Key Takeaways

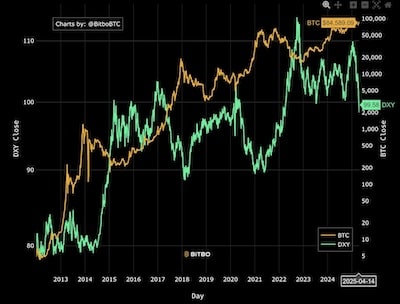

- DXY hit a 3-year low at 98.2 following Trump’s efforts to take away Jerome Powell.

- Bitcoin rose to $87,586, its highest since April 2, amid greenback weak spot.

- Trump’s criticism of Powell contains claims of politically motivated charge selections.

The US Greenback Index (DXY) fell to 98.2 on April 21, its lowest degree since March 2022, following President Donald Trump’s renewed push to take away Federal Reserve Chair Jerome Powell.

This drop coincided with a pointy rally in Bitcoin, which surged to $87,586 — its highest worth since April 2, also called “Liberation Day” by Trump supporters.

Trump’s push in opposition to Powell

In keeping with Nationwide Financial Council Director Kevin Hassett, Trump and his workforce are “actively exploring” Powell’s removing, criticizing the Fed for politically biased charge selections.

Hassett accused the central financial institution of elevating rates of interest shortly after Trump’s election and later chopping them to learn Democrats.

Trump, for his half, referred to as Powell…

… all the time too late and improper.

He even added that….

… Powell’s termination can not come quick sufficient!

Market influence & reactions

The DXY’s decline spurred beneficial properties not solely in Bitcoin, but in addition gold and different main currencies.

Economist Peter Schiff famous the greenback’s widespread weak spot:

The euro is above $1.15. The greenback has additionally fallen under 141 Japanese yen and .81 Swiss francs… that is getting critical.

Issues over Fed independence

With Powell’s time period set to run till Could 2026, the scenario raises issues about Federal Reserve independence.

Nonetheless, traders reacted swiftly.

Bitcoin jumped 3.5% in a single day, pushed by expectations that rate of interest cuts — if Trump replaces Powell — may additional weaken the greenback.

Sean McNulty, Derivatives Buying and selling Lead at FalconX, commented:

USD weak spot is driving the rally.