Hedera (HBAR) is on the transfer, climbing greater than 8% on Friday and lengthening its seven-day positive factors to a formidable 21.7%. This rally comes alongside rising momentum indicators, together with a surging BBTrend and an RSI that has pushed into overbought territory.

Worth can also be nearing a key resistance zone, backed by bullish EMA alignment that implies the uptrend should have room to run.

Hedera’s BBTrend Is Hovering – What Does it Imply?

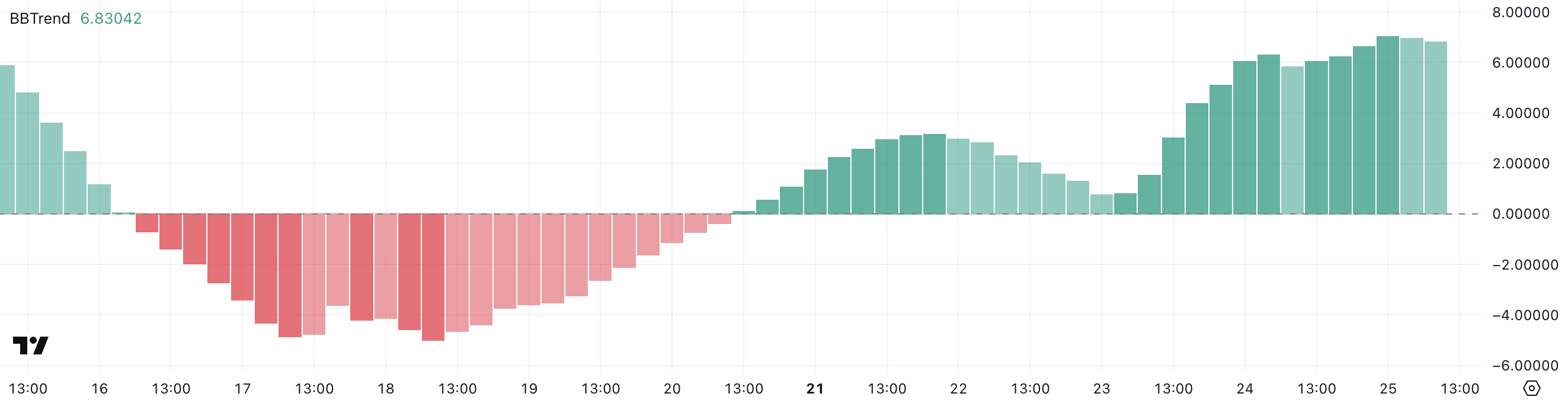

Hedera’s BBTrend indicator has surged to six.83, up sharply from simply 1.5 two days in the past. This bounce indicators a major improve in volatility and momentum within the value motion.

BBTrend, quick for Bollinger Band Pattern, is a metric derived from Bollinger Bands that measures the energy and route of a development. Values under one usually replicate a weak or flat market, whereas values above 3 point out the emergence of a robust development.

A sudden rise in BBTrend typically means that the asset is transitioning out of a low-volatility part and coming into a extra directional transfer.

With BBTrend now at 6.83, Hedera could also be within the early levels of a robust bullish or bearish breakout. Such elevated ranges recommend that volatility is increasing shortly, and value is beginning to transfer decisively away from its latest vary.

Whereas BBTrend doesn’t point out route by itself, when mixed with different bullish indicators, like rising value or quantity, it may well affirm the beginning of a sustained uptrend.

Merchants will watch intently to see if this momentum continues or fades, as a reversal from such elevated ranges may additionally result in sharp pullbacks.

Hedera RSI Enters Overbought Zone—What Comes Subsequent?

Hedera’s RSI has climbed shortly to 73.93, up from 52.49 two days in the past, signaling a robust burst of shopping for momentum. The Relative Energy Index (RSI) is a momentum oscillator that measures the pace and magnitude of value actions.

It ranges from 0 to 100, with values above 70 usually thought-about overbought and people under 30 seen as oversold.

An RSI rising above 70 means that the asset could also be overheating within the quick time period and could possibly be due for a cooldown or consolidation.

With RSI now effectively into overbought territory, Hedera could also be nearing an area prime—at the very least briefly. Whereas a excessive RSI confirms robust bullish momentum, it may well additionally sign that patrons have gotten exhausted.

If the worth continues to rise and not using a pause, the chance of a pullback will increase.

Then again, sustained overbought situations can even happen throughout robust uptrends, in order that merchants will watch intently for both continued breakout energy or indicators of reversal.

Hedera Nears Breakout—However Help Ranges Are Key

Hedera’s EMA strains present a bullish alignment, with short-term shifting averages positioned above the long-term ones—a traditional sign of upward momentum.

HBAR value can also be buying and selling close to a key resistance degree at $0.20, which has acted as a ceiling in latest periods. If patrons can push the worth by this zone, the subsequent resistance ranges to observe are $0.227 and $0.258.

A robust uptrend continuation may even ship HBAR to $0.287, marking its first break above $0.28 since February 1.

Nevertheless, merchants also needs to monitor the draw back threat. If the help at $0.179 is examined and fails, it may set off a deeper pullback.

In that case, HBAR might slide to $0.16 and presumably $0.152, each of which have served as prior help zones.

If bearish momentum accelerates, a drop towards $0.124 isn’t out of the query, making the present ranges a important battleground for short-term route.

Disclaimer

In step with the Belief Venture tips, this value evaluation article is for informational functions solely and shouldn’t be thought-about monetary or funding recommendation. BeInCrypto is dedicated to correct, unbiased reporting, however market situations are topic to vary with out discover. All the time conduct your personal analysis and seek the advice of with an expert earlier than making any monetary selections. Please be aware that our Phrases and Circumstances, Privateness Coverage, and Disclaimers have been up to date.