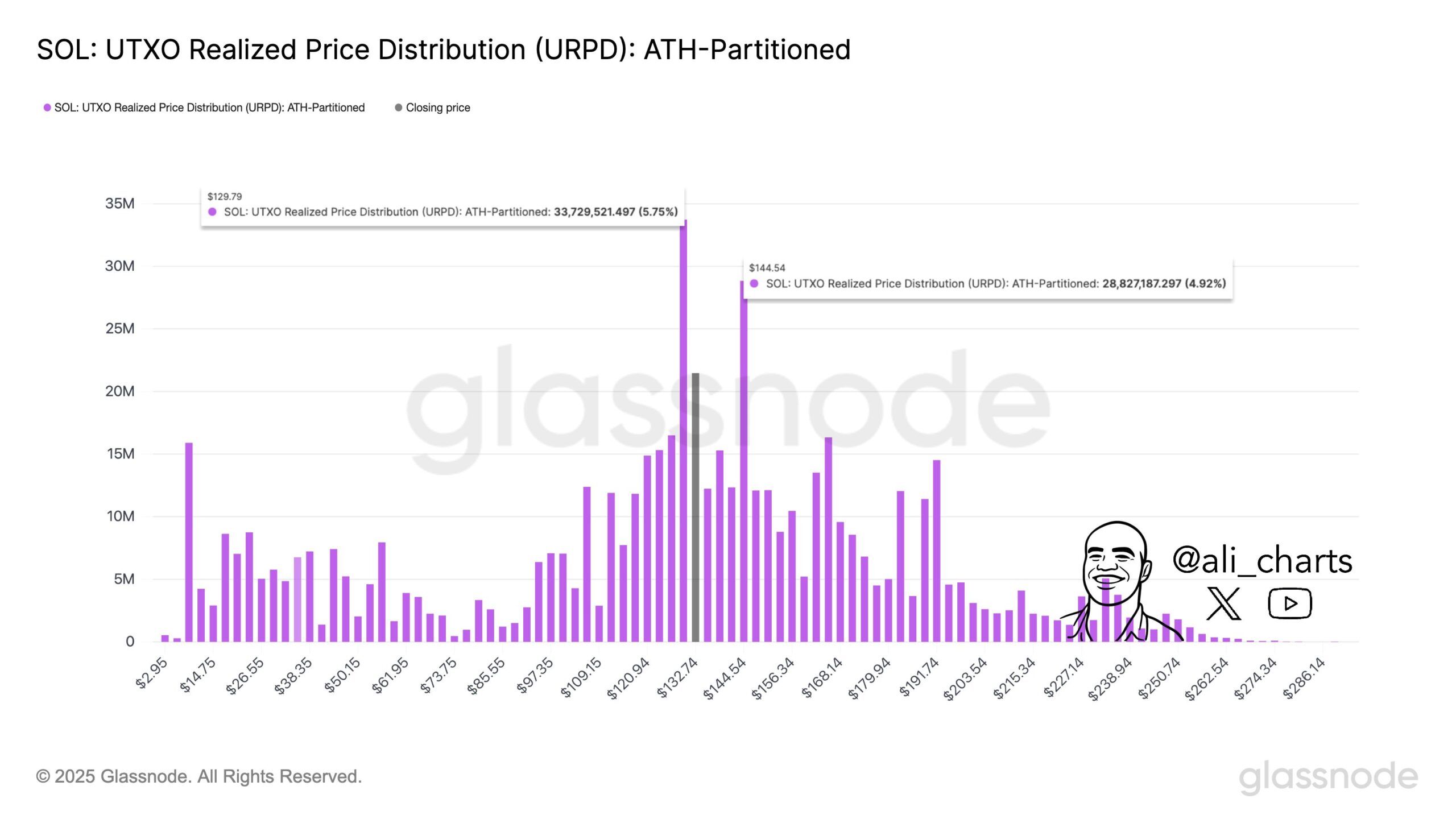

As of this writing, SOL was buying and selling at $140.49, up 3.53% previously 24 hours. Analysts spotlight $129 as essential assist for the Solana value, with $144 presenting the important thing roadblock to beat earlier than Solana’s upside potential will be realized. Breaking above the aforementioned roadblock may propel SOL towards new highs.

Conversely, dropping beneath the $129 assist stage may set off elevated promoting strain. However, SOL has proven a exceptional restoration, with a 14.34% enhance over the previous week.

One other issue to contemplate is the continuing improvement of the Solana ecosystem. Key improvements embody the QUIC information switch protocol, the mixture of Proof-of-Historical past (PoH) and Proof-of-Stake (PoS), and the diversification of validator shoppers.

With these, Solana continues to reinforce its efficiency and decentralization. Moreover, the launch of the Solang compiler, suitable with Ethereum’s Solidity, has attracted builders from the Ethereum ecosystem.

BeInCrypto additionally reported on Solana’s upcoming group convention, in any other case termed Solana Breakpoint. Key bulletins from this occasion may present additional tailwinds for the SOL value.

However, regardless of surpassing Ethereum in staking market capitalization, Solana faces vital challenges. Ethereum advantages from a extra mature DeFi ecosystem, larger institutional belief, and enhanced safety by way of its slashing mechanism.

To some, Ethereum’s decrease staking ratio (28%) could also be a deliberate technique to cut back community strain and guarantee liquidity for DeFi purposes.

In distinction, Solana’s excessive staking ratio (65%) may restrict liquidity inside its DeFi ecosystem. This raises the query of whether or not Solana can strike a stability between staking and the expansion of its decentralized purposes.

As Solana continues difficult Ethereum’s dominance, the crypto group stays divided. Is Solana’s rise a sustainable breakthrough, or simply one other wave of hype?

Disclaimer

In adherence to the Belief Challenge tips, BeInCrypto is dedicated to unbiased, clear reporting. This information article goals to offer correct, well timed data. Nonetheless, readers are suggested to confirm info independently and seek the advice of with knowledgeable earlier than making any selections primarily based on this content material. Please notice that our Phrases and Circumstances, Privateness Coverage, and Disclaimers have been up to date.