- Bitcoin’s price foundation reveals the chance for a market rally with a brand new all-time excessive shut if momentum is maintained.

- A fractal sample and accumulation of Bitcoin might affect the asset’s transfer upward.

Bitcoin [BTC] has maintained a bullish market momentum, staying above the $90,000 area for six days. Over the previous week, the digital asset has moved upward by 11.41%, with potential to maneuver ahead.

AMBCrypto evaluation seems into Bitcoin’s efficiency and sees {that a} rally is close to, exhibiting how the asset might probably transfer to the upside, and that is the way it might play out.

Will Bitcoin’s price foundation maintain or fall?

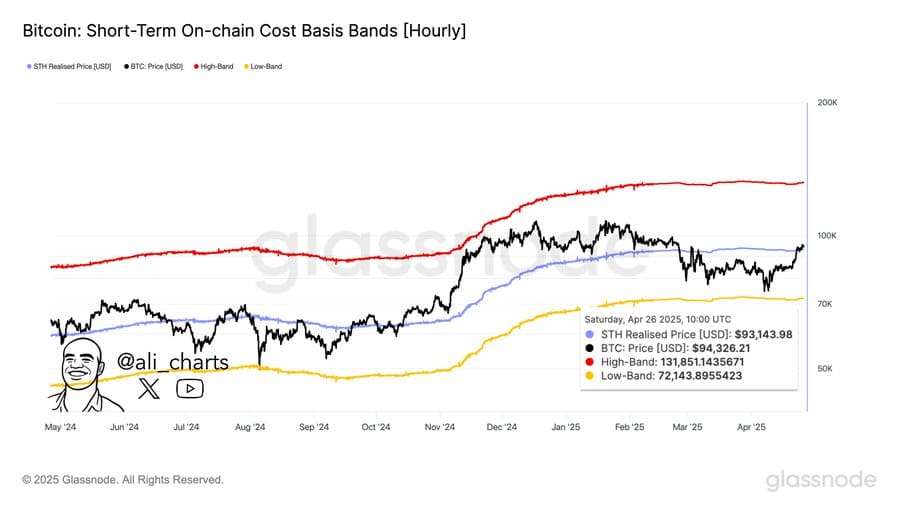

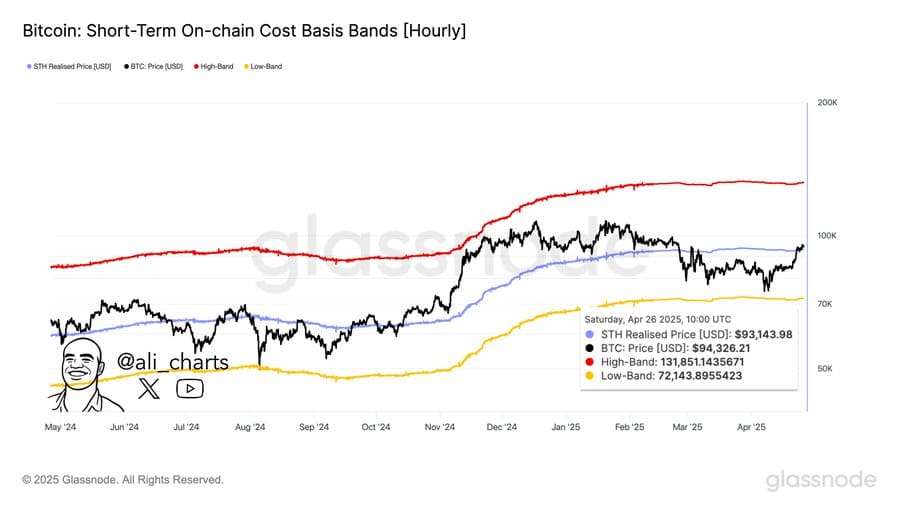

Evaluation of Bitcoin’s Brief-term Holder (STH) Price Foundation, used to find out potential market development and asset course, confirmed that the asset is at a crucial juncture.

In truth, on the hourly chart, Bitcoin crossed its STH price foundation at $93,145. In fact, sustaining above this stage remained essential for sustaining bullish momentum and aiming for brand spanking new all-time highs.

Supply: Glassnode

The sample consists of two key ranges: the higher band at $131,800 and the decrease band at $71,150.

When the asset is above the mid-range (STH Price Foundation), prefer it at the moment is, it alerts a bullish indicator of a possible rally, but it surely requires additional momentum to maintain this run to the higher area.

Additional evaluation confirmed that Bitcoin is more likely to preserve that momentum, trending to the upside.

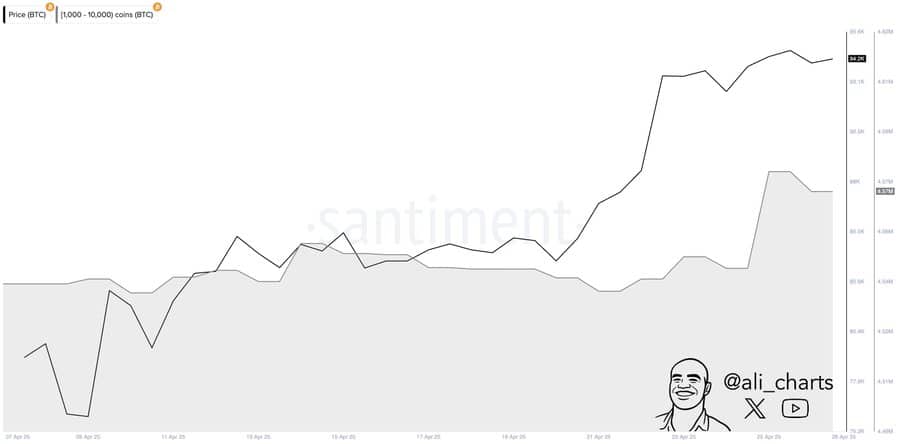

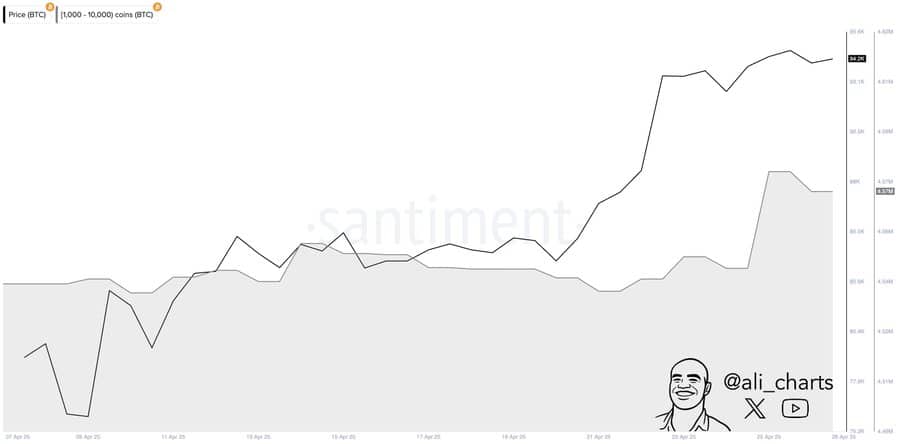

Supply: Santiment

Furthermore, additional evaluation revealed robust accumulation tendencies.

Previously 48 hours alone, Santiment information confirmed 20,000 BTC, value $1.86 billion, had been bought from the market.

A big buy like this tends to again Bitcoin’s value transfer, including to its momentum and value rally potential.

What does this fractal sample imply?

Apparently, evaluation by Alphractal confirmed that Bitcoin indicated the same section of a sample it has repeated since 2015, throughout all 4 cycles.

Per the evaluation, which has helped mark Bitcoin’s market tops and bottoms exactly at decided dates, Bitcoin continues to be within the markup section.

Supply: Alphractal

A markup section is a interval out there the place an asset continues to rally following a interval of accumulation. This present section reveals that the asset will proceed to rally till it hits the cycle prime.

The market prime is predicted to be reached between the twelfth and sixteenth of October, and adopted by a yr of decline.

Ought to this evaluation maintain like within the earlier four-year cycles, it means that Bitcoin is more likely to commerce into the STH price foundation prime on the $131,800 area on the chart.

What’s subsequent for Bitcoin

Evaluation on the month-to-month time-frame means that Bitcoin is bullish. The market has simply reacted off a key ascending help line that has led to a market rally since 2018.

This rally can be extra bullish as soon as the resistance stage on the $102,000 area is breached, establishing new highs.

Supply: TradingView

This sample is necessary because it has occurred severally occasions and, when breached to the decrease facet, was reclaimed.

With this risk at hand, the asset would proceed its rally streak, persevering with to extend in worth.