Hedera (HBAR) has fallen over 6% within the final seven days as key indicators level to shifting momentum. After 10 days of bullish power, the BBTrend has turned detrimental at -3.35, suggesting rising draw back danger.

In the meantime, the RSI has rebounded to 49.82 however stays under the vital 50 mark, signaling indecision. With HBAR buying and selling in a decent vary between $0.1849 and $0.189, a breakout in both path might outline the following development.

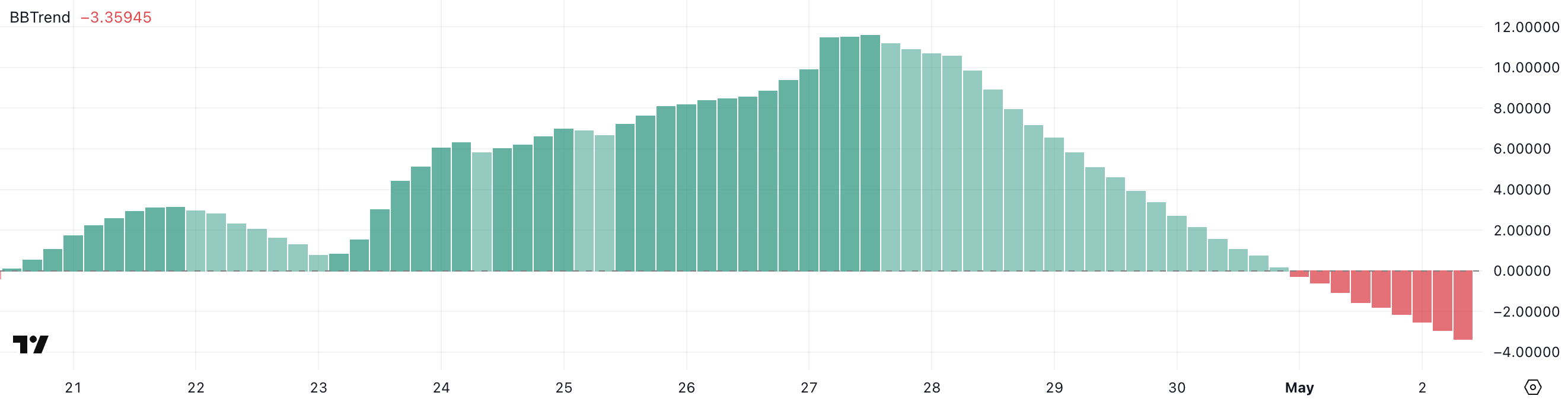

HBAR BBTrend Turns Detrimental After 10-Day Run

Hedera’s BBTrend has simply flipped detrimental after holding above zero for 10 consecutive days, suggesting a possible shift in momentum.

Presently, the BBTrend stands at -3.35, a pointy distinction from the bullish tone seen earlier this month. This reversal occurred two days in the past and should mirror weakening upward stress on HBAR’s worth.

After exhibiting constant power, the current change raises warning amongst merchants looking forward to early indicators of a downtrend.

BBTrend, or Bollinger Band Development, is a momentum indicator that measures worth distance and path relative to the Bollinger Bands.

When the BBTrend is above zero, it sometimes displays robust bullish momentum, indicating the value is pushing towards or staying close to the higher band. When it strikes under zero, because it has now for HBAR, it typically suggests rising bearish sentiment, with the value leaning towards the decrease band.

A studying like -3.35 factors to elevated volatility and the potential for additional draw back, particularly if different indicators start aligning with this weakening sign.

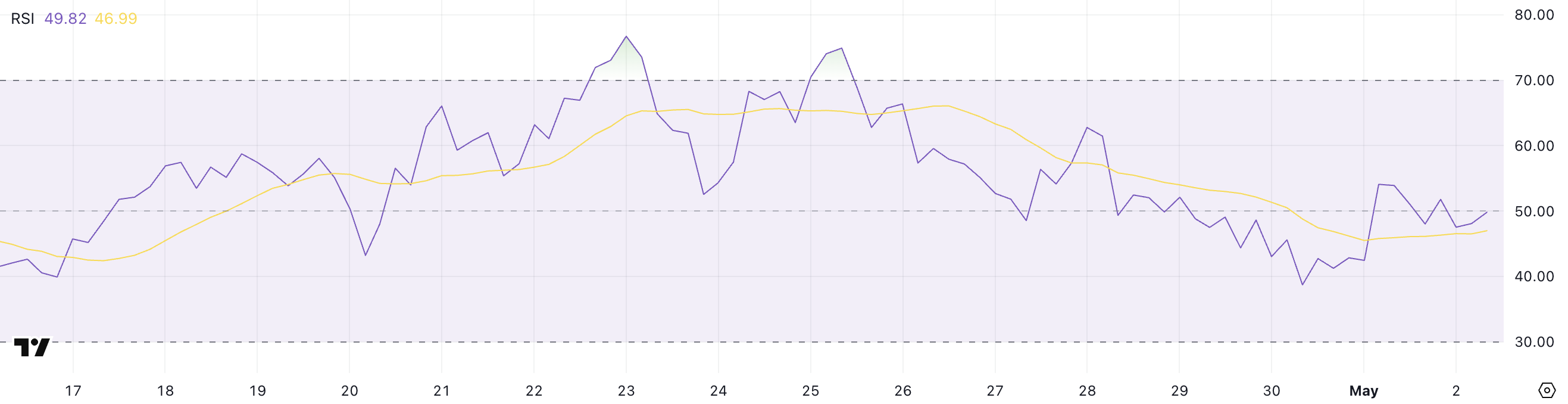

Hedera RSI Rebounds however Stays Under Key Bullish Zone

Hedera’s RSI is at the moment at 49.82, rebounding from 42.45 yesterday after briefly touching 54 earlier within the session. This bounce suggests some restoration in shopping for curiosity, however the RSI stays under the important thing 50 threshold.

The current motion signifies a tug-of-war between bulls and bears, with no clear dominance but.

After sliding earlier within the week, this slight uptick might mirror a possible shift towards stabilization.

The Relative Power Index (RSI) is a momentum oscillator that ranges from 0 to 100, used to evaluate overbought and oversold situations.

Readings above 70 sometimes point out an asset is overbought and could also be due for a correction, whereas values under 30 counsel oversold situations and a doable rebound. Ranges between 30 and 70 are thought of impartial, with 50 as a pivot level.

HBAR’s present RSI of 49.82 locations it proper on that line, signaling indecision, although the current rise hints that momentum might tilt bullish if it breaks above 50 and holds.

Hedera Consolidates—Will Bulls or Bears Take Management?

Hedera worth is buying and selling in a decent vary between resistance at $0.189 and assist at $0.1849, with different key ranges shut by. If the $0.189 resistance breaks, it might open the door for a transfer towards $0.199 and $0.202.

A sustained uptrend might push HBAR to retest the $0.258 stage, marking a big bullish breakout.

For now, worth motion stays cautious because the market waits for a decisive transfer.

On the draw back, if the $0.1849 assist is damaged, HBAR might fall towards $0.175 and $0.16.

A deeper downtrend might drag it as little as $0.124, erasing a lot of its current good points. These ranges symbolize vital turning factors, and merchants will watch intently for quantity spikes or momentum shifts.

Till then, Hedera stays in consolidation, with stress constructing on either side.

Disclaimer

In keeping with the Belief Challenge tips, this worth evaluation article is for informational functions solely and shouldn’t be thought of monetary or funding recommendation. BeInCrypto is dedicated to correct, unbiased reporting, however market situations are topic to alter with out discover. All the time conduct your individual analysis and seek the advice of with an expert earlier than making any monetary selections. Please be aware that our Phrases and Situations, Privateness Coverage, and Disclaimers have been up to date.