Coinbase, the biggest digital property trade in america, has revealed that residents throughout 5 states have missed out on greater than $90 million in potential staking rewards since June 2023.

The trade defined that the missed earnings stemmed from these states’ ongoing authorized actions in opposition to the platform’s staking companies.

Coinbase Pushes Again Towards Outdated Staking Bans in US States

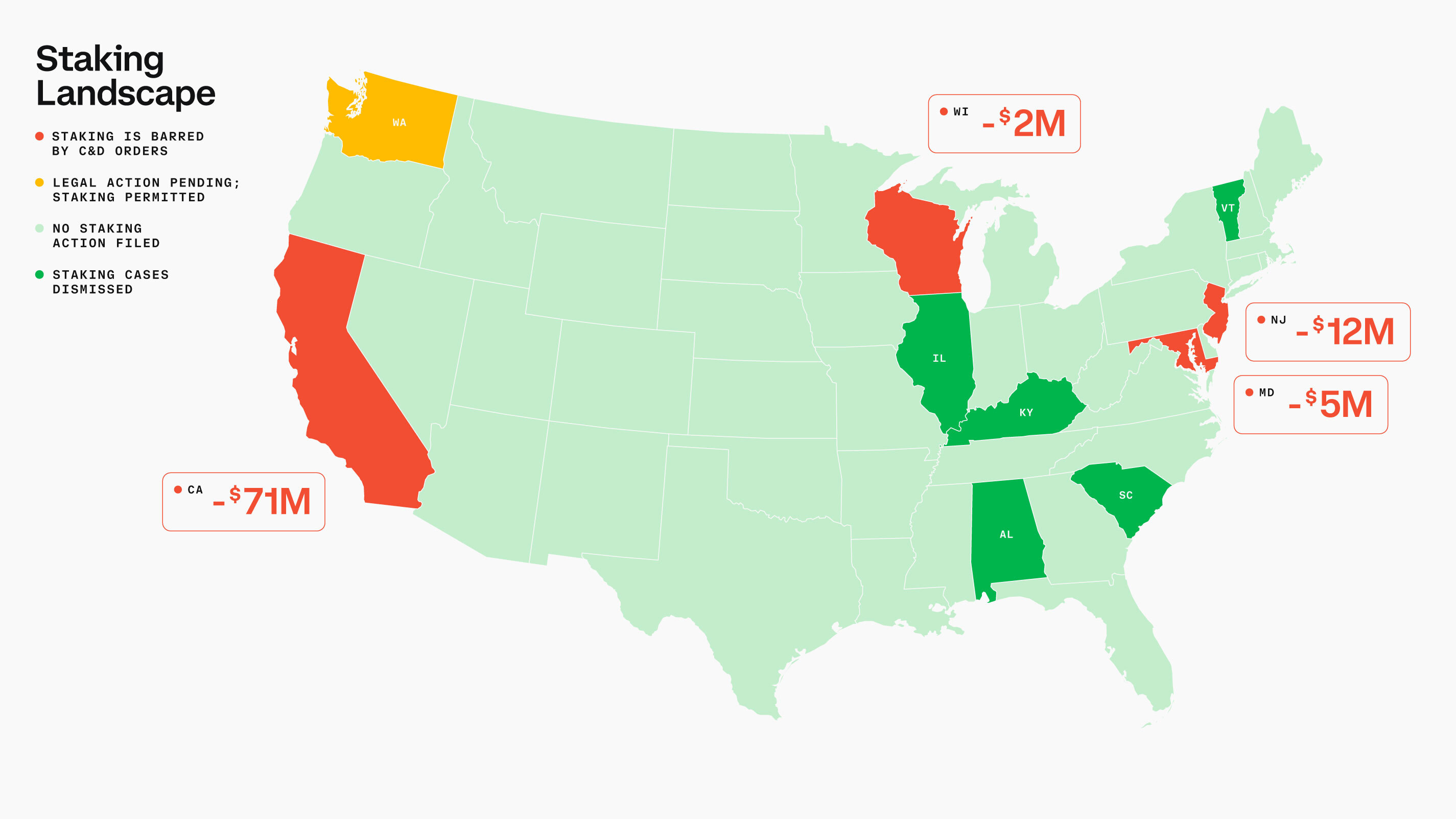

On April 25, Coinbase publicly urged California, New Jersey, Maryland, Wisconsin, and South Carolina to raise their restrictions in opposition to its staking companies.

In accordance with the trade, eradicating these restrictions would align these states with the Securities and Alternate Fee (SEC). Notably, a number of different states have already deserted related efforts.

Earlier this 12 months, the SEC dropped its enforcement motion in opposition to Coinbase’s staking operations, permitting the trade to renew its companies with out federal opposition.

Following the SEC’s transfer, Illinois, Kentucky, South Carolina, Vermont, and Alabama additionally withdrew their actions, leaving solely a handful of states sustaining restrictions.

Coinbase argues that the holdout states have imposed outdated and misdirected bans. The corporate stresses that regulators initially designed cease-and-desist orders to fight scams, not authentic monetary companies like staking.

Contemplating this, the agency warned that the monetary impression on residents will proceed to develop except the restrictions are lifted quickly.

“The holdouts actively hurt their shoppers by barring their entry to protected wealth technology instruments like staking. They’ve price these People tens of hundreds of thousands of {dollars} in potential earnings – and counting,” Coinbase’s chief authorized officer Paul Grewal mentioned on X.

Past misplaced earnings, Coinbase believes these state-level actions hurt shoppers by limiting their selections.

The trade warned that residents is perhaps compelled to hunt staking choices by way of much less safe, calmly regulated platforms. This shift may expose customers to larger dangers with out the protections provided by licensed and established exchanges.

“By singling out Coinbase, these holdout states are arbitrarily choosing winners and losers. That’s the job of shoppers, not state bureaucrats. Their actions not solely deprive shoppers of competitors and selection, but additionally push them in direction of doubtlessly much less regulated (or unregulated) staking platforms,” Coinbase pressured

Coinbase additionally raised considerations in regards to the wider results on the crypto business. The continuing bans, it mentioned, add to the regulatory uncertainty that continues to cloud the US digital asset market.

Whereas the SEC and a number of states have moved towards offering higher readability, the holdout states danger isolating themselves from the rising federal framework.

“Towards this backdrop, continued litigation by the holdout states is extra indefensible than ever. These lawsuits don’t defend shoppers – they confuse them and expose them to higher danger,” Coinbase acknowledged.

The trade urges these states to align with nationwide efforts to modernize crypto rules.

The agency emphasised that dropping the staking restrictions would profit residents and promote safer innovation. It added that this transfer would assist create a stronger, extra aggressive crypto financial system in america.

Disclaimer

In adherence to the Belief Undertaking pointers, BeInCrypto is dedicated to unbiased, clear reporting. This information article goals to offer correct, well timed data. Nevertheless, readers are suggested to confirm details independently and seek the advice of with an expert earlier than making any choices primarily based on this content material. Please notice that our Phrases and Situations, Privateness Coverage, and Disclaimers have been up to date.