- Whales have modified their minds and have begun channeling funds again into the TRUMP token as they accumulate.

- The derivatives market metric provides a blended sign on the potential route of the value from its present stage.

Up to now 24 hours, Official Trump [TRUMP] recorded a modest 1.57% acquire, a pointy distinction to final week’s 79% surge.

Whale accumulation and spot market buying and selling exercise have remained excessive; nonetheless, some derivatives metrics present that sellers are opposing TRUMP’s try and repeat final week’s transfer.

Whales accumulate TRUMP once more

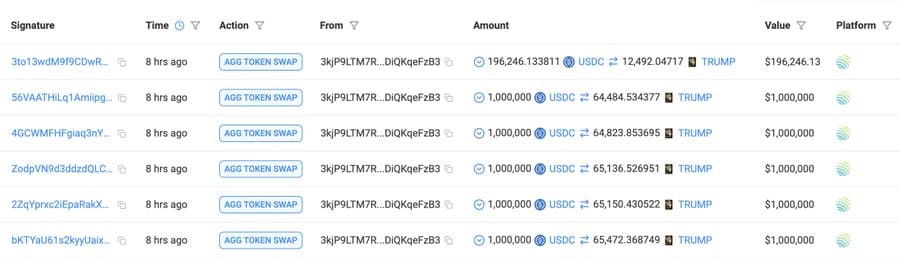

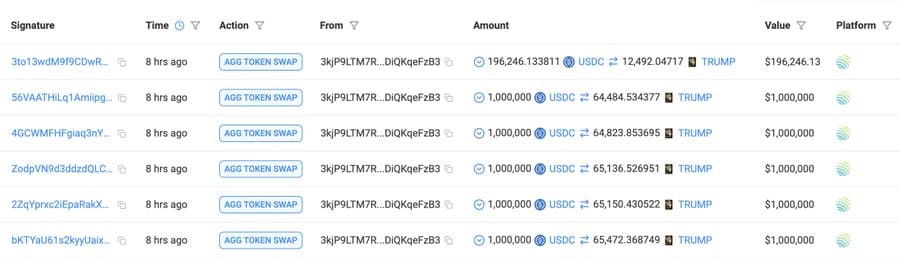

Actually, whales seemed to be betting on TRUMP once more, as curiosity reignited forward of Donald Trump’s unique dinner.

Two new whales available in the market have collectively bought a large quantity of TRUMP value $6.42 million.

The primary whale, who initially offered off their holdings, regained curiosity following the dinner announcement, shopping for 337,950 TRUMP for $5.2 million.

Supply: Solscan

The opposite whale pivoted their commerce, offloading their Fartcoin [FARTCOIN] holdings and switching to TRUMP after a $1.22 million purchase. This shopping for exercise follows two days of constant promoting from the spot market, which has now halted.

Beforehand, spot merchants had offered roughly $27.63 million value of TRUMP in 24 hours, stalling its earlier momentum.

A shaky stance however bullish alerts

Having mentioned that, derivatives market information mirrored a fragile steadiness between bullish and bearish forces. That is mirrored in liquidation information over the previous 24 hours, which exhibits a close to steadiness between brief and lengthy liquidations.

On the time of writing, $4.42 million value of lengthy positions have been forcefully closed, whereas $4.37 million value of brief positions have been additionally closed.

This near-equal liquidation stage between longs and shorts implies a commerce steadiness, with no decisive route for value motion.

Supply: CoinGlass

Nevertheless, sentiment nonetheless leans towards lengthy merchants, because the OI-Weighted Funding Fee rises. The OI-Weighted Funding Fee compares a number of derivatives market metrics to foretell the market’s potential route.

With a constructive studying of 0.0116%, it suggests the market is in a bullish section, prone to proceed rising.

TRUMP bears nonetheless lurk

Regardless of bullish alerts, the Funding Fee has continued to remain adverse. On the time of writing, the funding fee dropped to -0.0019.

A dip into adverse territory implies that brief merchants are paying a premium in charges to keep up their positions.

Supply: CoinGlass

This setup provides brief merchants a bonus, with extra energetic positions in comparison with lengthy merchants. Moreover, Derivatives Buying and selling Quantity stays adverse, at present under 1, reinforcing bearish sentiment.

The Lengthy-to-Quick Ratio, which signifies whether or not shopping for or promoting quantity dominates, exhibits sellers in management.

If this ratio continues to remain under 1, TRUMP’s value is prone to expertise additional declines.