Pi Community (PI) has been down greater than 8.5% within the final seven days. It has traded under $0.65 for six straight days however crashed under $0.60 right this moment. The development stays weak, with value motion caught under the Ichimoku Cloud.

The altcoin’s RSI briefly went above 50 however has dropped again to 45, displaying fading bullish momentum. EMAs are nonetheless bearish. It’s hovering simply above key help, and the subsequent transfer might determine between a deeper drop and a possible rebound.

Pi Community Faces Bearish Stress Under the Ichimoku Cloud

Pi Community remains to be buying and selling under the Ichimoku Cloud, signaling a bearish market construction total. Nevertheless, a possible shift could also be growing, because the blue Tenkan-sen (conversion line) has not too long ago crossed above the crimson Kijun-sen (final analysis).

This crossover is usually seen as an early bullish sign, particularly if confirmed by rising quantity or a transfer into the cloud.

Regardless of this, the longer term cloud stays crimson, indicating continued resistance forward and signaling that the broader development remains to be beneath strain.

The Chikou Span (lagging line) remains to be under each the value candles and the cloud. This implies any upside transfer has not but been confirmed.

For an actual development reversal, PI should break into and above the cloud. The longer term cloud should additionally flip inexperienced, with all Ichimoku alerts aligning bullishly.

Proper now, the setup exhibits indecision. There’s a short-term bullish crossover, however the value remains to be beneath the cloud, and the broader development stays bearish.

Pi Community Momentum Slows as RSI Dips Under 50

Pi Community’s RSI presently sits at 45.41, easing off after a pointy rally from 28.49 to 54.40 simply two days in the past. This means a slowdown in momentum following a short interval of restoration.

The pullback from above 50 suggests that purchasing strain has weakened, and PI is getting into a extra impartial zone, the place neither bulls nor bears are in full management.

The fast reversal additionally displays uncertainty within the present value development.

The Relative Energy Index (RSI) is a momentum oscillator starting from 0 to 100, generally used to establish overbought or oversold circumstances.

Readings above 70 counsel an asset could also be overbought and due for a correction, whereas readings under 30 point out oversold circumstances and potential for a bounce. Values between 30 and 70 are thought of impartial, with 50 as the important thing pivot level.

PI’s present RSI at 45.41 is under that threshold, hinting at a slight bearish lean except the metric turns again upward. If RSI continues to say no, it might mirror rising promoting strain and a danger of additional value weak spot.

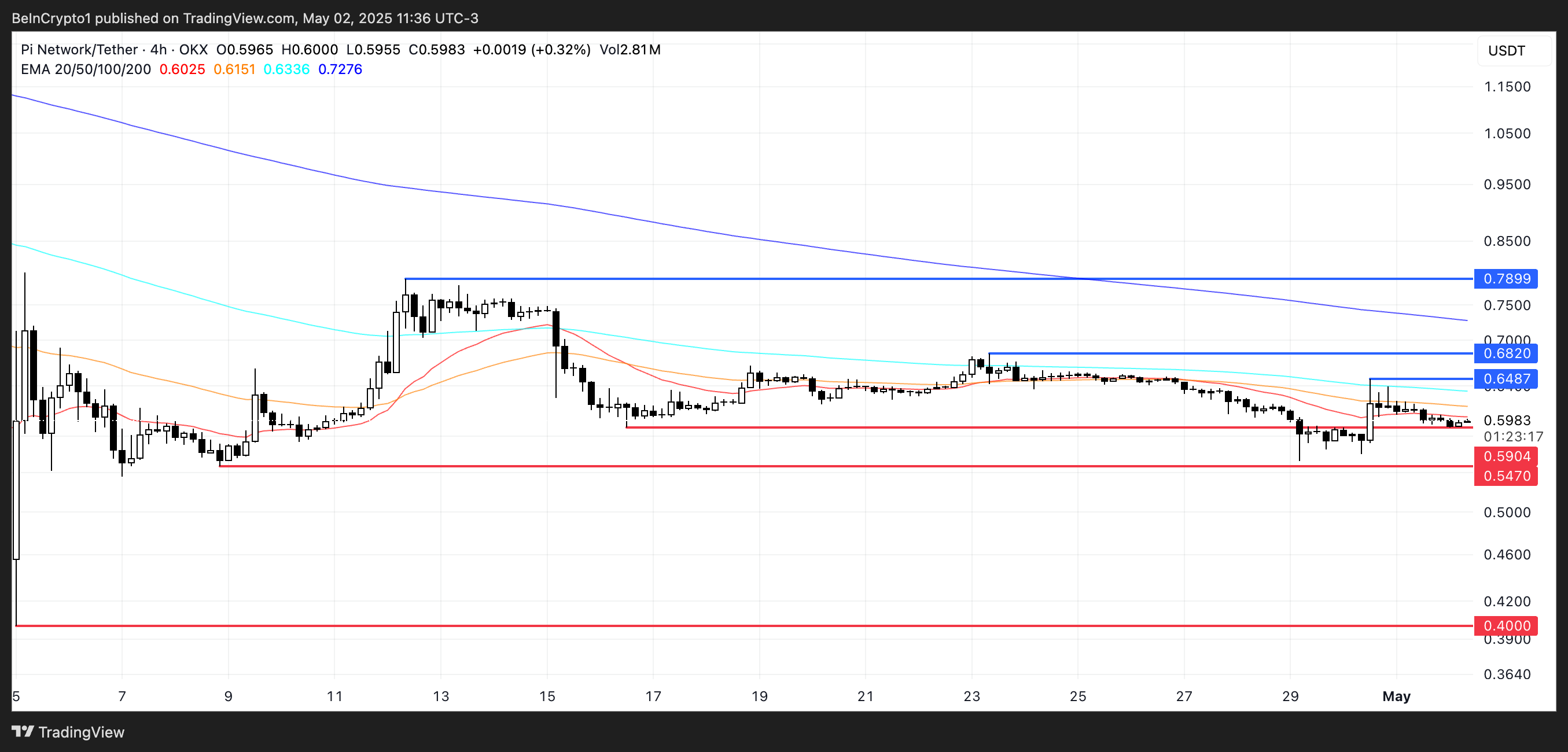

Pi Community Hovers Close to Key Assist With Bearish EMAs

PI value is buying and selling simply above a key help at $0.59, with bearish strain constructing.

If this stage is examined and damaged, the subsequent necessary helps lie at $0.547 and $0.40, probably exposing the token to a deeper correction.

The Exponential Shifting Averages (EMAs) stay in a bearish alignment, with short-term EMAs positioned under the long-term ones. This construction sometimes alerts that the broader development remains to be downward.

Nevertheless, if the development reverses and consumers step in, PI may climb to check resistance at $0.648, adopted by $0.682.

A breakout above each—particularly if supported by quantity and a bullish EMA crossover—may push the value towards $0.789, signaling a shift towards a extra sustained uptrend.

Disclaimer

According to the Belief Undertaking pointers, this value evaluation article is for informational functions solely and shouldn’t be thought of monetary or funding recommendation. BeInCrypto is dedicated to correct, unbiased reporting, however market circumstances are topic to vary with out discover. At all times conduct your individual analysis and seek the advice of with an expert earlier than making any monetary selections. Please notice that our Phrases and Situations, Privateness Coverage, and Disclaimers have been up to date.