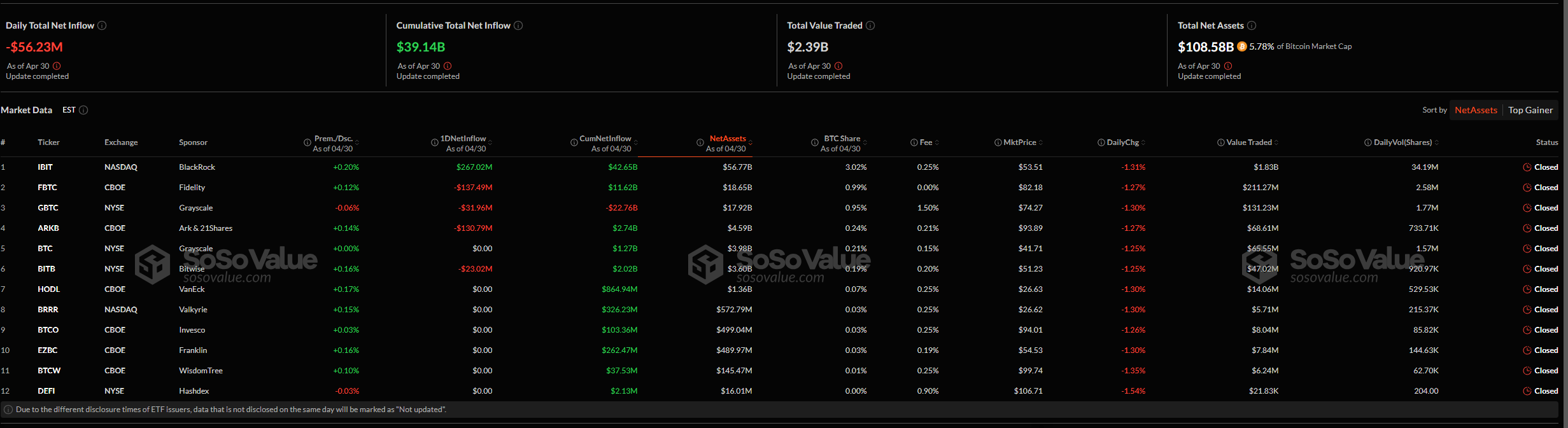

Though the worth of Bitcoin continues to be hovering simply above $95,000, sustaining the breakout from earlier this month, there may be impending hassle. Though technically bullish, the market is witnessing a regarding decline in ETF inflows, indicating that institutional curiosity in BTC publicity is starting to wane. There was a internet outflow of $56.23 million from Bitcoin spot ETFs on April 30.

The one ETF to report a internet influx of $267 million was BlackRock’s IBIT, indicating that the sector-wide decline was not because of normal market sentiment. Different important gamers, akin to Ark Make investments’s ARKB and Constancy’s FBTC, suffered important losses within the interim, with withdrawals of $137 million and $130 million, respectively. Following its conversion to an ETF, Grayscale’s GBTC, which has already skilled regular outflows, misplaced a further 0.31%.

Though the entire ETF market nonetheless has a cumulative internet influx of $3.914 billion, the steep one-day bleed is regarding. Bitcoin is struggling to interrupt by the $95,000 mark, which is why it’s retreating. Because the rally took Bitcoin above $90,000, the spot market’s quantity has been dropping, which means that momentum is waning.

The asset is approaching overbought territory in accordance with the RSI, which is circling round 66, however there should not sufficient important inflows to assist a continuation. Institutional gamers’ short-term conviction is eroding, in accordance with the ETF knowledge. If inflows don’t come again, the market might expertise a interval of consolidation or perhaps a correction, although the long-term setup continues to be in place, notably given the doable golden cross between the 50- and 200-day shifting averages.

Ethereum’s scenario is comparable. Constancy’s FETH was the one fund with an influx on the identical day that spot ETFs for ETH noticed a internet outflow of $2.36 million. Not solely Bitcoin is below stress; all cryptocurrencies are being uncovered.

Regardless of Bitcoin’s continued energy on the chart, the capital movement signifies in any other case. If institutional inflows don’t come again quickly, the rally might run out of steam earlier than it reaches six figures.