Altcoins like AIXBT, Echelon Prime (PRIME), and Balancer (BAL) have posted large good points heading into the primary week of Might, however key technical indicators now recommend all three could also be overbought. AIXBT is up practically 95% on the week with robust worth momentum, but it nonetheless lags the broader market with a low relative power.

PRIME and BAL have each surged over 30% within the final 24 hours, however every reveals excessive RSI readings above 70 whereas additionally underperforming in relative power—elevating pink flags about sustainability. Whereas the rallies have drawn short-term consideration, merchants must be cautious as these tokens present indicators of overheating with out broader market affirmation.

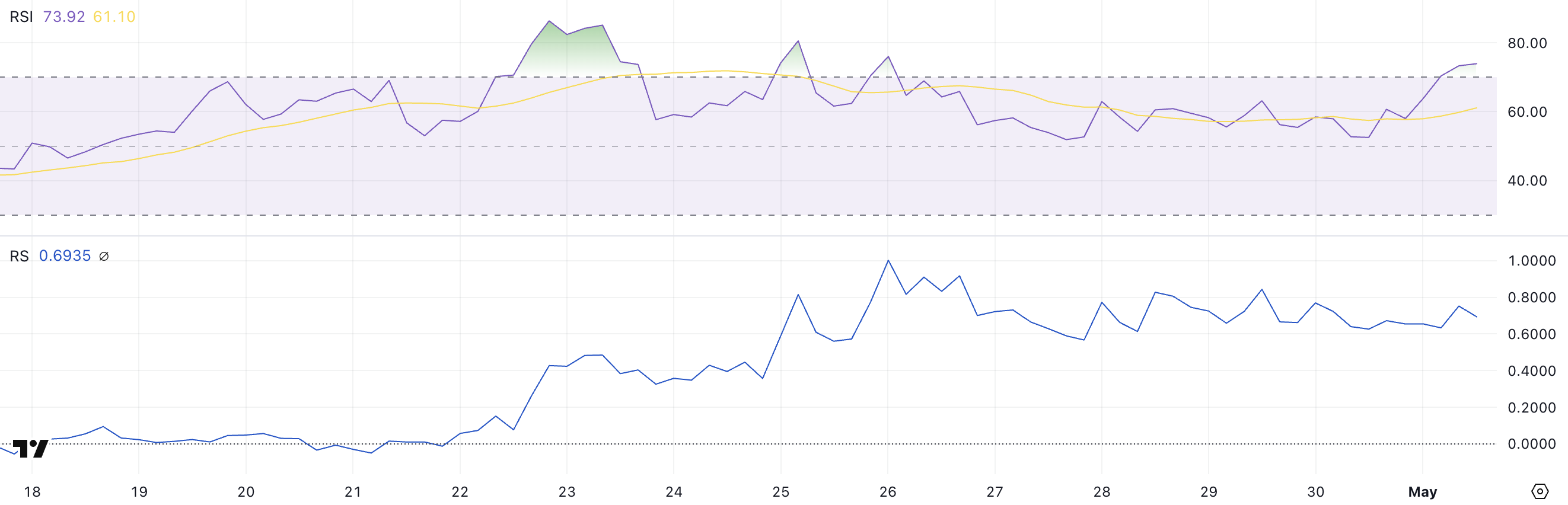

AIXBT

AIXBT, one of the crucial acknowledged crypto AI brokers tokens, has emerged as a prime performer, surging practically 40% within the final 24 hours and over 95% previously seven days.

This explosive rally locations AIXBT among the many best-performing altcoins of the week, drawing elevated consideration from merchants and speculators.

Nonetheless, technical indicators recommend the token could also be coming into overheated territory, warranting warning within the quick time period.

The Relative Power Index (RSI) is a momentum indicator that strikes from 0 to 100. Values above 70 imply the asset is overbought and should pull again. Values beneath 30 recommend it’s oversold and will rebound.

Relative Power (RS) compares a token’s efficiency to a benchmark. RS above 1.0 means outperformance. Beneath 1.0 means underperformance. AIXBT has an RSI of 73.92 and an RS of 0.69. That technically makes it overbought, however nonetheless lagging behind the broader market.

This reveals that AIXBT’s rally has been sharp, however not robust relative to different property. The surge could also be pushed extra by short-term hypothesis than sustained market power.

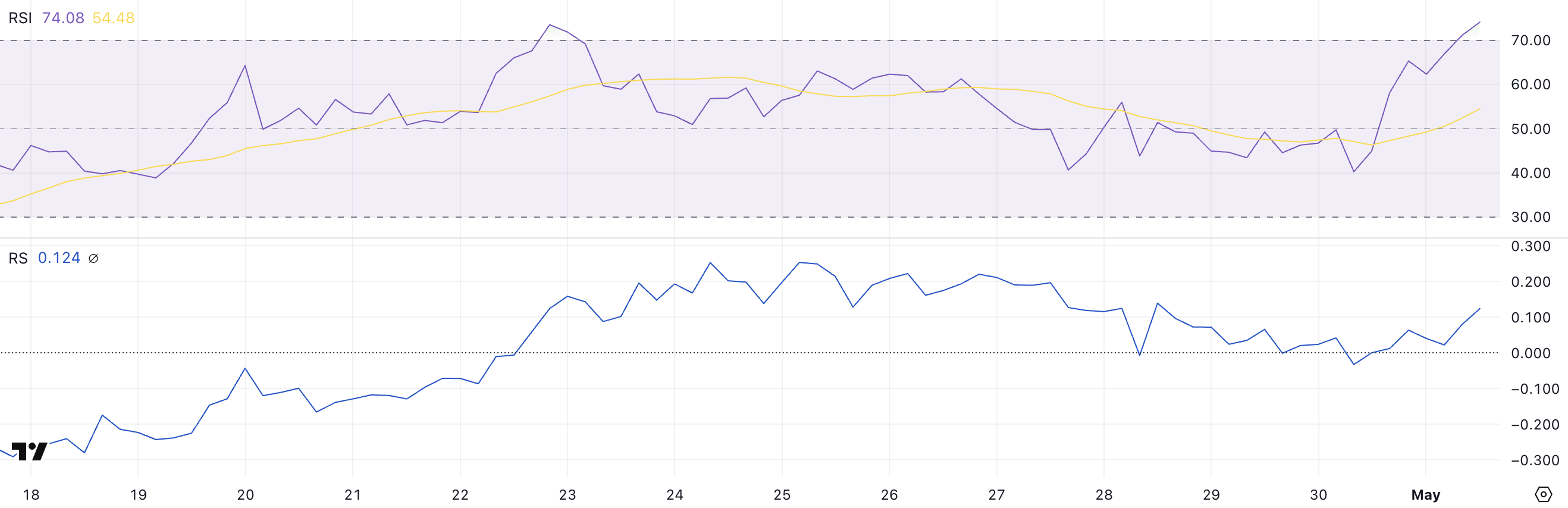

Echelon Prime (PRIME)

Echelon Prime has surged 33% within the final 24 hours, making it one of many day’s top-performing altcoins.

Its buying and selling quantity has exploded by 276%, reaching practically $16 million—a sign of heightened dealer curiosity and momentum.

Nonetheless, whereas the value motion is spectacular, technical indicators are flashing warning within the quick time period.

PRIME’s Relative Power Index (RSI) presently sits at 74, firmly in overbought territory. On the similar time, its Relative Power (RS) is simply 0.124.

This mixture—excessive RSI and low RS—suggests the latest rally could also be unsustainable.

Whereas there’s robust short-term demand, the token lacks affirmation from relative market power, making PRIME susceptible to a pointy correction if shopping for stress fades.

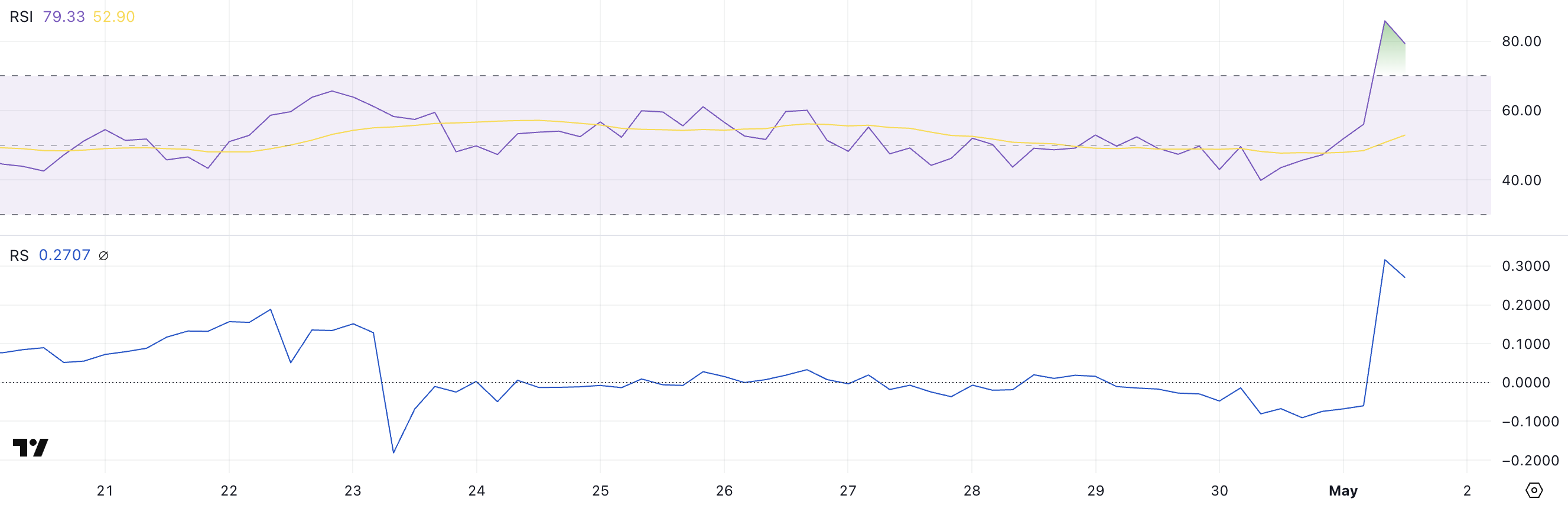

Balancer (BAL)

Balancer has jumped over 41% within the final 24 hours, supported by a pointy rise in buying and selling exercise, with quantity climbing to $53 million.

The worth surge locations BAL among the many strongest-performing altcoins available in the market. Nonetheless, technical indicators recommend the rally could also be overextended regardless of the breakout.

BAL’s Relative Power Index (RSI) is at 79.33, signaling excessive overbought circumstances. In the meantime, its Relative Power (RS) stands at simply 0.27, indicating it’s nonetheless underperforming relative to the broader market.

This mixture—very excessive RSI and low RS—typically factors to an unsustainable transfer pushed extra by hype than underlying power.

With out relative outperformance to assist the momentum, BAL may very well be liable to a near-term pullback as soon as shopping for stress cools.

Disclaimer

In keeping with the Belief Challenge pointers, this worth evaluation article is for informational functions solely and shouldn’t be thought-about monetary or funding recommendation. BeInCrypto is dedicated to correct, unbiased reporting, however market circumstances are topic to vary with out discover. At all times conduct your individual analysis and seek the advice of with an expert earlier than making any monetary selections. Please observe that our Phrases and Situations, Privateness Coverage, and Disclaimers have been up to date.