A current research from the Citi Institute, Citigroup’s analysis group, claims that the worldwide stablecoin market may attain as excessive as $3.7 trillion by 2030. This was its most bullish estimate, however the base case was $1.5 trillion.

It acknowledged a number of dangers that might result in a bearish state of affairs of $0.5 trillion, however the report largely remained optimistic. In any occasion, this sector may tremendously impression international markets.

Citigroup Is Extraordinarily Bullish on Stablecoins

Citigroup’s researchers had one clear cause to be optimistic about stablecoins: pleasant regulation worldwide. The Citi Institute’s report was titled “Digital {Dollars}.” It referred to as particular consideration to stablecoins’ rising integration with the US greenback. This might function the motor for long-term development:

“Authorities adoption of blockchain falls into two classes: enabling new monetary devices and system modernization. Stablecoins at the moment are main holders of US Treasuries, beginning to affect international monetary flows. Their rising adoption displays sustained demand for US dollar-denominated property,” claimed Artem Korenyuk, a managing director at Citi.

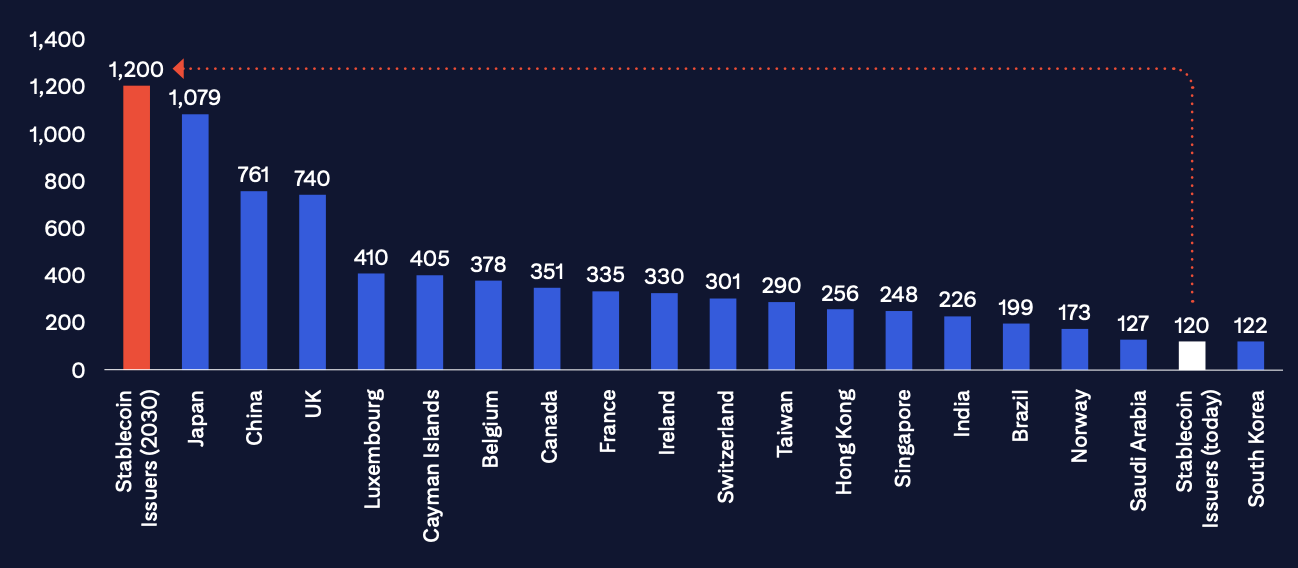

The group was significantly keen on mandates that stablecoin issuers maintain reserves of US Treasuries. It predicts that non-USD stablecoins, together with CBDCs, will in the end exist on the margins, with 90% of the stablecoin market sticking to the greenback.

These reserve mandates would, subsequently, trigger the issuers to turn into main holders of Treasury bonds.

By doing this, regulators will compel stablecoin issuers to considerably change their inner insurance policies. Citigroup predicts that this might higher combine stablecoins with the TradFi ecosystem.

Though stablecoins “pose some risk to conventional banking” for a number of causes, these laws will encourage a cooperative mannequin as an alternative. Public sector blockchain spending may also assist this dynamic.

Nonetheless, Citigroup acknowledged vital dangers on this rosy image of stablecoins. Though its most bullish estimate is a $3.7 trillion international sector by 2030, its bearish end result is just half a trillion.

That’s a really vital unfold. The most important dangers embody fraud, contagion from de-pegging occasions, and confidentiality considerations.

It’s necessary to recollect, nonetheless, that Citigroup has a surprisingly lengthy historical past with crypto. It first thought-about coming into the sector 4 years in the past and frequently publishes novel analysis available on the market.

Disclaimer

In adherence to the Belief Venture tips, BeInCrypto is dedicated to unbiased, clear reporting. This information article goals to supply correct, well timed info. Nonetheless, readers are suggested to confirm info independently and seek the advice of with knowledgeable earlier than making any choices based mostly on this content material. Please word that our Phrases and Circumstances, Privateness Coverage, and Disclaimers have been up to date.