|

Crypto corporations are now not simply difficult the standard monetary system — they’re more and more changing into a part of it.

Firms like Circle and BitGo are reportedly pursuing banking charters and making ready for a wave of incoming stablecoin laws that would additional blur the traces between crypto corporations and conventional banks.

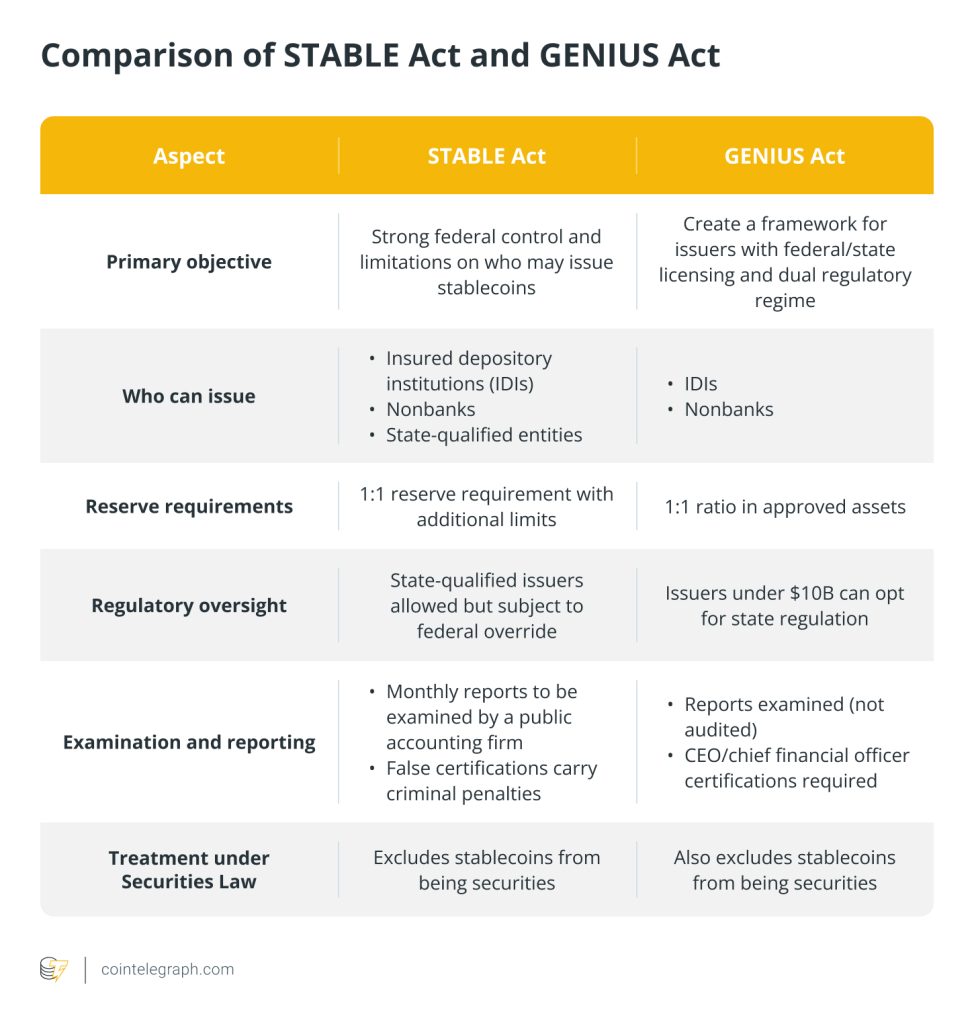

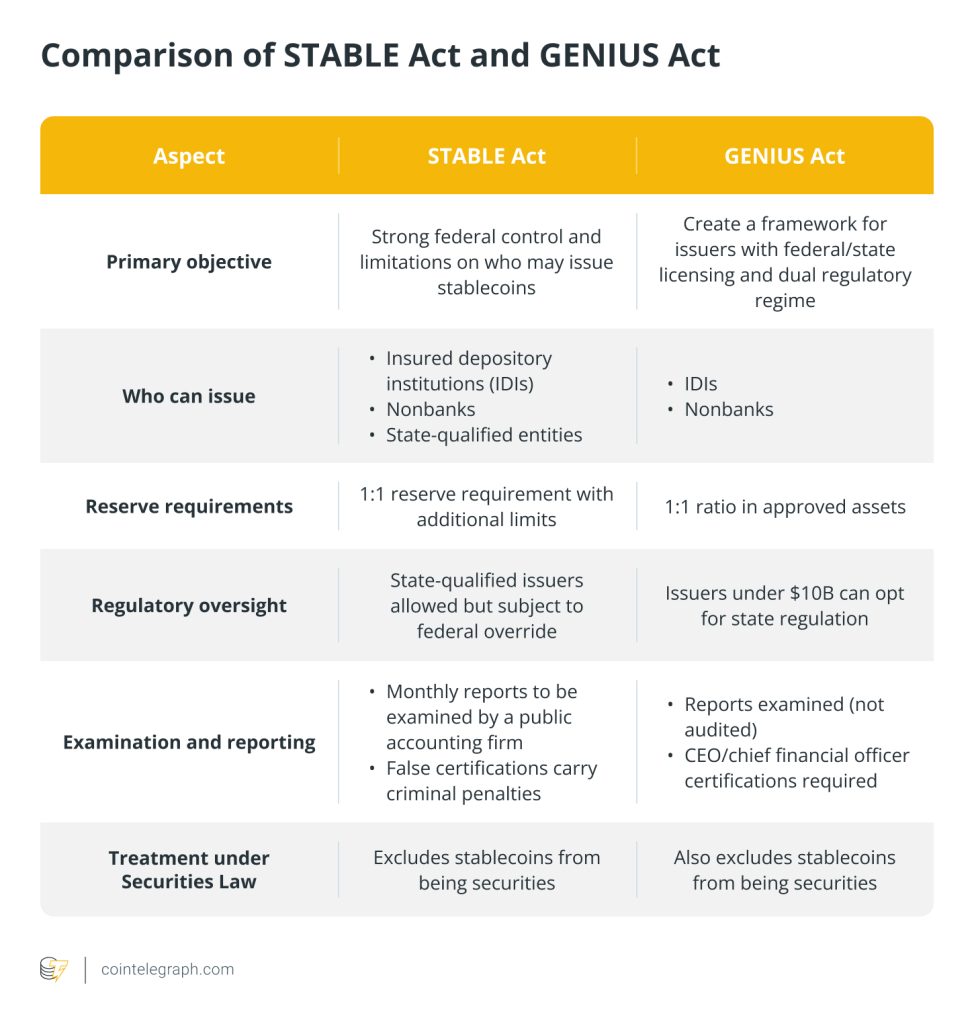

Within the US, two main payments — the Stablecoin Transparency and Accountability for a Higher Ledger Financial system (STABLE) Act and the Guiding and Establishing Nationwide Innovation for US Stablecoins (GENIUS) Act — goal to introduce new guidelines on stablecoin issuers, overlaying every thing from reserve necessities to licensing and compliance obligations.

Europe’s Markets in Crypto-Property (MiCA) framework alreadyregulates stablecoins,and in Hong Kong, a proposal would require stablecoin issuers to acquire a license from the Hong Kong Financial Authority.

To debate to ramifications, Journal introduced collectively authorized consultants from throughout the globe: Charlyn Ho of Rikka within the US, Joshua Chu, co-chair of the Hong Kong Web3 Affiliation, and Yuriy Brisov and CBDC and market researcher Alexandra Zviagintseva, each from Digital & Analogue Companions in Europe.

Journal: In what manner does changing into a regulated financial institution change how a crypto agency operates?

Chu (HK): Acquiring a banking license would give corporations a level of belief and permit them to supply conventional banking providers like deposit-taking and lending. With a financial institution constitution additionally comes regulatory oversight, together with capital management necessities, KYC/AML obligations, and common audits.

The concept of enormous crypto gamers searching for banking licenses is definitely not a brand new improvement. Again in 2017, Switzerland had at the moment invited main crypto establishments to return to the jurisdiction and contemplate acquiring a banking license. Even then, banks had a task to play. On-ramping and off-ramping currencies are an enormous a part of the method, whether or not you want fiat or not. One of many early frustrations amongst crypto gamers was seeing cash or wealth they couldn’t actually contact, as a result of the second they tried to money it in, they have been red-flagged by banks as a consequence of AML insurance policies round uncommon or irregular transactions.

Ho (US): Once I was at my previous regulation agency, one of many early professional bono initiatives we labored on concerned serving to ladies in Afghanistan who have been historically barred from having financial institution accounts. The objective was to make use of Bitcoin to offer them entry to funds in a manner that couldn’t be taken away by male members of the family. In distinction, conventional banks in some locations may impose restrictions like requiring a male co-signer for account creation or withdrawals. So crypto provided another system that would present banking-like entry with out conventional obstacles.

I don’t essentially suppose that crypto corporations getting banking charters means they may abandon all of these authentic beliefs. However the mainstreaming of digital property does imply some lack of independence from the standard banking system. If the GENIUS and STABLE Acts (or any future rules) move, they may successfully create a regulatory framework for crypto corporations that mirrors the framework for conventional finance and banking.

Journal: Are banks pushing again towards stablecoins, and is that making stablecoin corporations act extra like banks?

Brisov (EU): Initially, banks resisted stablecoins as a consequence of aggressive issues. However because it turned clear that stablecoins are right here to remain, banks have been the primary to pivot. In Europe, a number of banks have already utilized to situation their very own stablecoins. Equally, within the US, Financial institution of America and others have indicated curiosity.

From early on, one method was to make use of crypto as a expertise, whereas nonetheless viewing it as a part of the worldwide monetary system. Gamers like Circle and Coinbase adopted this path, adhering to rules and guidelines from the outset.

Kraken was the primary crypto alternate to use for a financial institution constitution in Wyoming. Wyoming is well-known amongst crypto lovers, and in 2020, it created a brand new entity known as a Particular Function Depository Establishment (SPDI). Kraken turned the primary SPDI in Wyoming. They said on their web site that they acquired a financial institution constitution. However it wasn’t a federal financial institution constitution or perhaps a conventional state financial institution constitution. It was a special-purpose answer permitting crypto corporations to obtain deposits, custody cryptocurrency, and facilitate crypto exchanges.

So I wouldn’t say crypto is solely being pushed into the worldwide monetary system, however it’s extra that sure gamers selected that path from early on.

For instance, Circle has constantly been pro-regulation. They started publishing attestation reviews even earlier than frameworks like MiCA in Europe. It was already performing like a financial institution or bank-like establishment.

Journal: What are the important thing procedural hurdles each the STABLE and GENIUS Acts must overcome to turn into regulation?

Ho: GENIUS and STABLE are parallel legislative proposals, and neither is regulation but. From what I perceive, the STABLE Act would create extra of a federal regulatory regime, giving stronger management to the federal authorities. The GENIUS Act leans extra towards a state-focused regulatory framework. Total, each acts are designed to create extra readability.

The method within the US is that you just usually have a sponsor. Typically talking, a invoice has to move each homes: the Home of Representatives and the Senate. If it does, it then goes to the president for both a signature or a veto.

Journal: How probably is both invoice to advance past committee?

Ho: I believe one or the opposite will advance. That is simply my very own opinion: since they’ve overlapping scopes, both they may have to be de-conflicted so there aren’t contradictory authorized necessities, or one of many two should be handed.

Brisov: This STABLE and GENIUS proposal within the US primarily mirrors a lot of what MiCA has already achieved. MiCA applies throughout 27 EU member states; the US has 50 states, however the framework is sort of comparable. Whereas MiCA is a broader regulatory regime, STABLE and GENIUS are centered solely on stablecoins.

Underneath these US proposals, both a financial institution or a tech firm might get hold of a license or constitution to situation stablecoins. They’ve additionally launched thresholds — just like MiCA. As an example, one of many payments states that if a stablecoin reaches $10 billion in turnover, it will then fall below twin regulation by the Federal Reserve System.

On the state degree, corporations can start receiving stablecoin licenses. If any of them develop giant sufficient, the Federal Reserve would then probably oversee and regulate them. Importantly, like MiCA, stablecoin issuers received’t be allowed to pay curiosity on stablecoin holdings.

Learn additionally

Options

Deposit danger: What do crypto exchanges actually do together with your cash?

Options

Are you able to belief crypto exchanges after the collapse of FTX?

Ho: I believe it’s essential to acknowledge that, like different areas of US versus European regulation, there are basic variations. For instance, I’m a privateness and cybersecurity specialist, and in privateness regulation, Europe’s GDPR creates a complete framework for shielding private information throughout the EU. In distinction, the US doesn’t have a federal privateness regulation but — privateness is dealt with state by state, which mirrors GDPR considerably, however solely on the state degree.

[The stablecoin bills] spotlight one other US-EU distinction. Within the US, there’s the potential for federal versus state regulatory battle.

Journal: And the way does MiCA regulate stablecoins?

Brisov: MiCA states straight that in the event you situation Digital Cash Tokens (EMTs) or Asset-Referenced Tokens (ARTs) — all stablecoins fall into the EMT class — issuers should first get hold of an digital cash issuance license in one of many EU member states. For instance, Circle acquired its license in France in 2023.

The second step is to get a license for the token itself. Issuers should show they’ve 100% reserves backing the tokens and adjust to the stablecoin rules. If a stablecoin person requests to alternate their tokens for fiat cash, the issuer should honor that redemption.

USDC, as an example, has totally complied with these necessities, which is why it’s allowed throughout all EU member states and even exterior the EU when counterparties are coping with European entities. Even in case you are based mostly exterior the EU, however your counterparty is in Europe, you continue to must observe MiCA guidelines.

That’s why main crypto exchanges needed to alter their operations round Tether (USDT) as properly. In the event that they didn’t, they may face fines or restrictions when working with EU prospects or corporations interacting with EU markets.

Journal: How are stablecoins seen by Hong Kong regulators within the wake of their pro-crypto stance?

Chu: The stablecoin invoice is approaching the heels of the stablecoin sandbox that was launched earlier. In case you take a look at the digital property buying and selling platform laws, it began as a sandbox. As soon as there was adequate supervisory expertise, regulators moved to enact formal laws. We’re seeing an analogous method now.

The upcoming stablecoin invoice was launched in December. It’s anticipated to be enacted quickly, with consultations accomplished. It should require fiat-referenced stablecoins to acquire a license from the HKMA. The licensing regime will embody necessities for reserve administration, operational controls, advertising restrictions and client safety. The HKMA license will create a class of central bank-approved stablecoins that aren’t CBDCs. It’s essential to distinguish the 2. This supplies a singular regulatory standing and mix for these two varieties of merchandise.

Journal: How does Hong Kong’s stablecoin invoice fare towards MiCA?

Chu: The stablecoin invoice had the benefit of observing what MiCA did within the EU. MiCA has been strongly criticized for prohibiting stablecoin issuers from providing curiosity or remuneration based mostly on holding length.

The Hong Kong regulatory method seems to be way more versatile. Hong Kong’s focus is on sustaining financial and monetary stability and defending buyers, with out an outright ban on yield-generating actions. That is thought of crucial by issuers like Tether.

If you consider it, it’s fairly a homecoming, as a result of Tether — the unique stablecoin innovation — was really based by a workforce based mostly in Hong Kong. So it’s becoming that the laws displays that heritage.

Journal: Do central bank-licensed stablecoins have the potential to function as de facto CBDCs?

Chu: In case you take a look at CBDCs, you possibly can look simply throughout the border into mainland China, which has a strict ban on crypto however sturdy encouragement for CBDC improvement. Stablecoins are particularly designed to combine with the Web3 crypto economic system. That’s why we made the choice to distinguish the 2: to place Hong Kong as a melting pot that may facilitate either side.

Learn additionally

Columns

Saudi Arabia’s Riyadh could also be crypto’s sleeping large: Crypto Metropolis Information

Options

Meet lawyer Max Burwick — ‘The ambulance chaser of crypto’

We haven’t seen plenty of companies reacting but, however there are big alternatives created by Hong Kong’s regulatory improvement that aren’t obtainable elsewhere. China is a large and essential monetary market, and it stays to be seen how that wealth may be accessed.

Now, the SFC has issued circulars making it clear that Hong Kong shouldn’t be used to bypass PRC legal guidelines. For instance, you possibly can’t merely arrange in Hong Kong to get mainland Chinese language customers to commerce crypto.

Zviagintseva: From a client perspective, we are able to see that CBDCs are competing with stablecoins. Each are merely cost strategies, and it doesn’t actually matter whether or not it’s a central financial institution digital foreign money or a stablecoin — the important thing distinction is the issuer and who you belief extra.

Totally different international locations are exploring completely different fashions. Some, just like the US, are leaning extra towards stablecoins. Europe and different developed economies are much less keen about CBDCs, largely as a result of they have already got secure and environment friendly monetary programs.

For these areas, the problem is figuring out compelling benefits, like client privateness. In Europe, one proposed advantage of CBDCs is anonymity and confidentiality, since many individuals are cautious of sharing private information with banks and governments. Europe is transferring cautiously. Solely in October 2025 are they anticipated to roll out their CBDC technique, and even then it’s simply an preliminary pilot stage.

The US has taken a transparent stance that, a minimum of within the close to future, there can be no digital greenback. However even earlier than this, progress was sluggish. Whereas there have been some exploratory efforts, they remained at an early stage.

Now, with that route clarified, USDC and USDT might emerge because the de facto digital representations of the US greenback, since they will already be used as cost strategies. This provides extra momentum to stablecoins.

Journal: Anonymity is proposed as a profit in Europe, however privateness has additionally been a key concern of CBDC opponents.

Zviagintseva: Shoppers usually need security and management over their information. They like to not share private info with establishments. In that sense, CBDCs might supply a bonus over conventional digital cash dealt with by means of banks—by transferring towards digital wallets and currencies that supply extra particular person management.

Nonetheless, this raises issues for governments, who don’t need to lose visibility over cash flows. If an excessive amount of of the financial system turns into untraceable, it might weaken oversight. That’s why the EU is contemplating particular limitations, like “anonymity vouchers”—a capped quantity of digital cash that customers can spend privately. The remainder of their transactions would stay traceable.

Subscribe

Probably the most participating reads in blockchain. Delivered as soon as a

week.

Yohan Yun

Yohan Yun is a multimedia journalist overlaying blockchain since 2017. He has contributed to crypto media outlet Forkast as an editor and has lined Asian tech tales as an assistant reporter for Bloomberg BNA and Forbes. He spends his free time cooking, and experimenting with new recipes.

Learn additionally

Hodler’s Digest

FTX 2.0 arising, Multichain FUD and Worldcoin raises $115M: Hodler’s Digest, Might 21-27

Editorial Workers

6 min

Might 27, 2023

FTX reboot is within the works, Multichain points spark uncertainty and Sam Altman’s crypto undertaking Worldcoin raises tens of millions of {dollars}.

Learn extra

Hodler’s Digest

SCB suggestions $500K BTC, SEC delays Ether ETF choices, and extra: Hodler’s Digest, Feb. 23 – Mar. 1

Ciaran Lyons

7 min

March 1, 2025

The SEC dismissed its lawsuit towards Coinbase, SCB say Bitcoin might attain $500,000 earlier than the top of Donald Trump’s time period: Hodler’s Digest

Learn extra