XRP has gained roughly 8% over the previous seven days. Earlier within the week, the world’s first XRP ETF was launched in Brazil. Regardless of the constructive momentum, XRP stays caught in a good buying and selling vary, with key resistance and assist ranges nonetheless defining its short-term outlook.

Latest indicators, together with the RSI rebound and a barely bullish Ichimoku Cloud construction, level to cautious optimism.

XRP’s RSI Rebounds: What It Means for the Value Motion

XRP’s Relative Energy Index (RSI) presently stands at 58.36, rising from 47.34 earlier at present however nonetheless down from 77.7 reached 4 days in the past.

This motion exhibits a restoration from latest decrease ranges, though it stays under the overbought situations seen earlier within the week.

The latest RSI pattern means that whereas bullish momentum has resurfaced within the brief time period, XRP has not but regained the identical energy it displayed just some days in the past, signaling a extra cautious sentiment amongst merchants.

RSI, or Relative Energy Index, is a momentum oscillator that measures the velocity and alter of value actions on a scale from 0 to 100.

Sometimes, an RSI above 70 indicators that an asset is overbought and is likely to be due for a correction, whereas an RSI under 30 signifies it’s oversold and could possibly be poised for a rebound.

With XRP’s RSI now at 58.36, the asset is in neutral-to-slightly-bullish territory, suggesting there may be nonetheless room for additional beneficial properties with out instantly triggering overbought situations.

If shopping for strain continues, this might set the stage for a gradual upward transfer, although a scarcity of sturdy momentum may additionally lead to range-bound buying and selling.

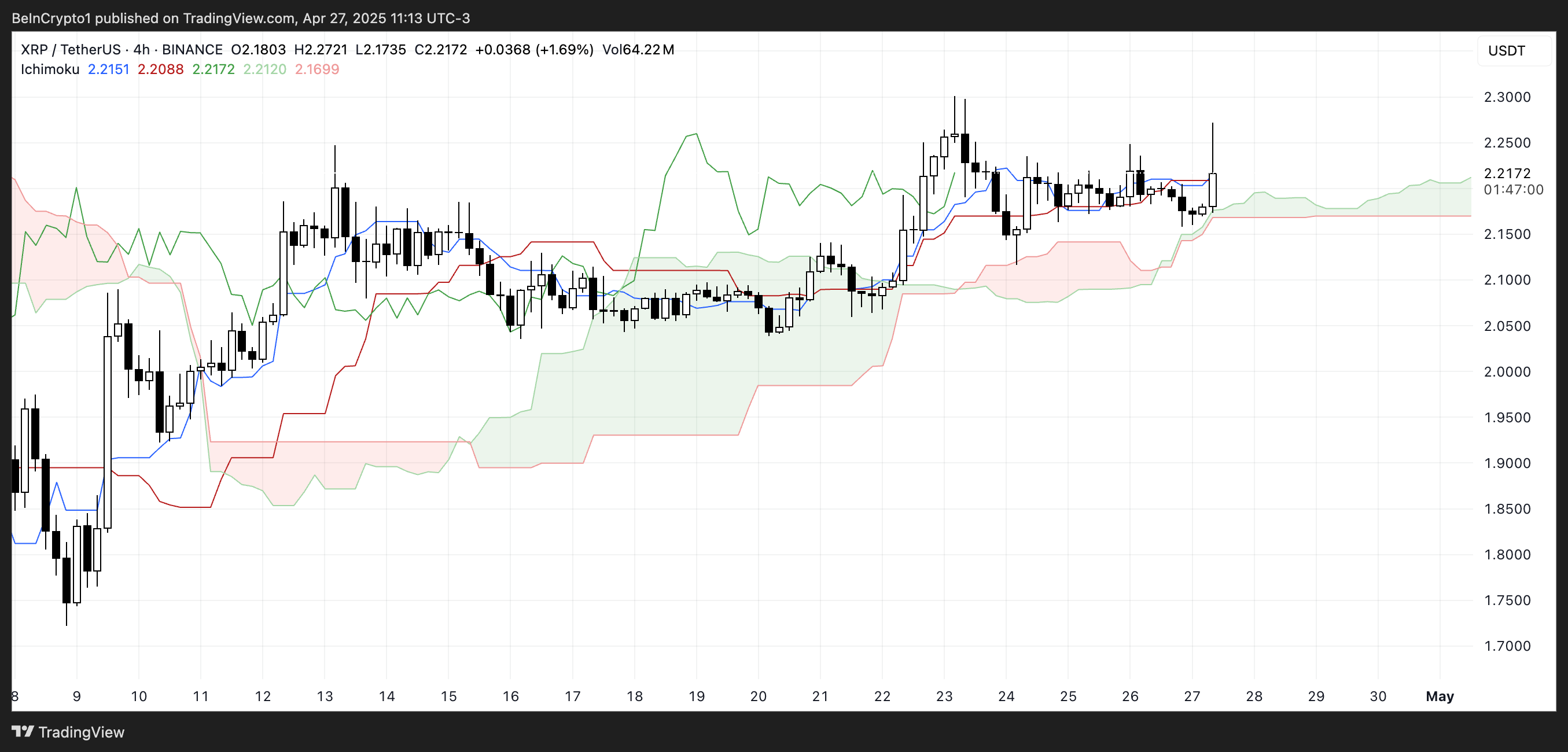

XRP Hovers Above Cloud as Momentum Stalls

The Ichimoku Cloud for XRP presents a bullish construction, with the worth simply barely above the cloud.

The blue (Tenkan-sen) and pink (Kijun-sen) traces are near the present candle, reflecting a market with a slight bullish bias however with out sturdy momentum.

The long run cloud stays inexperienced, indicating that bullish situations are nonetheless projected forward. Nonetheless, the proximity of the traces to the worth suggests some hesitation or consolidation within the brief time period.

The Ichimoku system absolutely views pattern path, momentum, and assist/resistance areas.

When the worth is above the cloud with a inexperienced cloud forward, it normally indicators a positive pattern, however when the Tenkan-sen and Kijun-sen hug the worth intently, it may possibly point out a scarcity of clear conviction from both consumers or sellers.

In XRP’s case, the bullish pattern stays intact, however the tight positioning of the traces factors to a fragile uptrend the place a pointy transfer in both path may simply shift the construction.

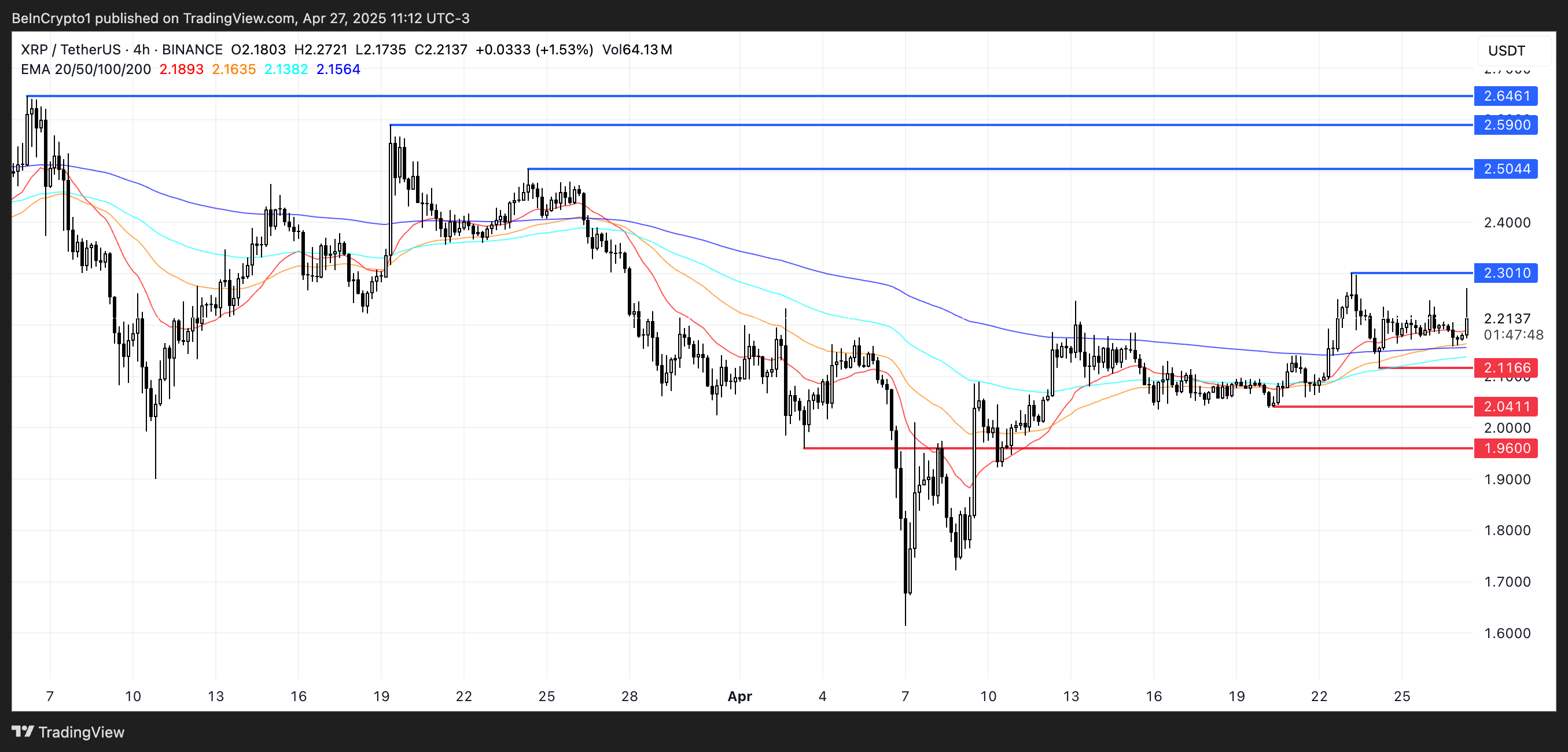

XRP Outlook: Will Bulls or Bears Take Management?

XRP value is buying and selling inside a good vary, caught between a resistance stage of $2.30 and a assist stage of $2.11.

This sideways motion comes simply two days after the launch of the world’s first XRP ETF in Brazil, a improvement that would ultimately affect market sentiment.

If XRP falls and loses the $2.11 assist, it may result in a decline towards the subsequent assist stage, $2.04.

Ought to bearish momentum intensify additional, a deeper retracement may see XRP take a look at decrease ranges at $1.96, making it essential for consumers to defend the present assist zone.

Conversely, if XRP checks and breaks above the $2.30 resistance with sturdy bullish momentum, the subsequent upside goal could be round $2.50.

Continued energy may push the worth towards $2.59, doubtlessly extending to $2.64 if consumers preserve management.

Disclaimer

In step with the Belief Challenge pointers, this value evaluation article is for informational functions solely and shouldn’t be thought of monetary or funding recommendation. BeInCrypto is dedicated to correct, unbiased reporting, however market situations are topic to alter with out discover. All the time conduct your individual analysis and seek the advice of with an expert earlier than making any monetary selections. Please notice that our Phrases and Situations, Privateness Coverage, and Disclaimers have been up to date.