Investor Tom Lee says that US equities are nonetheless in the course of a bull cycle after finishing a traditional worth correction.

In a brand new video replace for buyers on Fundstrat’s YouTube channel, the agency’s chief funding officer says he’s assured that the S&P 500 has already printed its low, however he simply isn’t positive if a fast V-shaped restoration like 2020 will play out or if a 2011-style consolidation will unfold.

Lee says buyers’ interpretation of a number of dangers, corresponding to tariffs and inflation expectations, will probably determine the inventory market’s subsequent transfer.

“I believe that we’re nonetheless in a bull market. I’m simply not clear if it’s a V-shaped restoration like 2020 or it’s a spread market like 2011.

Intuitively, I’m going to say that it is smart that we’ve made a backside, however we’re possibly vary sure for a bit. And that’s as a result of individuals are anxious that there are different sneakers to drop. The tariff conflict with China may flip into a chilly conflict. Traders are going to fret concerning the ripple results of this shock, resulting in a worldwide recession. These are excessive views, by the way in which.

[Or] that some individuals are going to fret a few monetary disaster from all this deleveraging, and that inflation expectations may surge to an extent that we get ‘greedflation.’ That’s the place firms are mainly elevating costs, and it’s going to pressure the Fed to hike. And naturally, if estimates fall greater than 20%, shares have draw back as a result of the inventory market already had a 20% drawdown.”

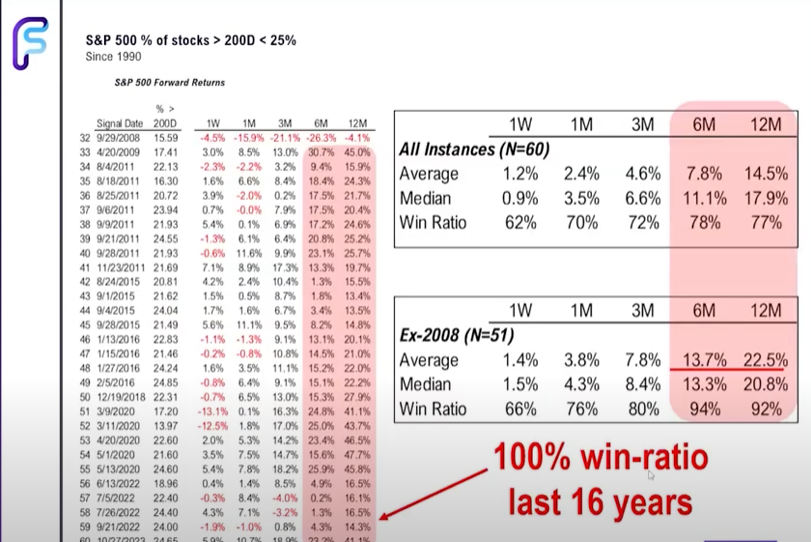

Lee shares a chart displaying that solely 6% of shares within the S&P 500 are above their 50-day shifting common, and simply 19% are above their 200-day shifting common. The investor says that traditionally, the setup has had excessive win charges for bulls.

“That is the proportion of shares above the 50-day shifting common on the high, and above the 200-day shifting common on the underside. Beneath 20% is a giant deal, as a result of over the past 16 years, the S&P was larger six months and 12 months later. The truth is, should you have a look at three months later, outdoors of 2022, the inventory market was larger three months later each single time, so I believe we did make a structural low.”

As of Friday’s shut, the S&P 500 is buying and selling at 5,282 factors.

Observe us on X, Fb and Telegram

Do not Miss a Beat – Subscribe to get electronic mail alerts delivered on to your inbox

Test Value Motion

Surf The Each day Hodl Combine

Disclaimer: Opinions expressed at The Each day Hodl are usually not funding recommendation. Traders ought to do their due diligence earlier than making any high-risk investments in Bitcoin, cryptocurrency or digital belongings. Please be suggested that your transfers and trades are at your individual danger, and any losses it’s possible you’ll incur are your duty. The Each day Hodl doesn’t suggest the shopping for or promoting of any cryptocurrencies or digital belongings, neither is The Each day Hodl an funding advisor. Please be aware that The Each day Hodl participates in internet online affiliate marketing.

Generated Picture: Midjourney