SUI and Solana have just lately made headlines with a notable shift in institutional curiosity. Over the previous few weeks, SUI has gained vital traction, surpassing Solana to grow to be one of many high property for institutional inflows.

The query now arises: Is that this a brief development, or are establishments genuinely shifting their focus towards SUI as the subsequent large contender within the blockchain area?

Sui Overtakes Solana

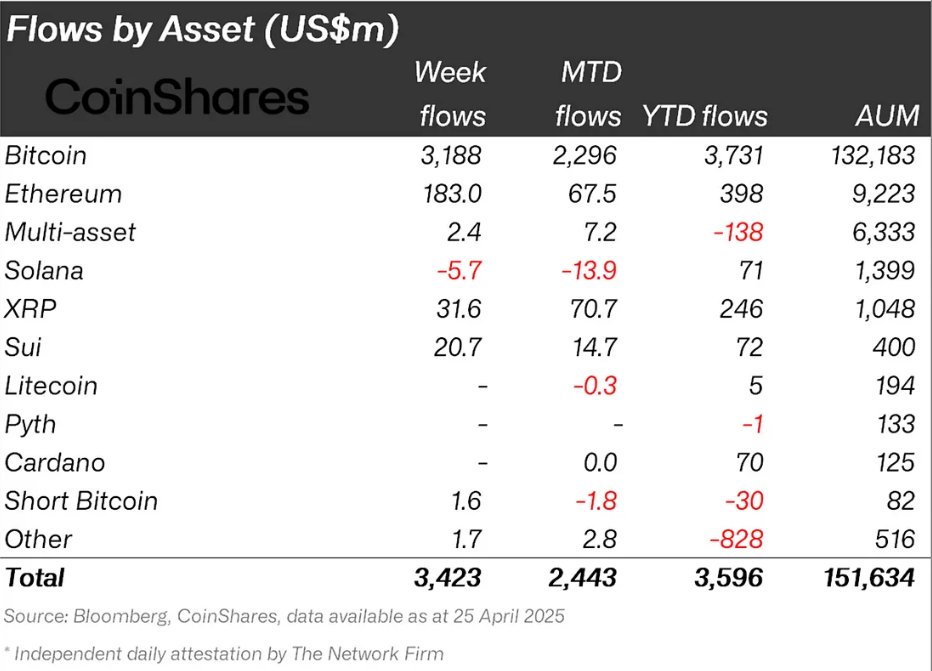

April proved to be a vital turning level for SUI because it surpassed Solana when it comes to institutional inflows. SUI attracted $14.7 million in inflows. In the meantime, Solana noticed $13.9 million in outflows throughout the identical interval.

Even year-to-date, SUI is giving powerful competitors to Solana, with inflows of $72 million. This shift in investor sentiment may point out a broader change out there, signaling that establishments are favoring SUI over its well-established counterpart.

The development is especially fascinating, given the efficiency of each property. Whereas Solana has lengthy been seen as a robust participant within the blockchain area, SUI’s latest rise means that traders could also be diversifying throughout main platforms.

Juan Pellicer, Senior Analysis Analyst at IntoTheBlock, shared comparable views with BeInCrypto relating to SUI.

“Establishments are diversifying fairly than changing Solana with SUI. Some capital has shifted, with cues that 60% of Solana’s outflows shifting to SUI, drawn by its development potential and newer know-how. But, Solana’s $73 billion market cap, established ecosystem, and robust ETF momentum hold it a mainstay, complementing SUI’s function in diversified institutional portfolios,” Pellicer informed BeInCrypto.

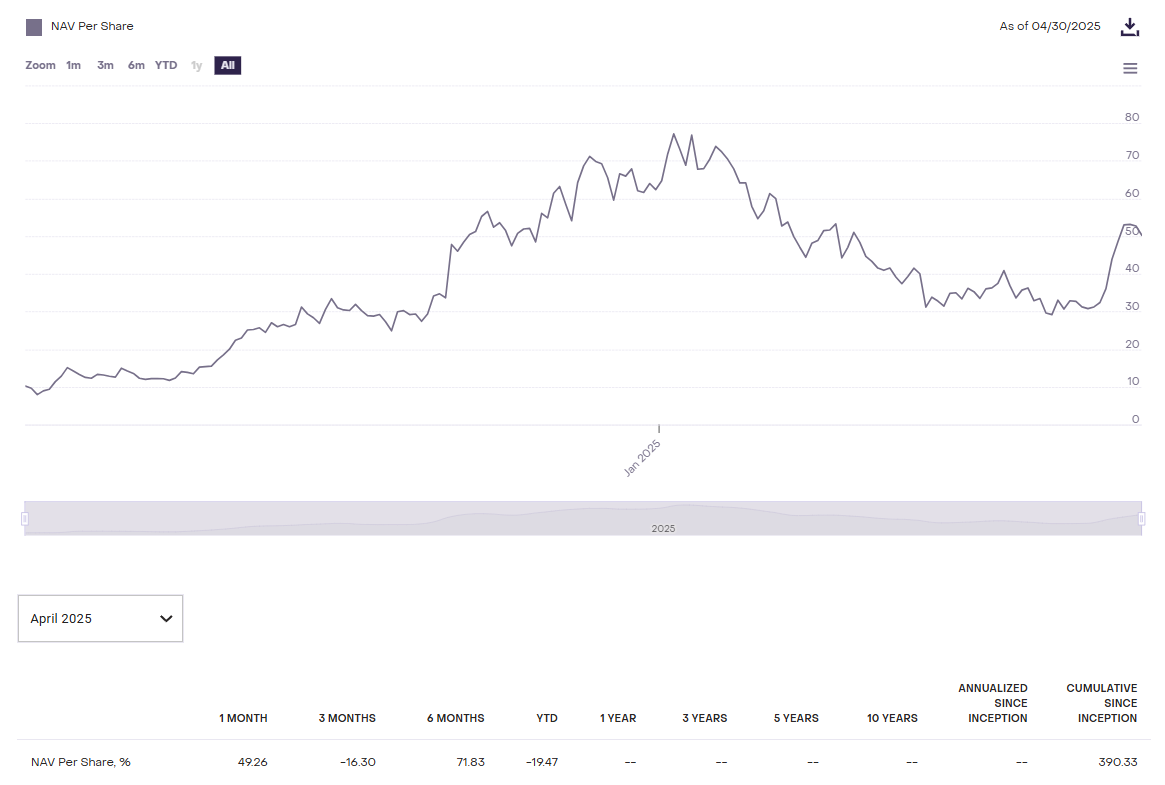

The macro momentum of each property can also be value contemplating, notably when evaluating the Grayscale Trusts for SUI (SUIFUND) and Solana (GSOL). Over the previous six months, the web asset worth (NAV) of Grayscale’s SUI Belief noticed a constructive 71.8% change, whereas Solana’s NAV remained flat.

This stark distinction in efficiency highlights the differing demand for these tokens and the following impression on their related funding autos.

Moreover, CBOE just lately filed for SEC approval for Canary Capital‘s SUI ETF. Nonetheless, Pellicer believes that this is probably not taking place anytime quickly.

“A SUI ETF is much less prone to be authorised earlier than a Solana ETF. Solana’s June 2024 filings, $73 billion market cap, and help from main companies like Constancy prioritize it for mid-2025 choices. SUI’s March 2025 submitting and smaller market presence face delays as a consequence of its newer standing and previous allegations, although a pro-crypto SEC could allow approval sooner than anticipated.”

SUI vs. Solana Worth Efficiency

Each SUI and Solana have skilled a decline in worth for the reason that starting of the yr, with SUI seeing a 14% lower and Solana a 19% drop. Nonetheless, April marked a big shift for each tokens, with SUI rising by 56.6% to commerce at $3.54, whereas Solana posted a extra modest 21% rally, standing at $151.

Regardless of the expansion in April, it’s essential to notice the distinction in market capitalization between the 2. Solana’s $11 billion market cap development in April was equal to your entire market cap of SUI. This distinction in market cap development signifies that whereas SUI’s rally is spectacular, Solana’s bigger market capitalization offers it a extra established presence out there.

Nonetheless, the robust efficiency of SUI in April highlights a local shift in curiosity, pushed by its extra scalable chain and rising partnerships. This development may proceed, fueling additional development for SUI in Q2 and Q3, because it builds on its momentum. Nonetheless, SUI continues to be removed from overtaking Solana as an institutional favourite.

Disclaimer

In keeping with the Belief Challenge pointers, this worth evaluation article is for informational functions solely and shouldn’t be thought of monetary or funding recommendation. BeInCrypto is dedicated to correct, unbiased reporting, however market situations are topic to vary with out discover. All the time conduct your individual analysis and seek the advice of with an expert earlier than making any monetary choices. Please notice that our Phrases and Circumstances, Privateness Coverage, and Disclaimers have been up to date.