Pi Community (PI) has seen a modest 5% acquire over the previous week, regardless of being down greater than 17% within the final 30 days. This bounce has introduced some aid however hasn’t but translated into a transparent bullish reversal.

The value is presently consolidating between key ranges, with technical indicators just like the Ichimoku Cloud, RSI, and EMA traces all pointing to indecision. Whether or not this consolidation results in a breakout or additional draw back may rely on how PI reacts to resistance at $0.68 and assist at $0.617 within the coming classes.

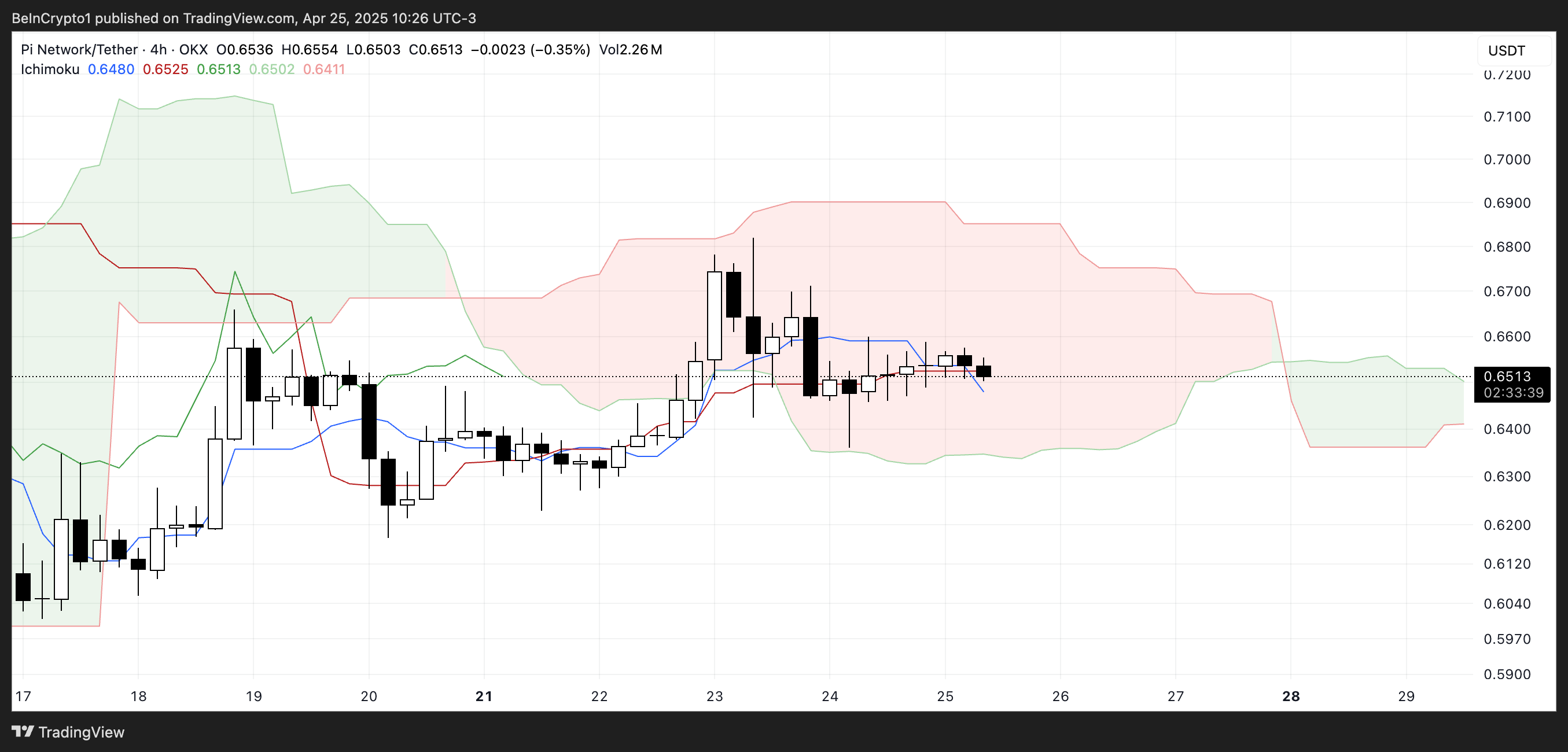

Ichimoku Alerts Uncertainty for PI

Pi Community trades contained in the crimson Ichimoku Cloud, reflecting indecision and a scarcity of sturdy directional bias.

The value sits between the crimson baseline (Kijun-sen) and simply above the blue conversion line (Tenkan-sen), indicating weak short-term momentum however no clear breakdown.

The presence of the crimson cloud reveals that the prevailing pattern remains to be barely bearish, and worth motion inside the cloud typically alerts consolidation or neutrality.

Nonetheless, wanting forward, the cloud shifts to inexperienced, suggesting that sentiment could also be beginning to shift.

A inexperienced cloud sooner or later factors to a possible bullish transition, however provided that the value manages to interrupt above the cloud with sturdy follow-through.

A decisive transfer above the cloud would assist a pattern reversal, whereas a rejection and transfer under the Tenkan-sen and Kijun-sen would reinforce bearish strain.

PI RSI Cools Off: What Comes Subsequent?

Pi Community’s Relative Power Index (RSI) is presently sitting at 51.41, falling from a excessive of 70 simply two days in the past.

This drop displays a noticeable momentum cooling, because the asset moved from near-overbought territory to extra impartial ranges.

The RSI measures the velocity and magnitude of latest worth modifications to judge overbought or oversold situations. Values above 70 are typically thought-about overbought, and people under 30 are thought-about oversold.

An RSI at 51.41 locations PI proper in the course of the vary, suggesting that neither patrons nor sellers presently have a transparent benefit.

This impartial studying usually coincides with a consolidation section, the place the value stabilizes earlier than deciding its subsequent course. If the RSI tendencies once more, it may level to renewed bullish momentum.

However, continued decline towards 40 or under might sign rising weak point and open the door for a deeper pullback.

PI Consolidates—Is a Breakout Coming?

Pi Community worth has been consolidating over the previous few days, presently buying and selling inside a spread outlined by resistance at $0.68 and assist at $0.61.

This sideways motion is mirrored within the EMA traces, that are clustered intently collectively—a basic signal of low volatility and a scarcity of sturdy directional momentum.

The market seems to be ready for a decisive push from both patrons or sellers earlier than committing to a brand new pattern. Till then, PI stays in a holding sample, with worth motion trapped between key ranges.

If bullish momentum returns, a breakout above $0.68 may sign the beginning of a contemporary rally.

In that case, the following resistance ranges to look at are $0.789 and $0.85. If the uptrend strengthens additional, PI may goal $1.04—marking its first transfer above $1 since March 23.

Nonetheless, a breakdown under the $0.617 assist may result in renewed bearish strain, with $0.59 and $0.54 as the following potential draw back targets.

Disclaimer

In step with the Belief Mission pointers, this worth evaluation article is for informational functions solely and shouldn’t be thought-about monetary or funding recommendation. BeInCrypto is dedicated to correct, unbiased reporting, however market situations are topic to vary with out discover. All the time conduct your individual analysis and seek the advice of with knowledgeable earlier than making any monetary choices. Please be aware that our Phrases and Situations, Privateness Coverage, and Disclaimers have been up to date.