Hyperliquid (HYPE) continues to generate sturdy income, accumulating $42.53 million in charges during the last 30 days. Nonetheless, regardless of the sturdy fundamentals, momentum indicators are weakening, with RSI and BBTrend each displaying indicators of cooling.

HYPE lately failed twice to interrupt key resistance at $19.26, placing strain on its short-term development. Now, the worth sits at a vital level the place it may both collapse beneath help or mount a brand new rally towards $25.

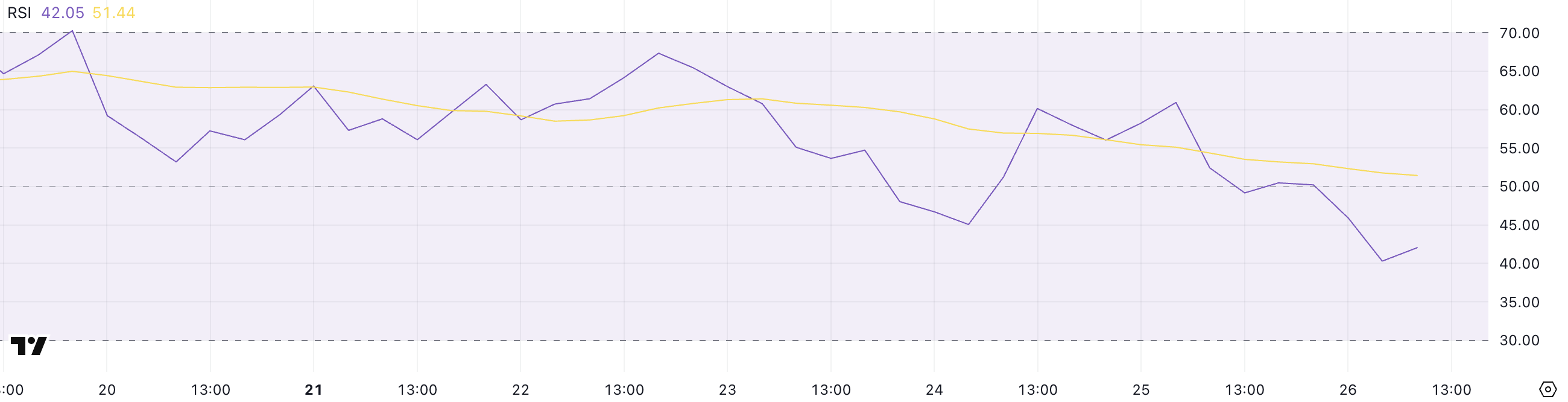

Hyperliquid (HYPE) RSI Drops to 42 as Momentum Weakens

Hyperliquid’s Relative Power Index (RSI) is cooling sharply, dropping to 42 from 60.93 yesterday.

This sudden decline alerts that current bullish momentum has weakened and merchants have gotten extra cautious.

After reaching overbought territory earlier within the week, HYPE approaches ranges suggesting impartial to barely oversold circumstances.

The RSI is a momentum indicator that measures the pace and magnitude of an asset’s current worth adjustments. It ranges from 0 to 100, with readings above 70 usually signaling overbought circumstances, and readings beneath 30 suggesting oversold circumstances.

With HYPE’s RSI now at 42, the token is sitting in a impartial zone however leaning towards weak spot.

If the RSI continues to fall, it may open the door for extra draw back strain, but when it stabilizes and bounces again, HYPE may regain power earlier than deeper losses set in.

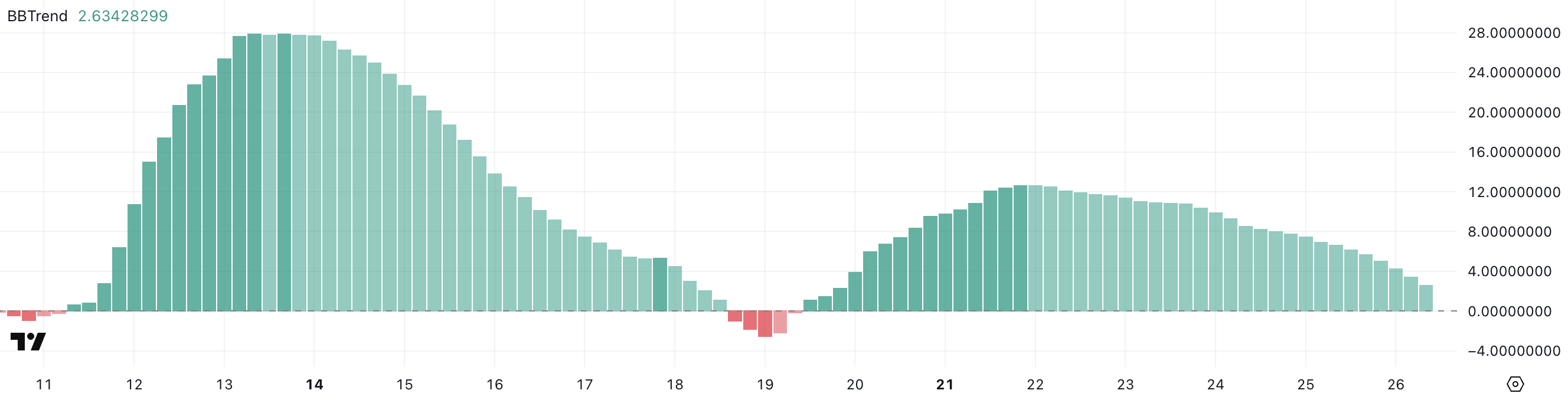

Hyperliquid (HYPE) Might Enter Consolidation After BBTrend Drop

Hyperliquid is seeing a pointy drop in its BBTrend indicator, now at 2.63, down from 12.68 5 days in the past. This steep decline reveals that the bullish momentum seen earlier has light shortly.

BBTrend readings falling this sharply typically mirror a significant slowdown in development power, signaling that the worth might be coming into a consolidation part or getting ready for a deeper correction.

BBTrend, or Bollinger Band Pattern, measures how strongly an asset is trending primarily based on the width and enlargement of its Bollinger Bands.

Excessive BBTrend values, typically above 10, point out sturdy trending circumstances, whereas low values nearer to 0 counsel a weak or sideways market. With HYPE’s BBTrend at 2.63, the present studying factors to weak development power.

If the BBTrend continues to remain low, it may imply that HYPE’s worth will consolidate or transfer sideways except new momentum builds.

Will Hyperliquid (HYPE) Collapse Beneath $16 or Rally Previous $25?

Hyperliquid has examined the $19.26 resistance stage twice over the previous few days however failed each instances. In consequence, its development now seems to be weakening, with a attainable demise cross forming quickly.

If the bearish momentum continues, HYPE may drop to check help at $16.82.

If promoting strain intensifies, a break beneath $14.66 may open the way in which towards deeper help ranges at $12.42 and even $9.32.

Alternatively, if bullish momentum returns, HYPE may mount one other problem on the $19.26 resistance.

A transparent breakout above that stage may open the trail towards $21, and if momentum stays sturdy, HYPE may rally to $25.87.

This could mark its first time breaking above $25 since February 21.

Disclaimer

In keeping with the Belief Venture tips, this worth evaluation article is for informational functions solely and shouldn’t be thought of monetary or funding recommendation. BeInCrypto is dedicated to correct, unbiased reporting, however market circumstances are topic to alter with out discover. At all times conduct your individual analysis and seek the advice of with knowledgeable earlier than making any monetary selections. Please observe that our Phrases and Circumstances, Privateness Coverage, and Disclaimers have been up to date.