Bitcoin has lastly began to alter its correlation with US equities, signaling a possible shift in market dynamics. Analysts are calling for an aggressive surge if BTC manages to carry present ranges and proceed pushing increased. Bulls are feeling more and more assured after Bitcoin pushed above the essential $90K mark — a pivotal zone that had beforehand acted as sturdy resistance throughout months of consolidation and promoting stress.

Whereas bulls are actually in short-term management, dangers of a pointy downturn stay elevated. International commerce instability, fueled by ongoing tensions between the US and China, continues to threaten broader monetary markets. Worry and volatility have dominated the panorama ever since US President Donald Trump secured re-election in November 2024, creating an unpredictable macroeconomic backdrop.

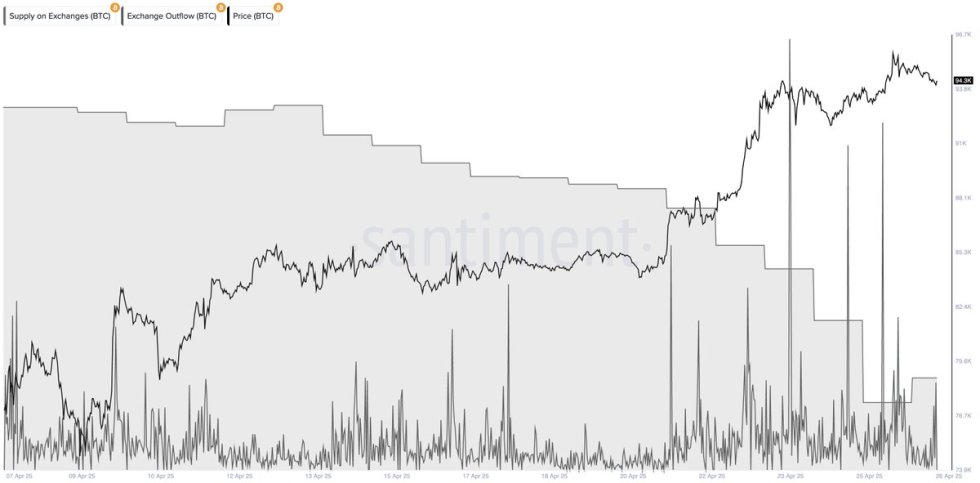

Regardless of these headwinds, on-chain metrics paint a bullish image. Based on current information, greater than 40,000 Bitcoins have been withdrawn from exchanges over the previous week, signaling a robust accumulation development. This motion means that buyers are more and more choosing self-custody, decreasing out there provide on buying and selling platforms — a dynamic that traditionally helps increased costs. Because the market heads right into a essential part, Bitcoin’s habits within the coming days may outline the subsequent main development.

Bitcoin Faces A Defining Second As Bulls Maintain Quick-Time period Management

Bitcoin is now coming into a essential part the place value motion over the subsequent few weeks may form the market’s route for months to return. Bulls are presently in short-term management, following a pointy surge that pushed BTC firmly above the $90K mark. Nonetheless, regardless of this momentum, excessive dangers of a reversal stay as world commerce instability continues to dominate macroeconomic narratives.

Tensions between the US and China persist, with rising tariffs and fractured provide chains threatening world markets. Whereas some analysts are optimistic, calling for Bitcoin to rally towards new all-time highs (ATH) within the coming weeks, others stay cautious, arguing that current energy could also be a short lived response relatively than the start of a sustained breakout.

A key sign supporting the bullish view is rising investor accumulation. Prime analyst Ali Martinez shared related information revealing that greater than 40,000 BTC have been withdrawn from exchanges over the previous week. This sturdy outflow development means that buyers are more and more shifting their BTC into chilly storage, decreasing out there provide and reinforcing the inspiration for a possible value surge.

As Bitcoin hovers at essential resistance ranges, the approaching days and weeks shall be pivotal. A continued surge may affirm the beginning of a brand new bull part, whereas failure to carry key help zones may result in renewed volatility.

BTC Value Replace: Bulls Maintain Regular As Essential Ranges Loom

Bitcoin is presently buying and selling at $93,900, sustaining a robust place after a powerful multi-week rally. Nonetheless, whereas bullish momentum persists, it seems that a clear push above the $95K–$96K resistance zone could take further time. This vary is a essential hurdle, and plenty of analysts anticipate some consolidation earlier than any decisive breakout happens.

For now, bulls should deal with defending key help ranges to maintain the restoration construction intact. Holding above $88,700 — roughly aligned with the 200-day shifting common — could be a significant signal of energy. This degree has turn into an essential pivot level, serving to to substantiate whether or not the rally can maintain additional upside stress.

If Bitcoin fails to carry above $88,700, it may set off a deeper correction, with the subsequent important help zone sitting round $84,000. A transfer right down to this space would nonetheless match inside a broader bullish construction however would delay makes an attempt at setting new all-time highs.

General, the $88,700 degree stays the important thing battleground. Bulls should proceed to defend it whereas getting ready for a possible retest of the $95K mark within the coming periods. Persistence and stability are essential as volatility stays elevated throughout monetary markets.

Featured picture from Dall-E, chart from TradingView

Editorial Course of for bitcoinist is centered on delivering completely researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent overview by our staff of prime know-how specialists and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.