- Solana (SOL) is seeing elevated whale exercise, rising social buzz, and robust improvement metrics, with value presently testing key resistance at $153.65 after a latest 1.74% dip.

- Retail sentiment stays optimistic whereas institutional traders are extra cautious, suggesting short-term volatility however a bullish longer-term setup.

- Technical indicators level towards a possible breakout, with a cup-and-handle sample forming and the MACD exhibiting bullish divergence — a profitable breakout may ship SOL towards the $180 degree.

Solana (SOL) has been making some noise once more — and never simply from value charts. A fairly main whale switch simply occurred: over 17,481 SOL moved to Kraken after being staked for 2 entire years. Large strikes like that? Yeah, they often get the market speaking.

On the time of writing, SOL was buying and selling round $148.52, down about 1.74% over the previous 24 hours. That dip, mixed with the whale strikes, is unquestionably stirring up a whole lot of hypothesis and social buzz. Each retail merchants and larger institutional gamers are watching carefully to see if this triggers Solana’s subsequent massive value swing.

Retail vs. Sensible Cash: A Break up in Sentiment

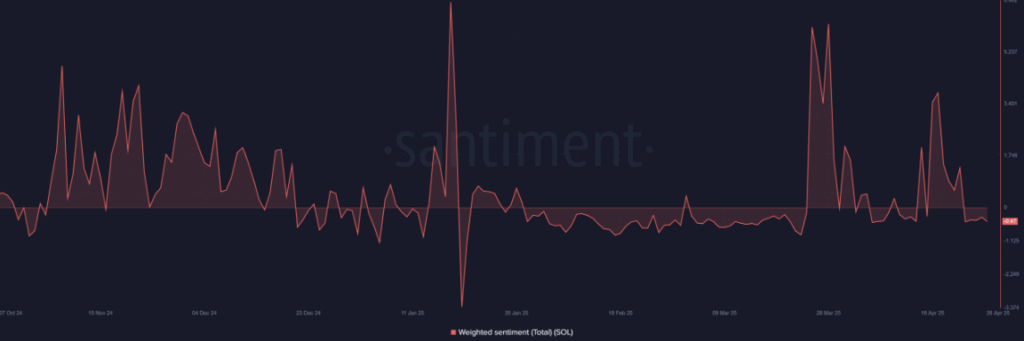

On the sentiment aspect, issues are kinda… cut up. As of April 26, 2025, Solana’s weighted sentiment was sitting at -0.47— not precisely a roaring bullish sign.

However right here’s the twist: crowd sentiment was nonetheless robust at 1.81, exhibiting retail traders aren’t able to again down but. In the meantime, sensible cash sentiment (aka the institutional of us) got here in a bit cooler at 0.88, signaling they’re just a little extra cautious after the value dip.

So that you’ve received common traders feeling upbeat, whereas larger gamers are enjoying it protected.

What’s that imply? Quick-term volatility might be on deck… however the long-term view? Nonetheless leaning bullish.

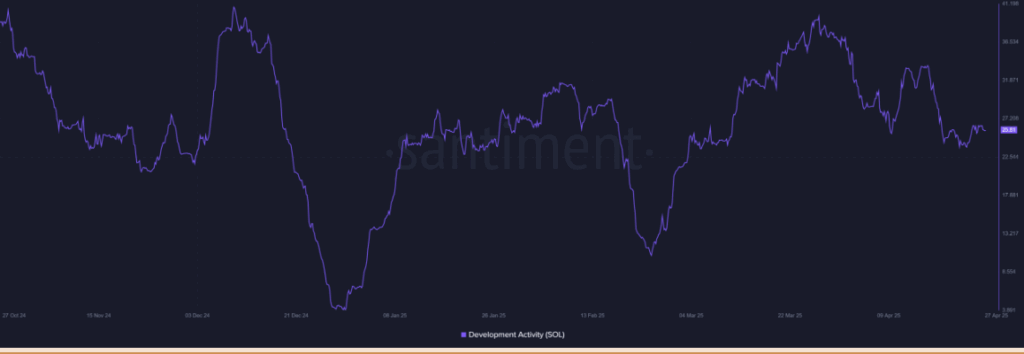

Growth Work Stays Sturdy Behind the Scenes

Beneath the value motion and hype, Solana’s fundamentals are nonetheless rock strong.

Growth exercise was holding regular at 25.81 as of April 27, 2025. That’s an enormous deal. It signifies that whereas the market will get noisy, the builders are nonetheless constructing — which units the stage for long-term progress.

Wholesome improvement retains boosting community effectivity and scalability, making it extra engaging for future customers (and traders). So even when costs wobble short-term, the muse seems robust.

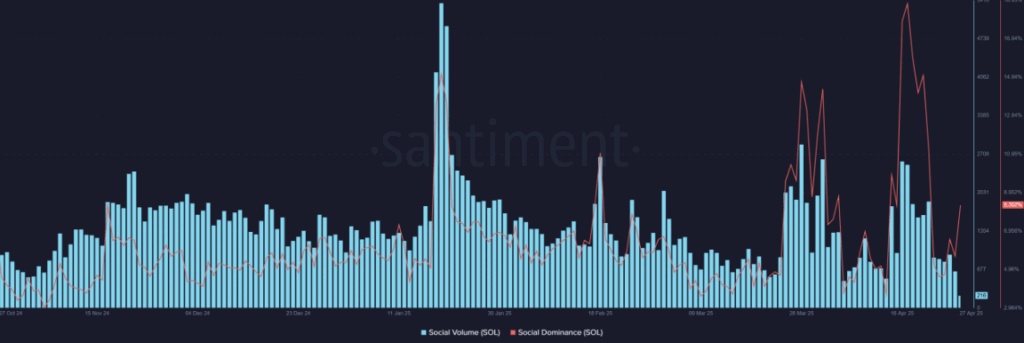

Social Buzz Picks Up Steam

If it feels such as you’ve been seeing Solana all over the place currently, you’re not imagining issues.

SOL’s Social Quantity hit 216, and its Social Dominance rose to 8.3% on the time of writing. In easy phrases: individuals can’t cease speaking about it.

Social Quantity measures what number of instances Solana pops up throughout platforms, whereas Social Dominance exhibits how a lot it’s standing out in comparison with different cryptos.

An uptick right here often means rising retail curiosity — and it usually finally ends up influencing short-term value motion, particularly if hype builds quick.

Technical Setup: Key Resistance at $153.65

Proper now, Solana’s value motion is shaping up right into a cup-and-handle sample, which generally hints at a possible breakout.

SOL is inching nearer to a crucial resistance degree at $153.65.

The MACD indicator is flashing a bullish sign too, with the MACD line crossing above the sign line — one other good signal for bulls.

If SOL can smash by that resistance? The following massive goal seems like $180.

But when it will get rejected? We would see some consolidation or perhaps a quick pullback earlier than the subsequent transfer.

Last Take: Solana Poised for a Large Take a look at

Proper now, Solana’s market vibe is a spicy combine: whale transfers, rising retail hype, strong improvement, and bullish technicals.

If SOL can break by $153.65, we could possibly be a critical leg up towards $180.

However even when there’s some turbulence, the long-term construction — with robust fundamentals backing it — retains the outlook promising.