Macro investor and fund supervisor Dan Tapiero believes that Bitcoin (BTC) is gearing up for explosive rallies as macroeconomic situations worsen.

In a brand new put up, Tapiero tells his 129,100 followers on the social media platform X that Bitcoin might soar greater than 90% of its present worth as a consequence of possible Fed price cuts to spice up the economic system.

Tapiero believes the liquidity improve would be the catalyst to ship Bitcoin to a brand new all-time excessive of $180,000.

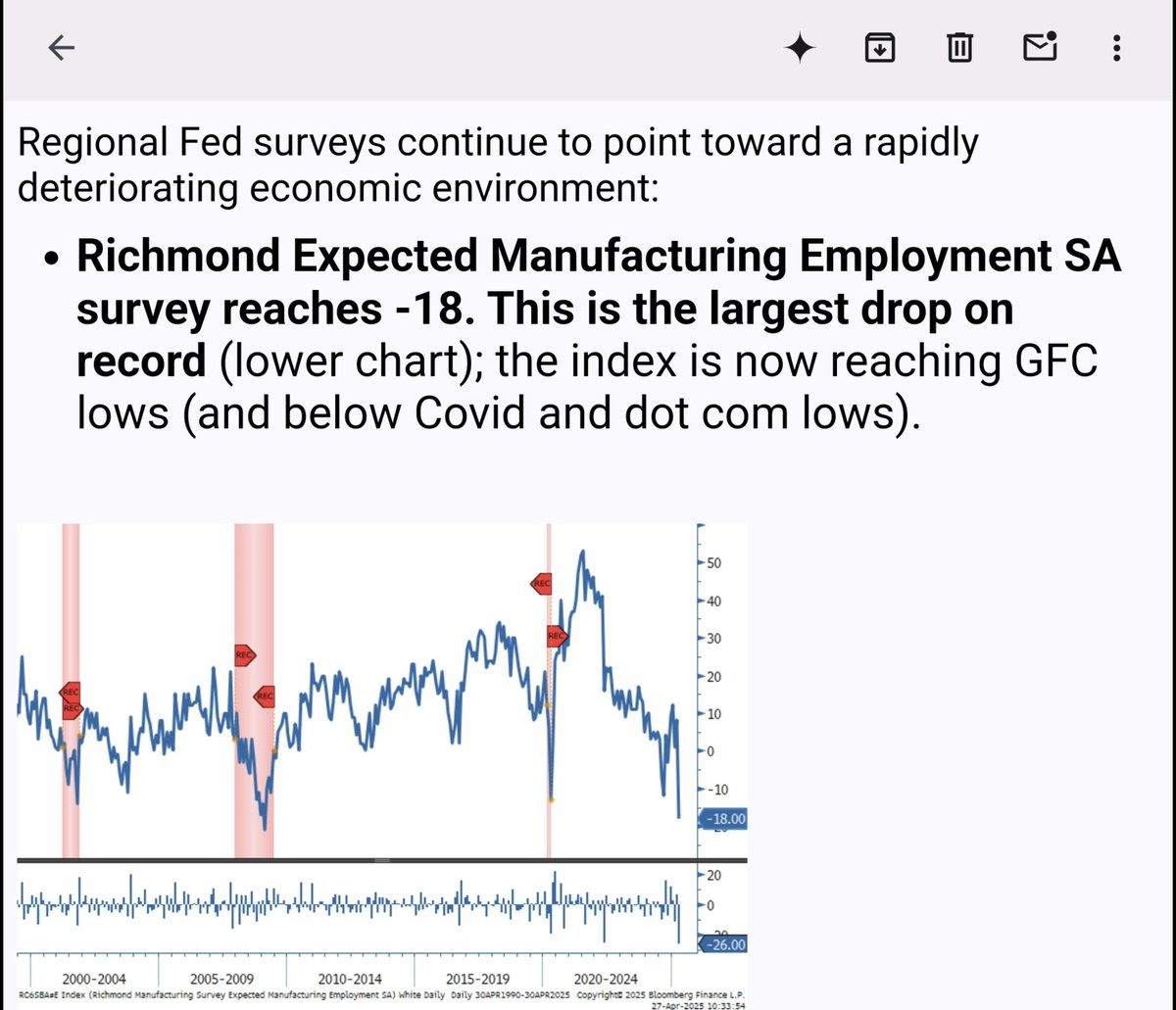

Among the many financial metrics he seems to be at is the Federal Reserve Financial institution of Richmond’s Anticipated Manufacturing Employment index, which has plummeted to ranges seen solely throughout financial crises.

“Right here we go once more. Extra second-tier macro information signaling a fast slowdown forward. Largest drop ever – again to ’08 lows. It’s a Fed survey, so arduous for them to disregard. Brief charges at 4% are means too excessive.

Similar theme: extra liquidity coming. BTC to $180,000 earlier than Summer time ’26…

[The Richmond Expected Manufacturing Employment index is] simply an indicator that exhibits we’re at an excessive very hardly ever if ever reached. I seek for these excessive outliers as they improve the chances that the slowdown is extra extreme than is presently priced in.”

Tapiero additionally says the worsening financial situations will possible result in more cash printing, which is able to debase the US greenback. He believes the foreign money debasement will trigger buyers to pour into Bitcoin as a hedge.

“Fed is taking part in with hearth. Huge collapse in client expectations for the economic system within the subsequent six months (hits 54.4). Again to March 2009 lows, nicely beneath Covid panic lows. That is excessive information. A lot decrease charges and USD wanted to offset fiscal austerity. Fiat debasement equals +BTC.”

Bitcoin is buying and selling for $94,277 at time of writing, flat on the day.

Observe us on X, Fb and Telegram

Do not Miss a Beat – Subscribe to get e mail alerts delivered on to your inbox

Test Value Motion

Surf The Every day Hodl Combine

Disclaimer: Opinions expressed at The Every day Hodl are usually not funding recommendation. Buyers ought to do their due diligence earlier than making any high-risk investments in Bitcoin, cryptocurrency or digital belongings. Please be suggested that your transfers and trades are at your individual danger, and any losses it’s possible you’ll incur are your accountability. The Every day Hodl doesn’t advocate the shopping for or promoting of any cryptocurrencies or digital belongings, neither is The Every day Hodl an funding advisor. Please observe that The Every day Hodl participates in internet affiliate marketing.

Generated Picture: Midjourney