- Accumulation or Setup? LINK trade reserves have hit their lowest since mid-2022, hinting at long-term holders transferring belongings off exchanges—presumably prepping for accumulation or a protracted maintain.

- Bullish Indicators, However Not Totally Baked: Energetic addresses and new wallets are on the rise, however total community exercise continues to be under earlier highs. Momentum’s constructing, nevertheless it’s not breakout-level simply but.

- Resistance in Focus: For LINK to actually flip bullish, it wants to interrupt and maintain above the $14.5–$15.55 vary. Till then, whale exercise and occasional massive inflows could hold merchants cautious.

Chainlink’s been using a rollercoaster these days. After pulling off a fairly strong 21.6% rally from April ninth to the twenty first, the token slipped by 3.9% in simply 24 hours. Not precisely panic-worthy… however nonetheless, price keeping track of.

This pullback may simply be a brief breather after that run-up—however zoom out slightly, and the larger image isn’t all that rosy. LINK’s been in a reasonably regular downtrend via most of 2025.

Change Reserves Inform a Bullish Story… Possibly

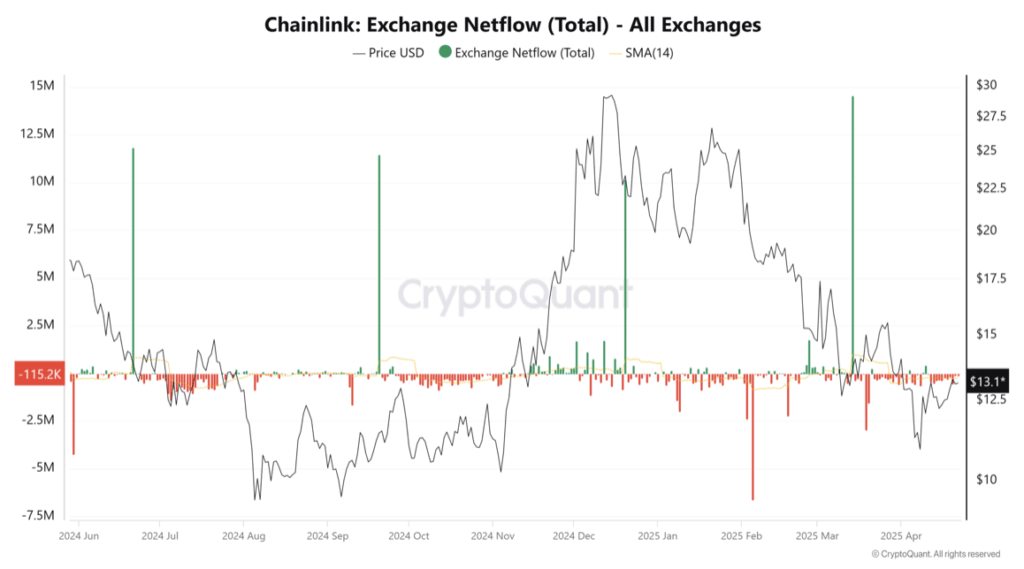

Trying on the numbers from CryptoQuant, one thing fascinating pops up. Chainlink reserves on exchanges have been falling constantly since means again in July 2024.

Now, this often means holders are transferring their tokens off exchanges—prone to chilly storage—which frequently hints at accumulation quite than promoting.

And even after a giant ol’ spike on March 14th, reserves continued their downward slide, hitting ranges we haven’t seen since June 2022.

So, ought to buyers begin stacking extra LINK right here? Let’s hold going.

![Is Chainlink [LINK] Gearing Up for a Bounce or Headed for Extra Ache? – BlockNews Is Chainlink [LINK] Gearing Up for a Bounce or Headed for Extra Ache? – BlockNews](https://blocknews.com/wp-content/uploads/2025/04/Chainlink-link-daily-active-addresses-1024x444.png)

Energetic Addresses Spiked, However Warning Is Nonetheless Warranted

IntoTheBlock information exhibits new addresses are up practically 41%, and lively addresses jumped by 18.5%. Not dangerous, particularly since LINK additionally grew 6.88% in worth throughout that very same stretch.

That’s a bullish signal… within the brief time period.

However maintain on. Should you zoom out a bit, community exercise’s nonetheless nowhere close to what we noticed throughout November and December’s highs. So whereas the uptick seems to be good, it’s not time to pop champagne simply but. Actual, sustained development? That’s what is going to matter most in the long term.

Whales Are Enjoying Each Sides

Right here’s the place it will get slightly murky. A latest snapshot confirmed that whales management round 46.1% of all LINK provide. That’s a giant chunk.

And again in mid-March, a large 14.57 million LINK acquired despatched to exchanges in a single shot. Now, that might’ve been for promoting, or possibly used as collateral in derivatives—both means, it raised eyebrows.

Since then, there’s been extra motion out of exchanges, which seems to be good… however these massive inflows hold displaying up right here and there, with outflows not often matching them. May very well be whales trimming their baggage quietly—one thing that might cool off long-term bullish momentum.

Key Ranges to Watch

Trying forward, Chainlink actually must clear that sticky $14 to $14.5 resistance zone. That’s the primary actual hurdle. However the greater one? It’s at $15.55.

If LINK can break via that stage on the each day chart, it may flip its present construction bullish—and that could be the inexperienced mild swing merchants have been ready for.

![Is Chainlink [LINK] Gearing Up for a Bounce or Headed for Extra Ache? – BlockNews Is Chainlink [LINK] Gearing Up for a Bounce or Headed for Extra Ache? – BlockNews](https://i2.wp.com/blocknews.com/wp-content/uploads/2025/04/Chainlink-link-daily-active-addresses-1024x444.png?resize=1024,1024&ssl=1)