- Coinbase is launching a Bitcoin Yield Fund on Could 1 for establishments outdoors the U.S., focusing on 4–8% annual returns.

- The fund makes use of a cash-and-carry technique to generate yield with out counting on staking.

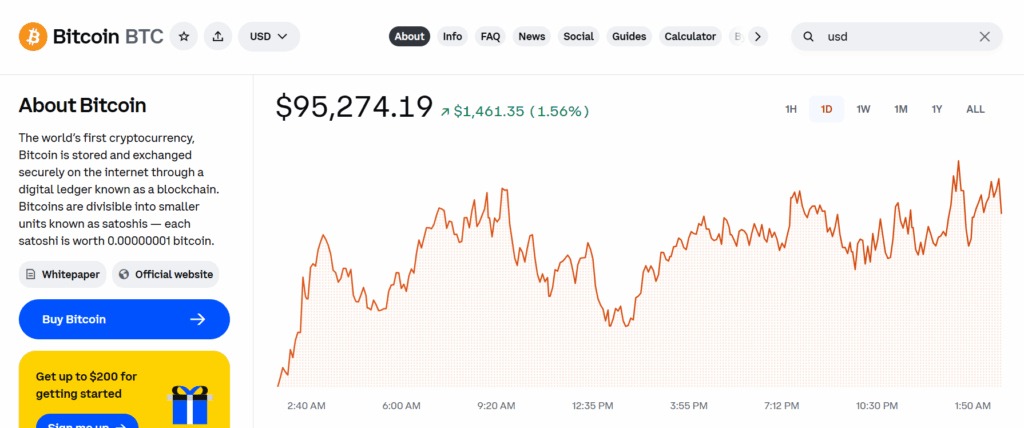

- Bitcoin’s current value leap to $94K was pushed by ETF inflows and rising institutional demand.

Coinbase is gearing as much as launch its model new Bitcoin Yield Fund on Could 1, aiming squarely at institutional traders based mostly outdoors the U.S. The alternate — presently the third-largest globally by buying and selling quantity — says the fund will provide publicity to Bitcoin with the potential for a internet annual return between 4% and eight%.

In a weblog put up shared on April 28, Coinbase Asset Administration defined the pondering behind it: “To deal with the rising institutional demand for bitcoin yield, Coinbase Asset Administration is happy to introduce the Coinbase Bitcoin Yield Fund (CBYF).”

What’s the Technique Behind It?

The fund’s returns received’t come from staking — since Bitcoin, in contrast to Ethereum or Solana, doesn’t help native staking. As an alternative, it’ll use a cash-and-carry technique, which principally means it’ll capitalize on the value distinction between spot and futures markets.

Coinbase says this setup will scale back the sort of funding and operational dangers that normally preserve institutional traders on the sidelines. Most current Bitcoin yield funds, in response to the corporate, require purchasers to shoulder “vital” dangers — one thing CBYF is seeking to keep away from.

One of many backers? Aspen Digital, an Abu Dhabi-based asset supervisor that’s regulated by the Monetary Providers Regulatory Authority — which helps sign legit curiosity on this providing from globally acknowledged gamers.

Institutional Demand is Driving the Market

The transfer comes as institutional urge for food for Bitcoin continues to develop. Coinbase famous that robust curiosity from large gamers is without doubt one of the main causes behind the fund’s creation — and perhaps even a part of what’s been pushing BTC’s value again up.

Within the week main as much as April 28, Bitcoin jumped over 9%, bouncing again to round $94,000. That surge got here alongside huge ETF inflows — greater than $3 billion, marking the second-highest weekly influx ever, based mostly on knowledge from Farside Buyers.

Bitget’s chief analyst Ryan Lee identified that the rally’s been pushed by company and ETF shopping for, not retail. However that would change quickly. “Retail curiosity might surge if Bitcoin breaks $100K,” Lee informed Cointelegraph, citing media hype and FOMO as doubtless triggers. He added that $94,000–$95,000 is the vary to look at if you happen to’re on the lookout for that retail comeback.

And if you happen to ask BitMEX co-founder Arthur Hayes, time is perhaps working out. On April 21, he stated this might be the “final probability” to purchase Bitcoin below $100K — suggesting that U.S. Treasury buybacks might be the subsequent large push that sends BTC hovering.