Bitcoin (BTC) is hovering beneath the $94,000 stage whereas nonetheless exhibiting sensitivity to US financial indicators. Accordingly, this week’s US financial knowledge may spark volatility within the crypto market.

From shopper confidence to labor market power, financial indicators may affect sentiment and sway crypto costs.

US Financial Information To Watch This Week

The next US financial indicators may have an effect on the portfolios of crypto market merchants and buyers.

“Let me attempt that will help you make sense of every part that’s occurring: Tariff insanity, plunging shopper confidence, rising recession odds, market fragility and all of the ways in which the financial system will form your life,” economist Justin Wolfers remarked.

Client Confidence

The Client Confidence report will begin the listing of US financial indicators with crypto implications this week. On Tuesday, April’s Convention Board’s Client Confidence Index will present whether or not households are optimistic about monetary situations.

March’s 92.9 index signaled a comparatively pessimistic outlook amongst US customers regarding the financial system and their monetary state of affairs.

In keeping with knowledge on MarketWatch, the median forecast is 87.4. Robust confidence typically correlates with risk-on sentiment, driving funding into Bitcoin and altcoins.

Accordingly, studying beneath expectations would possibly set off profit-taking, denting confidence within the financial system’s general power.

With world commerce tensions, an surprising decline may amplify safe-haven demand for Bitcoin, although volatility stays a danger.

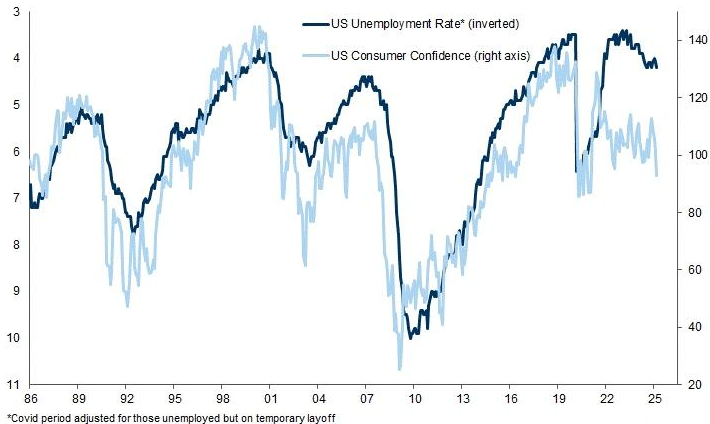

“The delicate knowledge means that the exhausting knowledge is about to fall. Client Confidence can lead the unemployment charge (inverted). If that finally ends up being the case this time round, we’re round 6% or larger,” wrote Markets and Mayhem.

JOLTS Job Openings

This week, the Job Openings and Labor Turnover Survey (JOLT), which tracks demand, provides to the listing of US financial indicators.

The final JOLTS report was launched on April 1, protecting February 2025 knowledge. It reported job openings at 7.6 million, hires at 5.4 million, and complete separations at 5.3 million. The subsequent JOLTS report, for March 2025, is due on Tuesday, with a median forecast of seven.4 million.

A rebound above 7.6 million for crypto may sign financial resilience, boosting danger property like Bitcoin. Robust openings counsel hiring confidence, doubtlessly growing disposable earnings for crypto investments.

Nevertheless, a weaker-than-expected determine, doubtlessly beneath the median forecast of seven.4 million, would possibly stoke recession fears. Such an final result would drive buyers towards Bitcoin as a hedge.

Crypto markets react to labor market indicators as they affect Federal Reserve (Fed) coverage expectations. With charges at 4.25%–4.5%, a good labor market may delay cuts, pressuring speculative property.

ADP Employment

The ADP Nationwide Employment Report tracks private-sector job progress and will probably be out on Wednesday. March 2025’s 155,000 jobs beat expectations, signaling labor market power regardless of tariff considerations.

A robust studying above 160,000 for crypto may ignite bullish sentiment, as job progress fuels shopper spending and danger urge for food. If employment knowledge suggests financial enlargement, Bitcoin may achieve extra upside potential.

Nevertheless, a miss beneath the March studying of 155,000 or beneath the median forecast of 110,000 would possibly spark fears of a slowdown. This might push buyers towards stablecoins or Bitcoin as secure havens.

In contrast to the Bureau of Labor Statistics’ Non-farm Payrolls (NFP), ADP’s payroll-based methodology excludes authorities jobs. This technique affords a granular view.

With markets eyeing Fed coverage, ADP’s final result will set the tone for Friday’s NFP.

Q1 GDP

The advance estimate for Q1 2025 GDP will probably be launched on Wednesday. This knowledge additionally measures financial progress.

Q3 2024’s 2.8% annualized charge fell wanting expectations, pressured by commerce deficits. In the meantime, This fall 2024’s 2.4% studying got here following a downward revision to imports.

Robust GDP progress above 3% in crypto indicators financial well being, typically boosting Bitcoin as buyers embrace danger. However, crypto markets are delicate to GDP revisions and affect Fed charge choices.

With inflation considerations lingering, a robust GDP, larger than This fall’s 2.4%, would possibly scale back rate-cut hopes, pressuring speculative cryptos. Conversely, sluggish progress may spur expectations of financial easing.

PCE

The Fed’s most well-liked inflation gauge is the Core PCE (Private Consumption Expenditures) Worth Index. This US financial indicator, protecting March, will come out on Wednesday this week after the March 28 knowledge protecting February.

After February 2025 noticed a 2.5% year-over-year (YoY) PCE index, economists anticipate a modest drop to 2.2% for March, reflecting persistent worth pressures.

However, a PCE studying beneath 2.5% for Bitcoin may sign cooling inflation, elevating hopes for charge cuts and boosting sentiment towards Bitcoin.

A warmer-than-expected determine above the earlier studying of two.5% would possibly tighten Fed coverage expectations. PCE’s exclusion of unstable meals and power costs affords a secure inflation view, making it a key driver of crypto sentiment.

With markets delicate to financial coverage shifts, merchants ought to monitor companies spending, because it displays shopper resilience. However, volatility is probably going, as PCE shapes the Fed’s rhetoric.

“March PCE inflation (out on Wed Apr 30) ought to learn 2.1% (rounded). April PCE (out in late Could) ought to learn 2.0% (rounded). Tariffs are a boss however that is the Fed’s goal measure. It might be time to chop, to be trustworthy, politics apart,” wrote hedge fund supervisor Ophir Gottlieb.

Preliminary Jobless Claims

This week, the Preliminary Jobless Claims, reported each Thursday, provides to the listing of US financial indicators. This knowledge measures weekly unemployment filings. Claims are a high-frequency indicator, providing real-time labor market insights, and crypto markets typically react swiftly to surprises.

For the week ending April 18, 222,000 claims indicated a gradual labor market regardless of tariff chaos. Accordingly, claims beneath 222,000 may sign rising employment, fostering risk-on sentiment, and lifting Bitcoin.

Nevertheless, larger claims above 222,000 may spark considerations of financial softening, driving buyers to stablecoins or Bitcoin for security. With the Fed carefully monitoring labor knowledge, an surprising spike would possibly gasoline rate-cut hypothesis.

Non-farm Payrolls

The Non-farm Payrolls (NFP) report will probably be launched on Friday. March 2025’s 228,000-job achieve exceeded expectations, with unemployment at 4.2%.

A robust NFP may drive bullish momentum, as job progress indicators shopper spending energy. A weak report beneath the median forecast of 130,000 would possibly set off recession fears, pushing capital to Bitcoin as a hedge or stablecoins for stability.

NFP’s broad scope, protecting 80% of GDP-contributing employees, makes it a market mover. Key curiosity may also be on wage progress, as 0.3% month-to-month will increase counsel inflation pressures, doubtlessly capping crypto positive factors.

With markets pricing in Fed coverage, surprises may spark sharp volatility.

BeInCrypto knowledge reveals Bitcoin was buying and selling for $94,154 as of this writing, up by a modest 0.29% within the final 24 hours.

Disclaimer

In adherence to the Belief Venture pointers, BeInCrypto is dedicated to unbiased, clear reporting. This information article goals to offer correct, well timed data. Nevertheless, readers are suggested to confirm info independently and seek the advice of with an expert earlier than making any choices primarily based on this content material. Please be aware that our Phrases and Circumstances, Privateness Coverage, and Disclaimers have been up to date.