Hedera (HBAR) is up greater than 6% within the final 24 hours, displaying renewed indicators of energy throughout a number of technical indicators. Momentum is constructing, with the DMI suggesting patrons are beginning to take management and the Ichimoku Cloud displaying a clear bullish construction.

A possible golden cross on the EMA traces may additional gasoline the uptrend, opening the door for a breakout above $0.178 and probably even $0.20. With sentiment enhancing and resistance ranges in sight, HBAR is positioning itself for a key transfer after weeks of consolidation.

Hedera Alerts a Potential Shift as Consumers Regain Momentum

Hedera’s Directional Motion Index (DMI) is displaying early indicators of momentum constructing, with its ADX rising to 16.27, up from 13.54 two days in the past.

The ADX (Common Directional Index) measures the energy of a development, no matter path. Readings beneath 20 point out a weak or sideways market, whereas values above 25 counsel a robust and sustained development is forming.

With the ADX nonetheless below 20, HBAR isn’t trending strongly but, however the latest enhance factors to a possible shift in momentum.

The +DI (constructive directional indicator) is at present at 22.6 — up from 14.19 two days in the past, although barely down from 26.17 yesterday, and rebounding from 17.8 earlier in the present day.

This reveals shopping for strain has picked up lately, even when there’s short-term fluctuation. In the meantime, the -DI (detrimental directional indicator) has dropped to 13.24 from 17.54 yesterday, signaling weakening promoting strain.

Collectively, these actions counsel bulls are beginning to take management, and if the ADX continues to rise above 20, it may affirm a strengthening uptrend for HBAR.

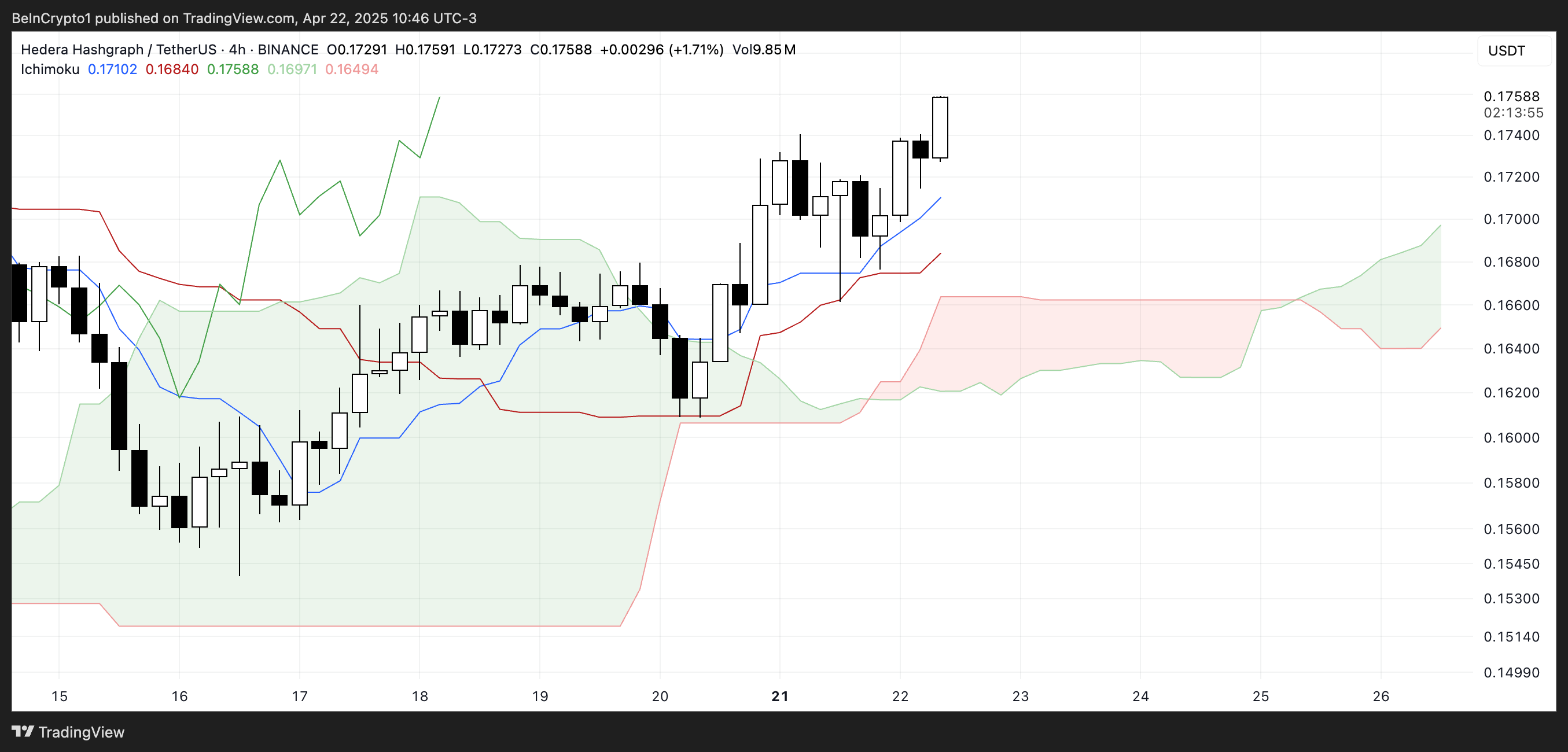

Hedera Maintains Bullish Momentum as Pattern Construction Holds Agency

Hedera’s Ichimoku Cloud chart is at present flashing robust bullish alerts. Worth motion is effectively above the Kumo (cloud), which signifies clear upward momentum.

The cloud has transitioned from crimson to inexperienced, signaling a shift in sentiment from bearish to bullish.

This transition typically means that the present development may maintain if no important reversal emerges.

The Tenkan-sen (blue line) is positioned above the Kijun-sen (crimson line), reinforcing a short-term bullish bias. Moreover, the long run cloud is sloping upward, hinting at continued energy forward.

The Chikou Span (inexperienced lagging line) can also be above the worth candles and cloud, additional confirming the alignment of all Ichimoku parts in favor of the bulls.

Until the worth breaks down beneath the Tenkan-sen or the cloud itself, the outlook stays constructive.

Hedera Eyes $0.20 Breakout as Golden Cross Nears

Hedera’s EMA traces are displaying indicators of convergence, indicating {that a} golden cross may type quickly — a basic bullish sign. If that occurs, HBAR may break the resistance at $0.178, and if the uptrend continues, it might climb to check $0.20.

Ought to bullish momentum absolutely return, Hedera value may rise towards $0.258, marking its first transfer above $0.25 since early March.

On the draw back, if HBAR fails to construct momentum, it may retest help at $0.153.

A break beneath that degree would weaken the construction and open the door to additional losses, with $0.124 as the subsequent main help.

Disclaimer

Consistent with the Belief Undertaking pointers, this value evaluation article is for informational functions solely and shouldn’t be thought-about monetary or funding recommendation. BeInCrypto is dedicated to correct, unbiased reporting, however market situations are topic to alter with out discover. At all times conduct your individual analysis and seek the advice of with knowledgeable earlier than making any monetary choices. Please be aware that our Phrases and Situations, Privateness Coverage, and Disclaimers have been up to date.