Hedera (HBAR) enters Could in a fragile but doubtlessly explosive technical setup, with futures exercise cooling and value actions intently tied to Bitcoin’s momentum. HBAR Futures quantity stays subdued, suggesting a decline in speculative curiosity in comparison with earlier this yr.

In the meantime, HBAR continues to trace Bitcoin’s efficiency with amplified volatility. As BTC flirts with the $100,000 degree and sentiment shifts bullish, HBAR might both break by way of key resistance ranges and rally towards $0.40—or face a deeper correction if technical help fails.

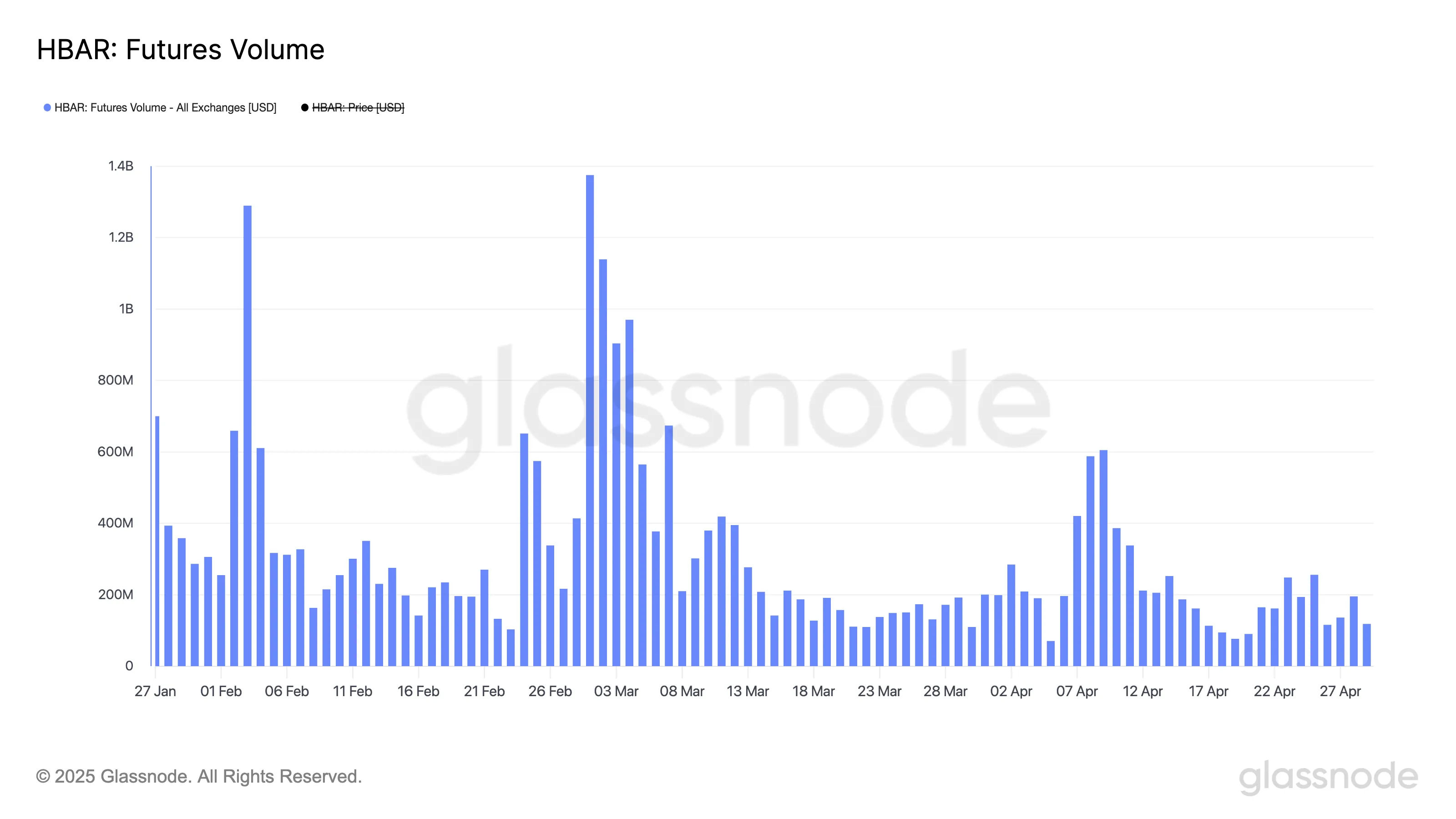

Low HBAR Futures Quantity Factors to Cooling Hypothesis

HBAR Futures quantity is at the moment at $118 million, up from a current low of $76 million on April 19—its lowest level within the final three months.

This follows a gentle decline from a lot increased ranges seen earlier within the yr.

Notably, HBAR Futures open curiosity had peaked at $1.3 billion on March 1 however has not surpassed $300 million since April 12, signaling a major drop in speculative exercise across the token.

Hedera Futures seek advice from by-product contracts that permit merchants to invest on the longer term value of HBAR, the native token of the Hedera community. Each retail and institutional members typically use these contracts to hedge danger or take leveraged positions.

Futures volumes and open curiosity are key indicators of market sentiment and liquidity—increased volumes usually counsel stronger conviction or elevated buying and selling exercise. On the identical time, declining figures might mirror decreased curiosity or confidence in near-term value motion.

The present decrease ranges counsel HBAR’s current value actions might have been extra influenced by spot demand than leveraged hypothesis.

Hedera’s Excessive Correlation with BTC May Drive Subsequent Rally

HBAR has not too long ago proven a excessive correlation with Bitcoin (BTC), typically amplifying the strikes of the broader crypto market chief.

When BTC rallies, HBAR tends to rise much more sharply; conversely, HBAR typically experiences deeper pullbacks throughout corrections. This sample displays Hedera’s sensitivity to market sentiment and positioning as a higher-beta asset within the crypto area.

In consequence, shifts in Bitcoin’s trajectory, particularly in periods of robust momentum, can considerably affect HBAR’s value motion.

With Bitcoin up 13% prior to now 30 days and now sitting simply 6.3% beneath the $100,000 mark, the following leg increased might have a powerful spillover impact on HBAR.

On-chain knowledge reveals a restoration in BTC’s obvious demand, whereas institutional sentiment is progressively enhancing, with ETF inflows displaying early indicators of a rebound. If Bitcoin breaks above $100,000, HBAR may benefit from renewed capital inflows and rising market enthusiasm.

Given HBAR’s tendency to outperform BTC in bullish phases, a decisive Bitcoin breakout might be a strong catalyst for a broader transfer in Hedera.

Key Ranges to Watch as HBAR Faces Bullish Breakout or Loss of life Cross

HBAR value faces a vital technical setup heading into Could, with the potential for a pointy transfer in both route. On the bullish facet, if HBAR can entice robust shopping for strain and set up a sustained uptrend, it might climb as a lot as 123% to achieve $0.40.

To take action, the token should first break by way of a collection of key resistance ranges at $0.20, $0.258, $0.32, and $0.37—every of which has beforehand acted as a rejection level throughout previous rallies.

A profitable breakout by way of these ranges might sign renewed momentum and broader market confidence in Hedera.

Nevertheless, draw back dangers stay firmly in play. HBAR’s EMA strains present indicators of an impending demise cross—a bearish sample wherein the short-term common strikes beneath the long-term common, indicating {that a} deeper correction could also be forward.

If this formation is confirmed, HBAR might first take a look at help at $0.16. Failure to carry that degree might result in additional losses towards $0.124, and in a extra aggressive downtrend, costs might decline to $0.0053.

Disclaimer

According to the Belief Challenge pointers, this value evaluation article is for informational functions solely and shouldn’t be thought-about monetary or funding recommendation. BeInCrypto is dedicated to correct, unbiased reporting, however market circumstances are topic to vary with out discover. All the time conduct your personal analysis and seek the advice of with an expert earlier than making any monetary choices. Please observe that our Phrases and Circumstances, Privateness Coverage, and Disclaimers have been up to date.