The current depeg incident involving sUSD from Synthetix has highlighted that this sector stays fraught with dangers regardless of the immense potential of algorithmic stablecoins.

The sUSD incident just isn’t the primary to reveal the vulnerabilities of algorithmic stablecoins. From technical challenges and regulatory pressures to dwindling neighborhood belief, tasks on this house should navigate quite a few obstacles to outlive and thrive.

The Panorama of the Algorithmic Stablecoin Market

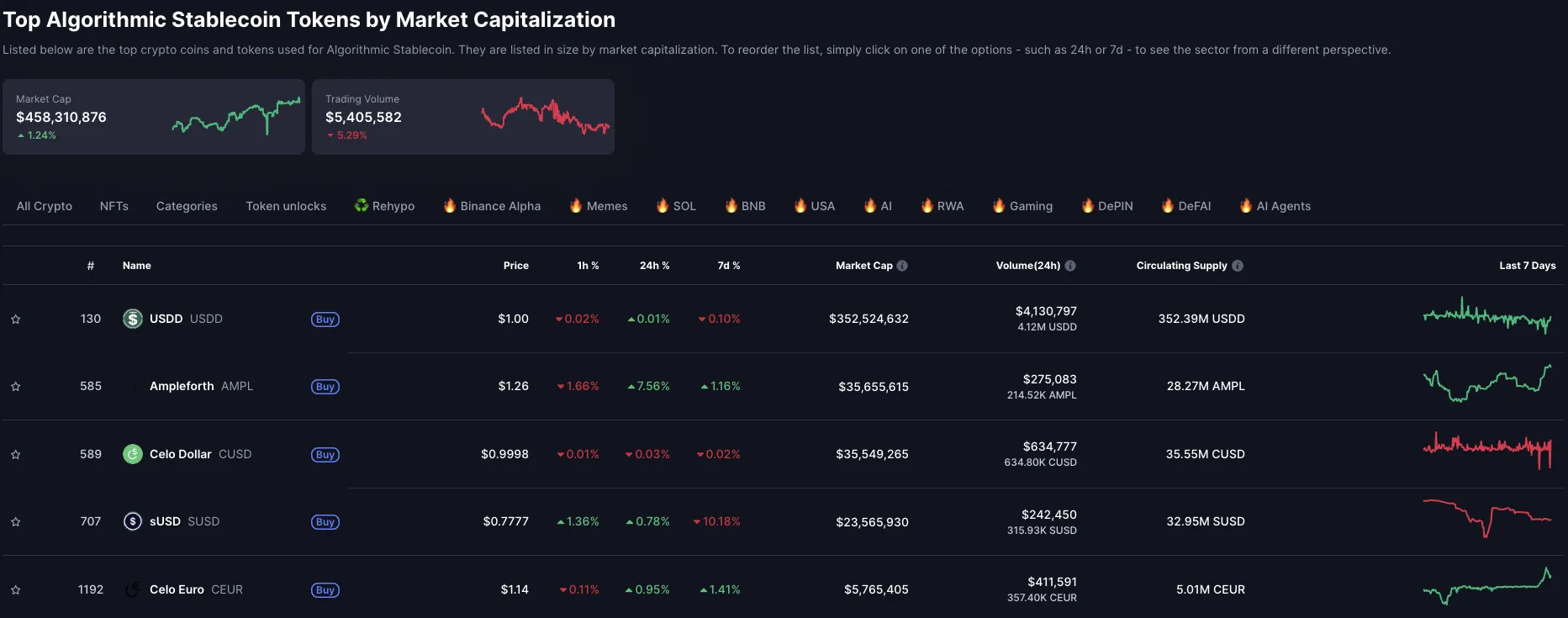

Algorithmic stablecoins, which preserve their worth with out direct asset backing, had been as soon as hailed as a breakthrough in decentralized finance (DeFi). Nonetheless, in response to CoinMarketCap information from April 2025, the entire stablecoin market capitalization stands at $234 billion, whereas algorithmic stablecoins account for about $458 million, equal to simply 0.2%.

This stark disparity displays the truth that algorithmic stablecoins have but to realize widespread belief from the neighborhood. Excessive-profile failures just like the collapse of UST/LUNA in 2022, coupled with regulatory uncertainties such because the EU’s MiCA framework, have fueled skepticism.

Extra not too long ago, the depeg of Synthetix’s sUSD is a typical instance of this mannequin’s inherent dangers.

A Deep Dive into Synthetix’s sUSD Depeg

Synthetix is a well known DeFi protocol celebrated for its artificial asset system. Inside this ecosystem, sUSD is an algorithmic stablecoin designed to peg its worth at 1 USD, backed by the SNX token and value information from Chainlink.

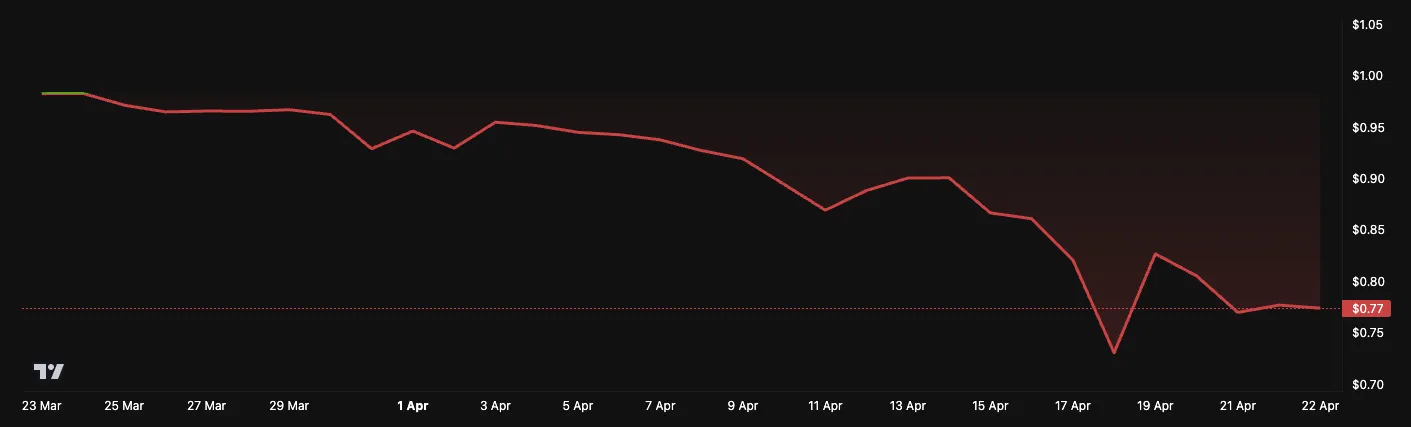

Nonetheless, sUSD has confronted important challenges with a chronic depeg not too long ago. On the time of BeInCrypto’s report, sUSD was buying and selling at 0.77 USD, which has continued since late March 2025. The first trigger was a significant liquidity supplier withdrawing from the sBTC/wBTC pool on Curve, which triggered intense promoting stress on sUSD. This compelled customers to transform different artificial belongings like sETH or sBTC into sUSD, exacerbating the value decline.

On April 21, 2025, Kain Warwick, the founding father of Synthetix, introduced on X that the staff had carried out an sUSD staking mechanism to handle the problem. Nonetheless, he famous that the mechanism stays guide and lacks a completely useful consumer interface (UI), which is anticipated to launch in a number of days.

“Replace on the sUSD depeg. We’ve got carried out an sUSD staking mechanism however it’s very guide till the UI goes reside in a number of days. Right here was my sizzling take from discord although,” shared Kain Warwick, founding father of Synthetix.

Warwick additional acknowledged that if the motivation mechanism (carrot) proves ineffective, Synthetix would undertake stricter measures (stick) to compel stakers within the 420 pool to take part extra actively. He emphasised that, with the collective internet price of SNX stakers reaching billions of USD, Synthetix has the monetary assets to stabilize sUSD and resume growth of spinoff merchandise on Layer 1.

No Efficiently Algorithmic Stablecoin Challenge

Earlier than the sUSD depeg incident, the market witnessed the dramatic collapse of UST/LUNA in 2022. UST, Terra’s algorithmic stablecoin, suffered a extreme depeg, dragging LUNA’s worth down from $120 to close zero. This occasion triggered billions of USD in losses and considerably eroded belief within the algorithmic stablecoin mannequin.

Extra not too long ago, the ‘Godfather of DeFi’, Andre Cronje, behind Sonic (previously Fantom), additionally shifted path. Sonic initially developed a USD-based algorithmic stablecoin however later pivoted to a stablecoin pegged to the UAE dirham.

“Fairly certain our staff cracked algo secure cash at this time, however earlier cycle gave me a lot PTSD unsure if we should always implement,” Cronje acknowledged.

Past technical dangers, algorithmic stablecoins face mounting regulatory pressures. The EU’s MiCA regulation, efficient since June 2024, imposes strict requirements on stablecoin issuers to make sure shopper safety and monetary stability. Underneath MiCA, algorithmic stablecoins are categorised as ART (Asset-Referenced Token) or EMT (E-Cash Token), requiring tasks to satisfy advanced compliance calls for.

This intensifies the stress on builders, particularly as different jurisdictions additionally tighten crypto laws.

These examples present the vulnerability of algorithmic stablecoins to liquidity shocks and market sentiment, notably as a consequence of their lack of direct asset backing.

The Potential of Algorithmic Stablecoins

Regardless of the challenges, algorithmic stablecoins nonetheless maintain developmental potential. A March 2025 publish on X by CampbellJAustin urged {that a} next-generation decentralized algorithmic stablecoin is possible if classes are discovered from previous failures.

“I truly suppose a next-gen decentralized algorithmic stablecoin is feasible. I additionally suppose it won’t be completed accurately by the crypto neighborhood as a result of the first constraints are financial and threat administration, not technological,” CampbellJAustin shared.

Nonetheless, tasks should deal with constructing extra value stability mechanisms, combining algorithms with liquidity safeguards to succeed. Moreover, they need to put together for regulatory necessities, notably in areas with stringent guidelines just like the EU. Transparency in operations, common audits, and clear communication with customers are essential to rebuilding neighborhood belief.

By addressing these elements, tasks on this house can seize the chance to regain confidence and drive innovation.

Disclaimer

In adherence to the Belief Challenge pointers, BeInCrypto is dedicated to unbiased, clear reporting. This information article goals to supply correct, well timed info. Nonetheless, readers are suggested to confirm information independently and seek the advice of with knowledgeable earlier than making any selections based mostly on this content material. Please word that our Phrases and Circumstances, Privateness Coverage, and Disclaimers have been up to date.