The XRP community is flashing early warning indicators, with a steep drop in newly created pockets addresses elevating considerations about fading curiosity.

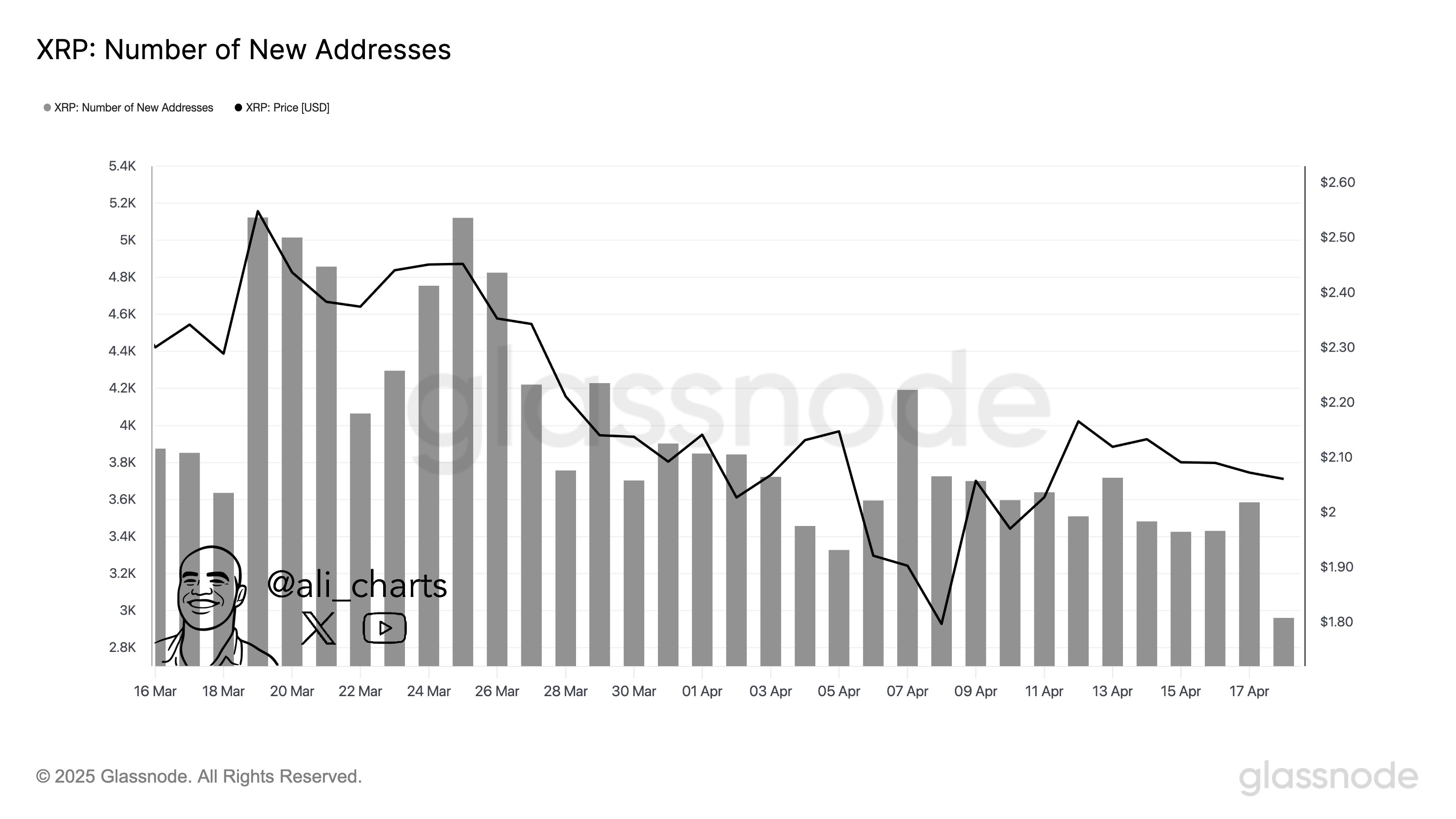

Over the previous month, new tackle exercise has declined by 44%, falling from round 5,200 on March 22 to simply 2,900 by April 17, based on Glassnode knowledge. This cooling adoption pattern coincides with a broader worth dip, suggesting that investor enthusiasm could also be waning.

Technical indicators are including to the warning. Crypto analyst Ali Martinez just lately pointed to a bearish head-and-shoulders sample on XRP’s chart, with the value breaking under a key neckline at $2.05—a stage that has since been retested and rejected.

If this sample performs out totally, XRP may retrace to the $1.30–$1.40 vary, marking a doable 30% drop from present ranges.

The bearish case is additional supported by an uptick briefly positions and growing whale exercise, as merchants anticipate extra draw back. One other analyst, CrediBULL, believes XRP should maintain the $1.60 zone to keep away from deeper losses and doubtlessly reset for a restoration.

At current, XRP is buying and selling at $2.04 after a 7% weekly decline, displaying short-term weak spot whereas nonetheless holding above its 200-day transferring common—an indication of longer-term resilience. Nevertheless, sentiment stays shaky. The Worry & Greed Index sits at 37, indicating investor warning, whereas momentum indicators corresponding to RSI stay impartial. Except XRP can reclaim misplaced floor quickly, a bigger correction may very well be on the horizon.