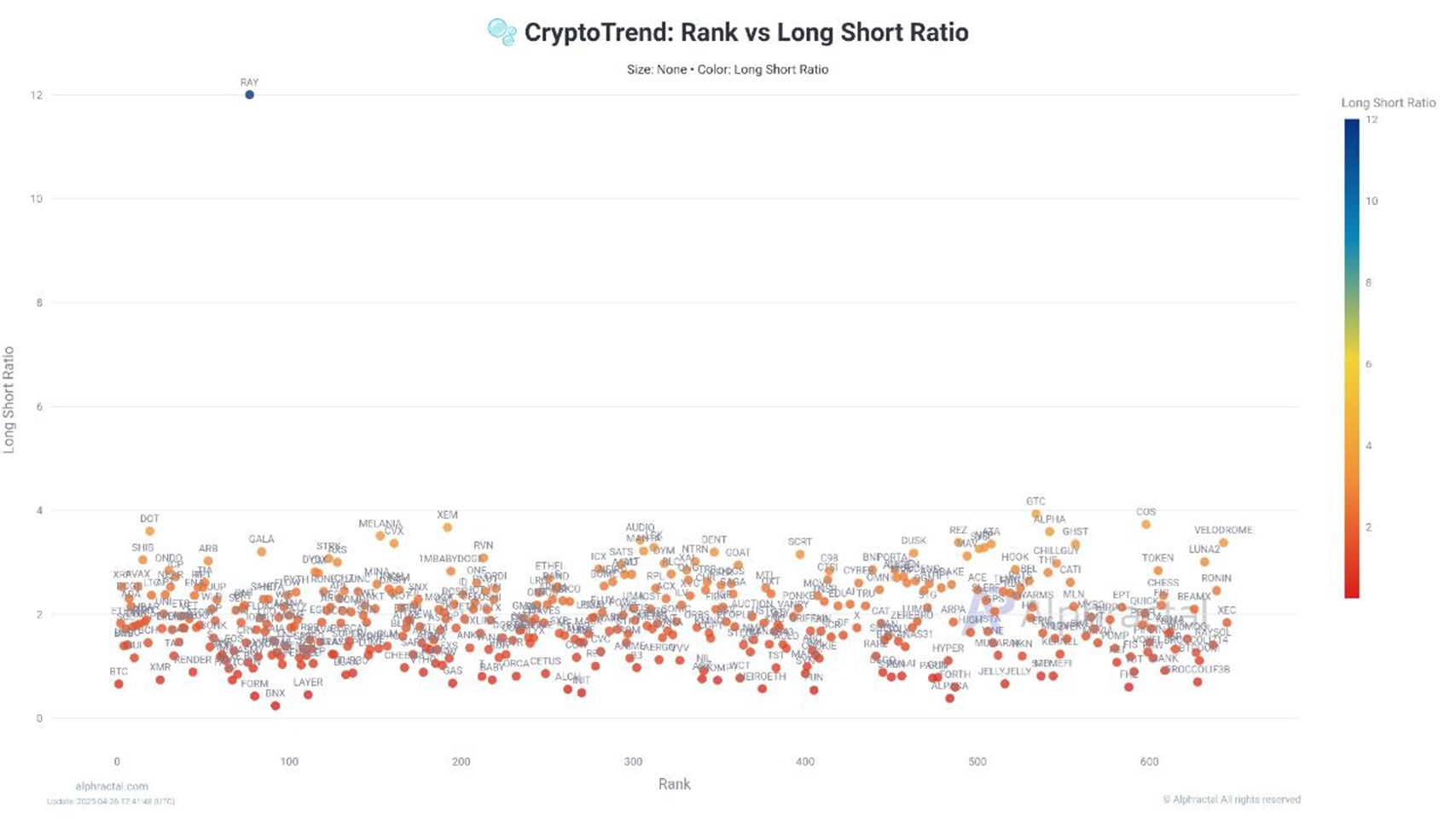

Crypto analytics agency Alphractal has launched new insights into the altcoin market, highlighting RAY because the token with the best long-to-short ratio amongst main altcoins.

Different cash exhibiting a heavy tilt towards lengthy positions embrace GTC, COS, DOT, ALPHA, MELANIA, AUDIO, and REZ.

The analysts warned that an unusually excessive lengthy/quick ratio doesn’t all the time favor value progress. In actual fact, it typically weighs on efficiency, though in some circumstances it could actually set off a reversal if a brief squeeze performs out.

That stated, Alphractal identified that for a real squeeze situation to develop, a noticeable uptick in Open Curiosity can be wanted — one thing they don’t at the moment see taking place. Consequently, they count on altcoin costs to principally drift sideways within the close to time period.

In the meantime, on the Bitcoin facet, Alphractal’s CEO Joao Wedson flagged a bullish sign rising on Binance. He pointed to the Bitcoin/Stablecoin Reserve Ratio transferring throughout the $76,000 to $77,000 vary — a sample that traditionally preceded main Bitcoin rallies, notably after the 2020 COVID crash and once more on the finish of 2022.

Wedson defined that rising stablecoin reserves relative to Bitcoin holdings counsel that contemporary capital is able to transfer into the market, doubtlessly setting the stage for one more upward surge.

Regardless of the cautious tone on altcoins, Alphractal’s report hints that broader market circumstances may quickly shift if Bitcoin leads one other rally. Analysts famous that sturdy Bitcoin momentum typically pulls liquidity again into riskier belongings, which means any vital Bitcoin breakout may finally breathe new life into altcoin markets as properly.