Pi Community plunged by double digits over the previous week, even because the broader crypto market exhibits indicators of restoration. The altcoin’s market cap dropped to $4.1 billion, as PI continues to see intense promoting stress.

With bearish stress intensifying, the token might quickly revisit its all-time low close to $0.40.

PI Dangers Deeper Drop

Regardless of some power throughout the broader market, investor sentiment towards PI stays weak, with technical indicators suggesting that its worth decline might proceed.

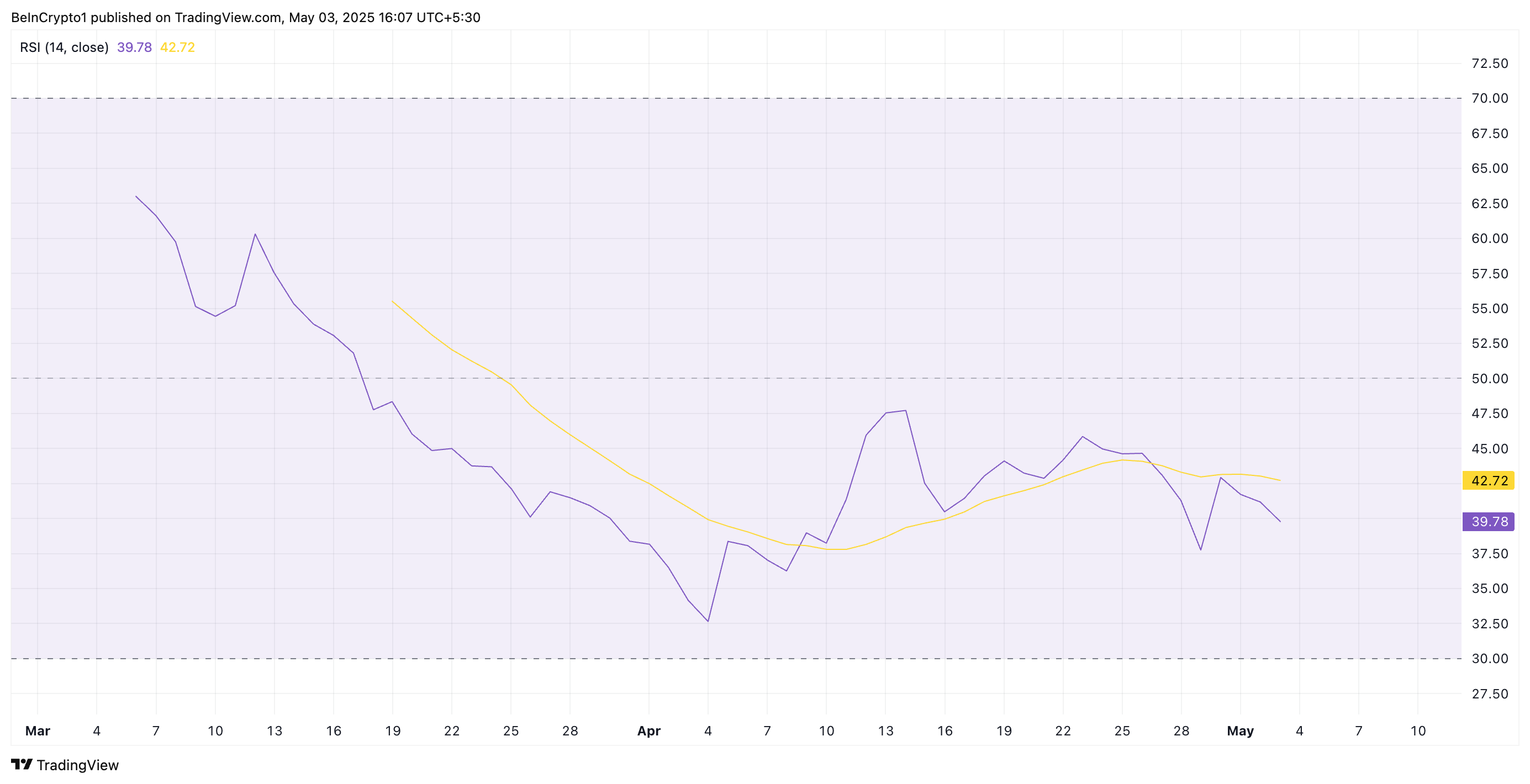

The Relative Energy Index (RSI), a key momentum indicator that tracks an asset’s overbought and oversold market situations, continues to drop, indicating falling demand and rising promoting stress.

At press time, PI’s RSI is in a downtrend at 39.78. This RSI studying signifies weakening momentum and positions the token simply above oversold territory, suggesting continued promoting stress might set off additional losses.

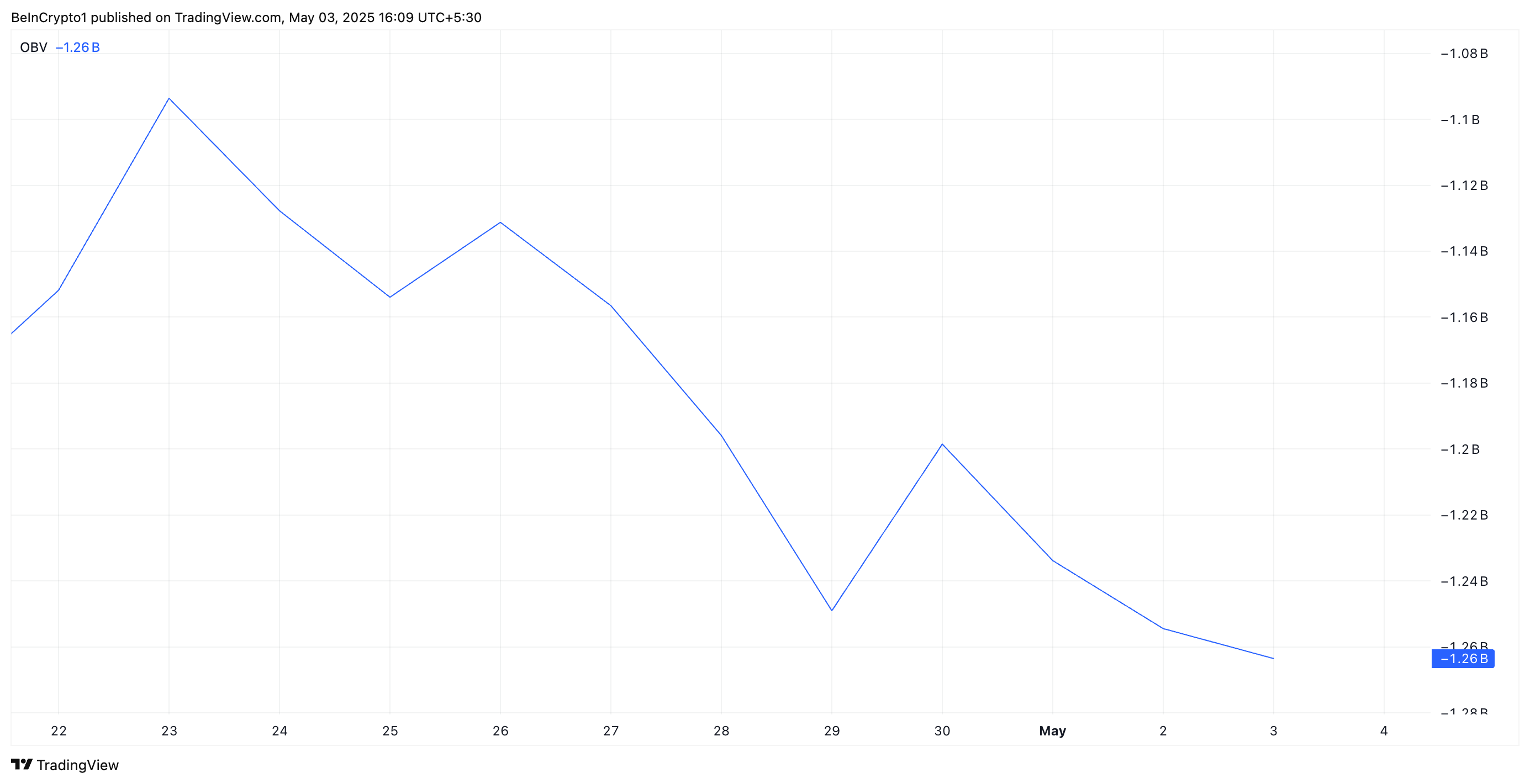

Moreover, Pi Community’s on-balance quantity (OBV) has additionally decreased, pointing to declining accumulation and decreased purchaser curiosity. This indicator is at -1.26 billion at press time, falling by 15% up to now week.

The OBV measures shopping for and promoting stress by monitoring quantity stream relative to cost actions. When OBV falls like this, extra quantity is tied to promoting than shopping for. This means weakening investor confidence and potential for additional worth declines.

PI Token Dangers Retesting All-Time Low

PI’s plummeting Chaikin Cash Movement (CMF) helps the bearish outlook above. At press time, this indicator, which tracks how cash flows into and out of an asset, is beneath the zero line at -0.15.

This destructive studying displays the power of the sell-side stress within the PI spot markets. If this pattern persists, PI might revisit its all-time low of $0.40.

Nevertheless, a bullish reversal within the present pattern might propel PI’s worth to $1.01.

Disclaimer

In step with the Belief Challenge tips, this worth evaluation article is for informational functions solely and shouldn’t be thought-about monetary or funding recommendation. BeInCrypto is dedicated to correct, unbiased reporting, however market situations are topic to alter with out discover. At all times conduct your individual analysis and seek the advice of with knowledgeable earlier than making any monetary selections. Please be aware that our Phrases and Situations, Privateness Coverage, and Disclaimers have been up to date.