Bitcoin is gaining momentum as soon as once more, breaking above the $93,000 stage and signaling renewed energy available in the market. After weeks of volatility and hesitation, bulls seem like in management because the main cryptocurrency pushes towards new native highs. Nonetheless, the trail forward stays difficult as macroeconomic tensions persist—significantly the escalating commerce battle between the USA and China. These world uncertainties proceed to rattle investor sentiment throughout conventional and crypto markets.

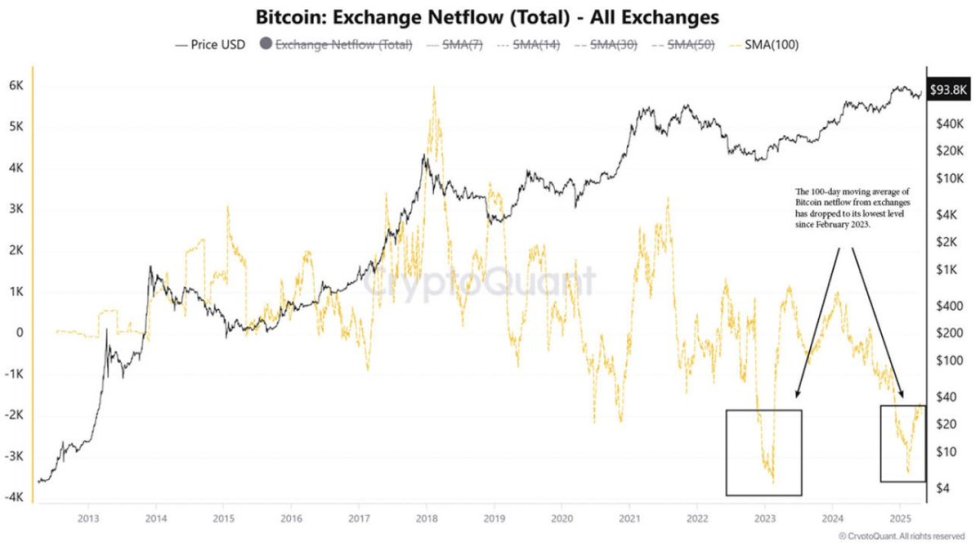

Regardless of this hostile backdrop, Bitcoin’s technical and on-chain construction appears more and more bullish. A decisive breakout above the $100,000 stage is now the subsequent main goal, and reaching it might mark the start of a major upward cycle. In keeping with knowledge from CryptoQuant, the 100-day shifting common of Bitcoin netflow from exchanges has dropped to its lowest stage since February 2023. This implies extra BTC is being withdrawn from exchanges than deposited, usually a robust sign of investor confidence and long-term holding conduct.

As outflows attain multi-year highs, it’s clear that many market contributors are decreasing sell-side stress and making ready for what could possibly be the subsequent leg of a serious rally—if key resistance ranges are efficiently damaged within the coming days.

Bitcoin Approaches Key Degree As Re-Accumulation Intensifies

Bitcoin is at a pivotal second. After reclaiming short-term management, bulls are aiming to push the worth into uncharted territory above the earlier all-time excessive. Confidence is slowly returning to the market, however warning stays. The continued commerce conflict between the US and China casts an extended shadow, introducing macroeconomic danger that would stall the rally—or ignite it additional, ought to buyers search refuge in non-sovereign belongings.

Analysts are divided on what’s subsequent. Some consider that is the start of Bitcoin’s breakout towards a brand new document run, presumably above $109,000. Others see the present surge as a cycle prime forming earlier than broader consolidation or perhaps a downturn. What’s clear is that Bitcoin continues to attract consideration as a possible driver of wealth in 2025, particularly if geopolitical and financial instability persist.

Supporting this bullish outlook is contemporary knowledge from CryptoQuant. In keeping with the platform, the 100-day shifting common of Bitcoin netflow from exchanges has dropped to its lowest stage since February 2023. This means the most important sustained outflow of BTC from exchanges in over a 12 months—typically interpreted as an indication of investor re-accumulation and long-term conviction.

Traditionally, comparable netflow patterns have preceded giant value expansions, as cash shifting off exchanges are usually destined for chilly storage fairly than imminent sale. If this pattern holds, Bitcoin could possibly be on the verge of a major breakout—pushed not simply by technical momentum, however by strengthening fundamentals and shifting investor conduct.

BTC Worth Holds Agency Above Key Help

Bitcoin is at the moment buying and selling at $92,500, exhibiting robust momentum after reclaiming and holding above the vital $90,000 mark. Bulls are actually answerable for short-term value motion, with renewed confidence pushing the market larger. This rally comes at an important second as world uncertainty and macroeconomic dangers proceed to weigh on broader monetary markets.

A key technical stage now in focus is the 200-day shifting common (MA), at the moment sitting round $88,700. This stage has traditionally acted as each dynamic assist and a sentiment indicator. So long as Bitcoin stays above this threshold, bullish momentum is predicted to carry. A decisive shut beneath it, nonetheless, might set off a wave of promoting stress and a possible drop into the $80,000 vary—and even decrease if risk-off sentiment intensifies.

For now, the construction appears stable, with bulls trying to push BTC towards the $95,000–$100,000 zone within the coming classes. Buyers are watching intently for consolidation above present ranges or indicators of breakout energy, each of which might affirm the beginning of a broader uptrend. The following few days will probably be essential in figuring out whether or not BTC can preserve this momentum or face a deeper pullback.

Featured picture from Dall-E, chart from TradingView

Editorial Course of for bitcoinist is centered on delivering totally researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent overview by our staff of prime know-how consultants and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.